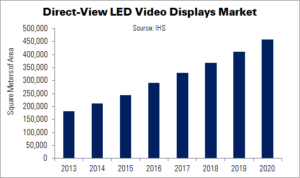

Area shipments of direct-view LED video displays rose 15.6% YoY in 2015, but overall revenue was up just 1.2%, says IHS, due to a ‘dramatic’ price decline across all pixel-pitch categories. Unit shipments in the direct-view LED video category are forecast to grow at a CAGR of 16% from 2016 to 2020.

LED displays are slightly different from the wider signage market, as they have very limited presence in corporate and education signage. The top applications are retail, outdoor sports and public spaces, with a growing trend in indoor applications.

The sub-1.99mm direct-view LED display market rose 366% YoY in 2015, and the 2 – 4.99mm category was up 129%. Most of this growth can be attributed to technological developments in the space. IHS expects this growth to continue, albeit at a slower pace, this year. Sub-1.99mm shipments will rise 84.8% and 2 – 4.99mm shipments will climb 77.1%.

The rate of adoption of very fine pixel pitch LED displays will slow significantly in the short term, due to the size limitations of current LED packaging. Price differences are also a factor, with sub-1mm displays costing almost two times as much as 1.2 – 1.9mm displays. Because of this, sub-1mm LED displays are rarely used as video walls. Several brands, including Aoto, Unilumin and Leyard (developer of the finest-pitch product available today, at 0.7mm), are developing these products for use as single large-format displays.

In the longer-term, the LED industry is moving to a new type of packaging known as chip on board (COB), rather than today’s surface mount device (SMD). COB is especially useful for fine-pitch displays, as it enables a much higher packaging density.