According to the latest figures published by International Data Corporation (IDC), the tablet market in Western Europe decreased 5.0% year-on-year this quarter. In total, 7.8 million devices were shipped in the region, which shows a slight weakening of the overall market. Nevertheless, the value of the sales in euros was better and the market remained fairly flat, with a slight decline of 0.1%.

According to the latest figures published by International Data Corporation (IDC), the tablet market in Western Europe decreased 5.0% year-on-year this quarter. In total, 7.8 million devices were shipped in the region, which shows a slight weakening of the overall market. Nevertheless, the value of the sales in euros was better and the market remained fairly flat, with a slight decline of 0.1%.

The commercial segment remained positive at 3.4%, with slate tablets growing for the first time this year (4.0%) driven mainly by Android-based devices. On the other hand, the consumer segment continued to erode by 7.1%. Although holiday season promotions helped to increase volume quarter on quarter, it wasn’t enough to make the segment grow. Detachables are slowing down, with a decrease of 8.5% year-on-year, particularly in the consumer segment, where it declined 14.3%. The rapid adoption of convertibles is one of the main reasons for contractions. However, the commercial segment was up at 2.2%, and in France and Germany there was significant growth of 12.9% and 17.5%, respectively, driven mostly by large and very large businesses. The trend for the slate’ market is the same as the trend for detachables, but it performed better in comparison, with a contraction of 5.6% in the consumer segment and an increase in the commercial side. Laura Llames, research analyst for IDC Western European Personal Computing Devices said:

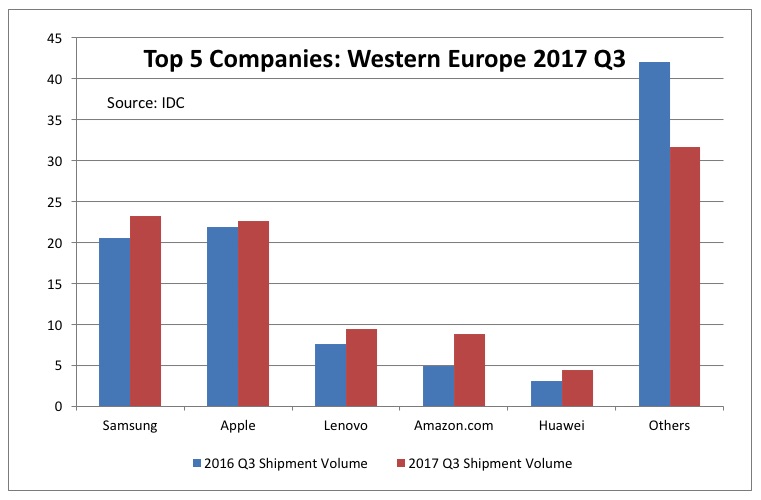

“Despite a negative quarter for tablets, the market is consolidating and the top five companies account for almost 70% of the total market in units, compared with less than 60% in the same quarter a year ago. The aggressive competition in the market is having a negative impact on local companies, as most of the major OEMs are offering a product mix that includes not only premium devices but also more affordable devices”.

The increasingly long-life cycles are making tablet renewal a lower priority for end users. Therefore, Android-based tablets decreased slightly further than in the previous quarter (-4.0%). However, the decline was softened due to the good performance of the main vendors (e.g., Samsung). iOS-based devices dropped this quarter (-2.0%) despite the new models and the attractively priced iPad. However, private enterprises in the main countries such as Germany and France boosted shipments, increasing 52.8% and 20.0% respectively. Windows-based devices declined for the third consecutive quarter due to the adoption of convertibles in terms of commercial mobility.

- Samsung ranked first with 23.2% market share and growth of 7.6% thanks to the wide range of products on offer. The Galaxy Tab A was still the most popular device and helped to increase volume.

- Apple ranked second, recording a market share of 22.6% but decreasing 2.0% year-on-year. The iPad introduction last quarter facilitated long-awaited renewals, representing more than 60% of its total market share.

- Lenovo gained 0.5% market share year-on-year to reach 9.4%, with solid growth of 17.8% year-on-year. This was driven mainly by the strong performance of the Android-based slate tablets, especially in the SMB segment and in large businesses.

- Amazon.com was in fourth place, due to its portfolio of low-cost slate tablets and an explosion of shipments on Prime Day. It posted significant growth of 69.0% year-on-year with a market share of 8.8%.

- Huawei continued to grow, with market share of 4.4% and 40.7% growth year-on-year, by focusing on its mobile broadband enabled devices.