IHS has released a report that looks in detail at the OLED plans for LG and Samsung.

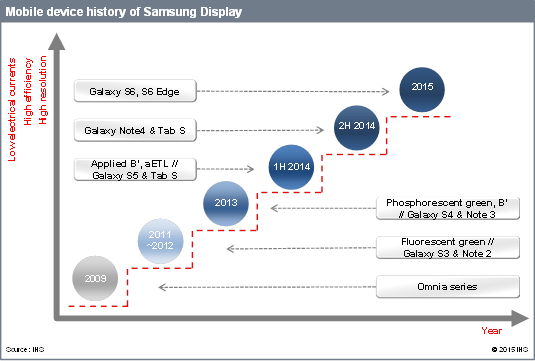

Samsung hnow has five years of experience in making small OLEDs for its Galaxy smartphones and has boosted performance in brightness, resolution and lifetime. After a slump in 2013, there have been developments in flexible OLEDs.

The Galaxy S4 saw a big boost in performance, said IHS, when green host materials were changed from fluorescence to phosphorescence, while the blue prime layer was first introduced to enhance the lifespan and efficiency of the blue host. In the case of the Galaxy S5, the sequel to the Galaxy S4, a new layer called additional electron transfer layer (aETL) was added to further extend the efficiency and lifespan of EML colour materials.

The Galaxy S6 and Galaxy S6 Edge recently released by Samsung Electronics used AMOLED panels applying new technology called M7 that has blue prime and aETL materials. Its structure is the same as the former device. The M7 remains largely unchanged, except for changes in suppliers for organic materials and the thickness of the organic layer to improve performance.

Compared to Samsung Display, LG Display is the second mover in the market. The company launched its small FMM (Fine Metal Mask) RGB-type panels and invested in production facilities later than its competitor. Consequently, its device development began later than Samsung Display. For instance, the panel maker still relies on fluorescent materials to produce the green host of the EML.

However, recently, the company has made tremendous research and development efforts to enhance device performance, IHS says. Devices using new functional layers, such as an electron blocking layer (EBL) or hole blocking layer (HBL), are currently under development. AMOLED panel devices developed by Samsung Display and LG Display are moving towards a longer lifespan and higher resolution through a series of improvements.

Analyst Comment

Comment (INITIALS)

The Galaxy series rolled out by Samsung Electronics Co. has turned AMOLED into a household name. From the Galaxy S to the Galaxy S6, which were released in 2010 and 2015, respectively, many improvements have been made to resolve the issues associated with AMOLED, which were identified at the outset, including lower brightness, lower resolution, and shorter lifespan compared to liquid crystal display (LCD). The AMOLED industry hit a stagnant point after 2013 in line with a slump in the high-end smartphone market. However, the small- and medium-sized AMOLED market is now picking up amid mounting expectations of future display products following the launches of flexible display gadgets, such as the Galaxy S6 Edge, the Galaxy Note Edge, and the G Flex 2.

The reliability of AMOLED panels is directly related to device quality, and is largely dependent on the performance of the panel maker’s device. Samsung Display Co. and LG Display Co., the two leading AMOLED panel makers, have made significant investments and efforts to enhance reliability. As a result, the two were able to employ an upgraded AMOLED device structure for each of their products.

The Galaxy S4 produced by Samsung Electronics saw much-improved device performance from its predecessors. Among emitting layer (EML) materials, green host materials were changed from fluorescence to phosphorescence, while the blue prime layer was first introduced to enhance the lifespan and efficiency of the blue host. In the case of the Galaxy S5, the sequel to the Galaxy S4, a new layer called additional electron transfer layer (aETL) was added to further extend the efficiency and lifespan of EML color materials.

Samsung Display has produced AMOLED panels equipped with devices employing blue prime and aETL materials. The Galaxy S6 and Galaxy S6 Edge recently released by Samsung Electronics used AMOLED panels applying a new device called the M7 that has blue prime and aETL materials. Its structure is the same with that of the former device. The M7 remains largely unchanged, except for changes in suppliers for organic materials and the thickness of the organic layer to improve performance.

Compared to Samsung Display, LG Display is a second mover in the market. The company launched its FMM RGB type panels and invested in production facilities later than the counterpart. Consequently, its device development began later than Samsung Display. For instance, the panel maker still relies on fluorescent materials to produce the green host of the EML. However, recently, the company has made tremendous research and development efforts to enhance device performance. Devices using new functional layers, such as electron blocking layer (EBL) or hole blocking layer (HBL), are currently under development. AMOLED panel devices developed by Samsung Display and LG Display are moving towards a longer lifespan and higher resolution through a series of improvements.

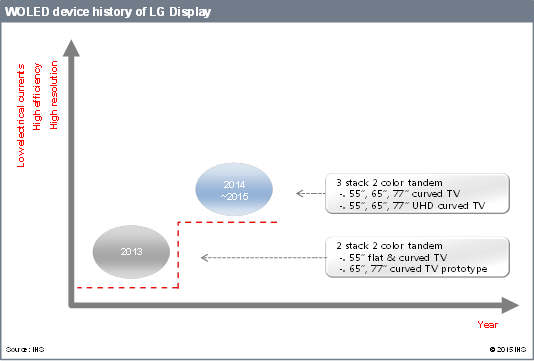

In the case of AMOLED TV, Samsung Display had used the fine metal mask (FMM) RGB technique. But it has discontinued its AMOLED TV business since the release of an AMOLED TV panel in 2013. On the contrary, LG Display’s WOLED type panels that were built on the open mask technique have seen rapid developments since its launch in 2013, including an extended product lineup and expanded production line. Based on a two-color two-stack vertical tandem structure, the early WOLED TV device produced white light using a combination of YG and blue. The resulting white showed a reduction in color purity when compared to white light generated by mixing the three primary colors, red, green, and blue. Also, the color had low brightness due to the vertical structure. To improve the brightness and color purity of white light, LG Display developed a two-color three-stack WOLED device structure and applied it to the curved ultra-high definition (UHD) WOLED TV released in late 2014.

This report published by IHS provides an in-depth analysis on Samsung Display and LG Display, the two major mass producers of AMOLED panels, from changes and developments in their AMOLED devices, a supply chain analysis for device materials, to a review of products using devices. By country, the research also covers the development status and mass production plan of key panel makers that are preparing for AMOLED production.

The report will help understand changes in AMOLED device technology at a glance and offer a valuable resource for current or prospective companies in the AMOLED business.