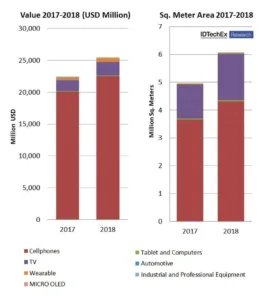

A new report from IDTechEx Research provides a comprehensive assessment of OLED display technologies and markets based on primary research conducted globally by the company’s analysts. The research finds that, in 2018, the OLED industry will be worth $25.5 billion, rising to $30.72 billion in 2019.

OLEDs used in mobile devices dominate the OLED industry, comprising of 88% of the market revenue in 2018. These are predominately supplied by Samsung, but recent capacity additions come from BOE Display, CSOT, EDO, Tianma and Visionox, all based in China. The second-largest sector is OLED TVs, supplied by LG, which represent 8% of the total market by revenue in 2018 but 27% of the market by display area. The third-largest OLED application in 2018 is wearables, representing 2% by market value and 0.4% by area in 2018. The thinness, flexibility and appearance of OLED displays are desirable in these applications versus LCDs.

Additionally, IDTechEx concludes that the OLED market will grow to $58 billion in 2025, with the total area of displays being 27.6 million m². The report also assesses the progress of emerging competitive technologies. For example, the impact of the Rec.2020 digital standard for next-generation UHD displays is better satisfied by quantum dot (QD) displays. Emissive QD displays are still in development and IDTechEx expects the first QD emissive displays to come to market in 2026, at which point the OLED industry will be more depreciated.

In the race to innovate and differentiate, there is rapid progress in glass-based OLED displays, plastic-based flexible displays and, ultimately, foldable displays. In 2017, 25.6% of manufactured OLED displays were plastic-based. That rises to 35.3% in 2020, when the first foldable displays come to market in volume. The first foldable OLED display products will launch in low volume during 2019. Printed OLED displays are still in development in the background, with JOLED having launched the world’s first commercial printed OLED display in late 2017 and others — particularly Chinese panel makers — aggressively pursuing research in this area.