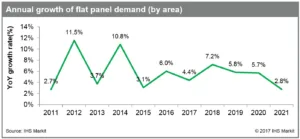

Global demand for flat panel displays by area is forecast to grow 7.2% to 210 million m² in 2018 compared to 2017, according to IHS Markit, representing the biggest annual growth since 2014. Ricky Park, director at IHS Markit, said:

Global demand for flat panel displays by area is forecast to grow 7.2% to 210 million m² in 2018 compared to 2017, according to IHS Markit, representing the biggest annual growth since 2014. Ricky Park, director at IHS Markit, said:

“Growth in demand for flat panel displays next year will be mainly driven by migration to large displays, declining panel prices, and high expectations for a recovery in the global economy”.

The rise in demand area is largely attributed to a fall in retail prices of applications along with a drop in panel prices, which is expected to spur consumers’ appetite for various display devices. The sharp fall in panel prices in the second half of 2017 should soon be reflected in the prices of consumer electronics goods in the upcoming peak shopping seasons later this year and in early 2018. The cheaper panel prices are also expected to bolster demand for larger display products. As 10.5G fabs are due to start operation in the first half of 2018, supply of super large TV panels, including 65 and 75″ products, is projected to grow, according to the Display Long-term Demand Forecast Tracker report by IHS Markit.

Increasing adoption of bezel-less flexible OLED displays in smartphones will lead to a growth in the size of overall smartphone displays next year. Park also commented:

“Launches of new smartphones with large screens should stimulate consumers’ demand to replace their old phones”.

The flat panel TV market is also expected to see a significant rise in replacement demand, following the transition into digital broadcasting from analogue signal that started in late 2000s. TV sales in markets where the digital transition was completed in late 2000s grew at 10 to 21% in 2009 and 2010, much faster than the compound annual growth rate of 3% between 2004 and 2014. Park continued:

“A consumer’s TV replacement cycle is usually about ten years. A hike in replacement demand for the next few years is expected.”

The global flat panel market will also get a boost from higher demand for new and larger TVs ahead of the 2018 PyeongChang Winter Olympics scheduled in February and the 2018 FIFA World Cup in Russia in June. Park said:

“Panel sales in even years when major world sports events were held had grown at a faster rate than in odd years”.

In addition, the ongoing recovery in the global economy bodes well for the panel demand. Global GDP is forecast to grow 3.2% in 2018, following 3.1% in 2017 and 2.5% in 2016, according to IHS Markit. In particular, the economic recovery in North America and emerging markets, such as India, Brazil and Russia, is expected to be stronger than the previous year. A rise in non-ferrous metal prices, often a precursor to an economic recovery, is another positive sign.

Unlike the strong gain in demand by area, the growth in the global flat panel market in value is, however, projected to be restrained by the fall in panel prices in the second half of 2017. The panel demand by value is forecast to rise 1% to $126 billion in 2018 from 2017, according to IHS Markit.