IHS DisplaySearch released its view of the display supply chain in 2014 and 2015. The report looks at large, medium and small panel supply and demand as well as materials and display technologies.

In recent years the display industry has not lived up to the dream of a fast growth industry it once was. After the decline in the TV industry, LCD shipments by area declined for the first time in many years. While the smartphone and tablet markets created some relief through higher unit volume shipments, this did not make up for the loss in large area TV sets.

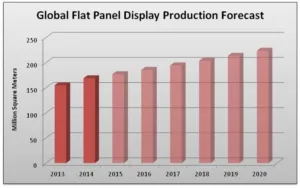

In the DisplaySearch report, the company now sees an overall growth of display in 2014 with a 9% growth to 168.9 million square meters. It also predicts that this display area growth will continue through 2020, even though at a lower pace. This will equate to total shipments of 223.6 million square meters or a 5% CAGR between 2012 and 2020. This growth will be driven by higher demand for large screen TVs, 5″+ smartphones, automotive and larger tablet displays. This assessment contains at least one speculative notion as in larger screen tablet displays. While several tablet makers are eyeing this larger size tablet segment as a new potential market, customer acceptance has not been great so far.

The company also added many observations for 2014 as well as its expectations for 2015. Here is a short summary of many more observations in the report.

- Large area LCD panels went into an under supply situation, causing price increases and an improvement for the panel makers. At the same time TV sales were still slow and the TV makers suffered with decreasing profitability. For 2015 DisplaySearch foresees pretty much the same, as there is very little capacity growth. It sees Samsung and LG taking higher allocations of production capacity, forcing other players to make stronger moves in the panel market and thereby increasing the supply shortage. It also sees a continued growth of new TV panel sizes that will lead to an increase in average TV size.

- For the small to medium sized panels, the demand is likely to increase in 2014, however it expects that the final numbers for 2014 show a decrease in display area used for tablets. While the demand for smartphones will most likely continue to increase in 2015 DisplaySearch is not so sure that the tablet market will increase at all. One of the drivers in this market segment is the demand for higher resolution panels that it defines as a pixel density of 300ppi+. At the same time it sees the panel demand for single use devices such as DSC, video cameras, games, etc. challenged by the the dominance of the smartphone.

- In general, all LCD fabs seem to focus on new technology like oxide backplanes to achieve a higher price for their panels. This is expected to continue for larger LCD panels but remain stable for smaller and medium sized panels.

- For large size OLED panels for TVs, all production is still haunted by low production yields making it an expensive high end display technology to produce. DisplaySearch does not see this changing much in 2015. As for the small to medium OLED production there are no large changes to expect as supply and demand is strongly controlled by Samsung. Future capital investment in small panel AMOLED by Samsung will not affect 2015 predictions. As for OLED materials, the market growth was much lower than expected and the growth in 2015 may hinge on the success of the Apple Watch.

Overall the report includes many more tidbits of information that I can’t cover here, but some of the observations and predictions are not as straightforward as one may think. Limited capital investment in recent years is leading to a more balanced LCD supply and demand situation with more stable panel pricing. On the other hand capacity is shifted from large panel manufacturing to small and medium panels. In addition, LCD technology shifts strongly influence the supply and demand of specific panel types, at least until new devices take advantage of the situation.

Analyst Comment

If you are familiar with the “chaos theory” you will know about the butterfly in Brazil, or how a small change in the current conditions in place may strongly effect the situation in another. The display industry is growing in complexity and as such is more susceptible to such behavior. Maybe in our industry it is not the butterfly, but changing a Gen 6 Fab from large panel to small panel production that can change the business situation for other companies significantly.

From a general perspective the display industry, and the LCD industry in particular, is more diversified than ever. In the long run, that may be a good thing as future device market swings create less of a strain on the total industry. It also seems fair to say that OLED is not going to take over the display market in 2015, but I guess you knew this already. – Norbert Hildebrand