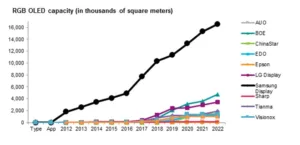

The latest Display Supply Demand & Equipment Tracker from IHS Markit forecasts that global AMOLED capacity will rise from 11.9 million m² in 2017 to 50.1 million m² in 2022, equivalent to 322% growth. The numbers include capacity for RGB OLED—ussed mainly for smartphones, mobile devices, virtual reality and automotive; as well as capacity for WOLED, also known as White OLED—used primarily for TVs. Of the two segments, RGB OLED has the larger share of market, with capacity growing from 8.9 million m² in 2017 to 31.9 million m² in 2022.

Among players, Samsung Display reigns supreme with 87% of global RGB OLED capacity, followed by fellow South Korean rival LG Display, and Tianma and Visionox from China. The Chinese are aggressive in expanding RGB OLED capacity, especially on flexible display technology and China’s share of market is projected to soar rapidly in the next couple of years.

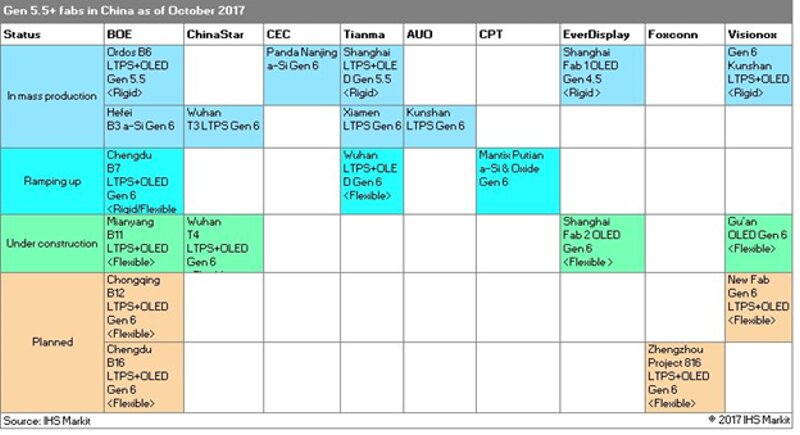

Developments on the Chinese front include the following:

- BOE is ramping up B7, its first 6G flexible RGB OLED fab, in late 2017 and is now constructing the new B11 fab; its B12 fab is also being planned. All three are 6G flexible-technology RGB OLED fabs with a capacity ranging from 30,000 to 45,000 substrate sheets per month. Furthermore, After B12, BOE is considering whether to build another two 6G flexible OLED fabs, but the support of local governments will be needed.

- ChinaStar is currently running a 6G LTPS/TFT LCD fab, while its next fab—the T4, a 6G RGB OLED facility with low-temperature polysilicon (LTPS) backplane capability—is under construction. ChinaStar is also deliberating whether to build another 6G OLED fab after T4.

- Tianma has an LTPS + OLED fab in Wuhan, in central China, targeting flexible substrates. The fab is now under construction and will be ready for mass production in 2018.

- EverDisplay is constructing a new 6G Flexible OLED fab in Shanghai, in addition to its current 4.5G rigid OLED fab also in the same city.

- Visionox at present operates a 5.5G LTPS+OLED fab for rigid glass substrates. And with an infusion of capital from China’s Black Cow group along with financial support from the local government, Visionox is building a 6G flexible OLED in Gu’an County north of Beijing. The company is also considering another new 6G flexible OLED fab outside Gu’an.

For their target, all the new RGB OLED fabs under construction in China aim to produce flexible substrates at full screen size, using the 18.x:9, 19.5:9 super-wide aspect ratio as well as a curved-edge smartphone display form factor for the next couple of years. In the long term, the fabs will undertake production of bendable and foldable screens for mobile devices.

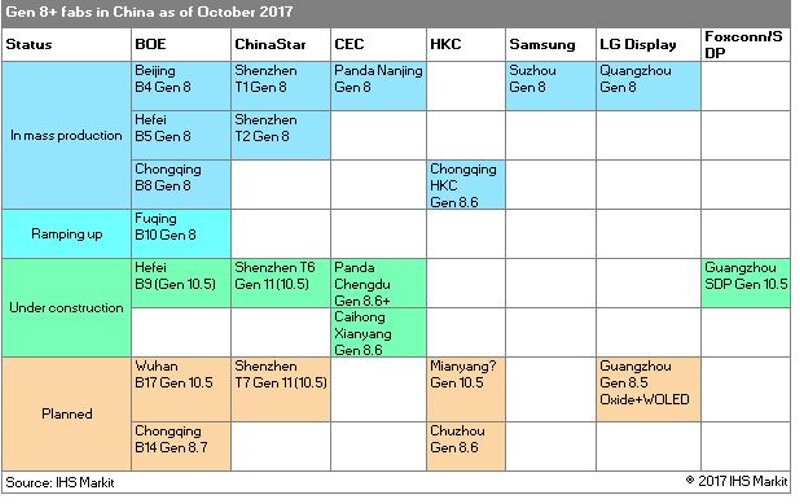

The charts below show Chinese fabs in development for 5.5G and above as well as for 8G.

