The market for wearable devices will rise 44.4% YoY in 2016 to 111.1 million units, up from this year’s expected 80 million units. By 2019, IDC expects total shipments to have reached 214.6 million, with a CAGR of 28%.

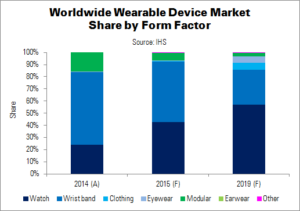

Second- and third-generation models will expand the market, building upon the hardware and software of their predecessors. Fitness trackers are today’s most popular form factor. However, IDC expects new device types and form factors to be launched, such as smart clothing, eyewear and even devices worn on the ears (‘hearables’).

Smartwatches will be very popular, reached 34.3 million unit shipments in 2015, up from 21.3 million in 2015. By 2019, shipments will reach 88.3 million (42.8% CAGR).

| Top Smartwatch Operating Systems with Shipments, Market Share and CAGR Growth (Millions) | |||||

|---|---|---|---|---|---|

| OS | 2015 Unit Shipments | 2019 Unit Shipments | 2015 Share | 2019 Share | 2015 – 2019 CAGR |

| WatchOS | 13.0 | 45.2 | 61.3% | 51.1% | 36.5% |

| Android Wear | 3.2 | 34.3 | 15.2% | 38.8% | 80.5% |

| Pebble OS | 1.8 | 2.3 | 8.6% | 2.6% | 5.8% |

| Tizen | 1.7 | 2.5 | 8.2% | 2.8% | 9.5% |

| RTOS | 0.8 | 1.9 | 3.8% | 2.2% | 23.8% |

| Android | 0.4 | 1.1 | 2.1% | 1.2% | 25.8% |

| Linux | 0.2 | 1.1 | 0.9% | 1.2% | 54.5% |

| Total | 21.3 | 88.3 | 100.0% | 100.0% | 42.8% |

| Source: IDC | |||||

Platforms (operating systems) will be important to the wearable market. These run tasks and processes, and are the main interaction point with the user. Apple’s WatchOS will lead the market to 2019, says IDC, thanks to Apple’s loyal fan base and a quickly-growing app selection. There is room for improvement, but WatchOS already has enough momentum to stay ahead of the market.

Unlike the smartphone sector, IDC says that Android/Android Wear will be a ‘distant second’ to Apple, even as its vendor list grows. The user experience is similar across devices, leaving little room for OEMs to differentiate. Customers choose Android smartwatches mainly based on price.

Although Pebble will cede market share to Apple and Android, it will not vanish. Pebble’s simple UI and devices are accessible, and its price point makes it affordable.

Samsung’s Tizen could be the ‘dark horse’ of the smartwatch market, potentially posing a threat to Android Wear. It is now compatible with most flagship Android smartphones and has a similar app selection. Technology developments like a QWERTY keyboard and cellular connectivity have also been of benefit to the OS.

Real Time OS (RTOS) will have a small but significant market. RTOS can run third party software, such as proprietary operating systems, and OEMs are likely to use it to promote their own devices.