After declining unit shipment volumes in 2017, global TV shipments are forecast to grow 3.6% year-on-year in 2018, with additional 1.4% growth in 2019, according to a new report from IHS Markit. Of the 226 million TVs expected to ship in 2019, more than half will be ultra-high-definition models, the majority of which will be 2160p. However, 8K TVs from major global TV brands will launch toward the end of 2018, kicking off the next wave of resolution transition, the report says. Research and analysis executive director Paul Gagnon commented:

“Growt

h in the TV market is typically the result of more attractive retail prices for large-screen sizes and the continued commoditisation of UHD resolution, driving TV replacements and upgrades. However, this growth through price compression has a negative effect on profits, so TV brands are actively looking for more growth from advanced TV models to improve earnings”.

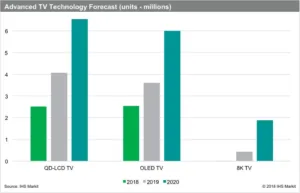

Technologies like 8K, OLED and quantum dot carry substantial premiums, and even UHD TVs still carry premiums of more than 35% at screen sizes where 1080p resolution is still an option, such as 40″ to 49″. IHS Markit forecasts that the 8K TV market will grow from less than 20,000 units in 2018 to more than 430,000 in 2019, eventually approaching 2 million units by 2020. This growth will be centred on 60″ and larger screen sizes, with 65″ TVs accounting for more than half.

OLED TV is expected to grow more than 40% in 2019, rising to 3.6 million units. This growth is in line with previous forecasts because demand is essentially matching industry production capacity. The size mix still favours 55″ TVs, based on current prices, but it will transition to mostly 65″ TVs by 2020, when substantial growth is expected in the OLED TV category as new production capacity is optimised for larger screen sizes. Quantum dot LCD TV shipments are now forecast to exceed 4 million units in 2019, based on more aggressive pricing and the introduction of transitional quantum-dot-equipped LCD TV models. Gagnon concluded:

“The high-end prices of non-QD-equipped LCD TV models and the prices of the low end QD-equipped LCD TV models have moved closer together. This extension of the quantum dot LCD TV lineup into more moderate price ranges effectively reduces the quantum dot premium to less than 100% at mid-range sizes, opening up the category to a larger addressable market of consumers”.