By 2022, Chinese makers will possess RGB OLED capacity of some 10.7 million m², equivalent to 34% share of the global total. Chinese capacity will mostly target the smartphone display market, reserving some volume for virtual reality and augmented reality applications as well as for the automotive space.

Some concerns remain

Despite the aggressive expansion of Chinese RGB OLED makers, concerns remain, especially because flexible OLED technology requires a long learning curve that impacts production variables such as yield rate, stability and reliability. Another important issue is customer cooperation. Because of the long learning curve, smartphone makers and other similar customers will need patience to work with the just-emergent technology on issues like display panel design and mass production.

Chinese OLED makers also may face s fierce onslaught from Samsung Display, a player of indisputable power and might with the commensurate capacity, technological acumen and strength to block Chinese manufacturers in their attempt to grow.

Indeed, Samsung Display remains the dominant force in RGB OLED for smartphone displays. Its RGB OLED capacity will increase from 7.7 million m² in 2017 to 16.6 million m² in 2022, with capacity built on giant fabs like the A4 and A5 in South Korea.

Centralising giant fabs in one site can be advantageous, offering the best economies of scale, optimum efficiency and a streamlined supply chain. Massive OLED fabs can also serve as a bulwark of stable and sufficient supply for large purchase orders from key customers. In Samsung Display’s case, these would be its internal customer of the same name, for the Samsung Galaxy line of smartphones and from Apple, for its industry-leading iPhone. Last, giant fabs are well-placed to enjoy cost savings in operations given that these fabs often already boast smooth throughput—an advantage they can wield over their competitors.

The centralised, giant-fab approach of the Koreans contrasts with the smaller, distributed tactics employed by China’s OLED makers. Because a giant fab at this point would provide little practical benefit, the Chinese are opting instead to build several dispersed and separate OLED fabs. Moreover, domestic players hoping to build infrastructure such as that required for RGB OLED will need the support of subsidies from local governments. As a result, it makes sense for the Chinese manufacturers to build around the country as they chase the available money from government coffers.

This type of investment, however, is not suitable for very-large-scale WOLED initiatives—simply because the risks for failure are too high. This is also one reason why there are numerous state-of-the-art 10.5G fabs in China for TFT LCD, where both the technology and market are comparatively mature, but this isn’t the case with 8.5G WOLED.

The much smaller capacity of the Chinese, compared to that of Samsung Display, may also shape competition in the future. Samsung Display will use its colossal capacity to meet the needs of the South Korean maker’s two critical customers—Samsung and Apple. Chinese makers, meanwhile, will be targeting the relatively smaller projects of smartphone makers in China, such as Huawei, Xiaomi, Vivo, Oppo, Meizu, Lenovo and ZTE, along with many white-box makers.

With the smartphone war now expanding from brand allure to also include essential components and features such as the phone’s display, the challenge facing China’s makers will be most acute during a stagnant or oversupply market situation. Because Apple and Samsung on their own won’t be able to digest all the excess RGB OLED panel output produced by Samsung Display in the event of market stasis, the South Korean titan will bring to bear all of its considerable heft and might to go after the local Chinese smartphone makers that currently make up the customer base of domestic OLED makers.

That is certain to put Chinese players in a bind, as they will inevitably have to compete with a powerful foreign-based player on the home front, on ground zero where they are supposedly most secure.

By 2022 and assuming that expansion is carried out by each key player accordingly, RGB OLED capacity for each player will stand at the levels shown below, based on IHS Markit forecasts in the Display Supply Demand & Equipment Tracker. The list includes only those companies deemed to have a greater than 30% possibility of investing in forthcoming RGB OLED capacity.

- Samsung Display: 16.6 million m²; 52% capacity share of world total

- BOE: 4.8 million m²; 15% capacity share

- LG Display: 3.4 million m²; 11% capacity share

- Tianma: 1.9 million m²; 6% capacity share

- ChinaStar: 1.5 million m²; 5% capacity share

- Visionox: 1.4 million m²; 4% capacity share

- EverDisplay: 1.2 million m²; 4% capacity share