Smartphone shipments in India reached a record high of 39 million units in the third quarter of 2017, with a substantial growth of 40% from the previous quarter and a healthy 21% growth from the same period last year as per International Data Corporation’s (IDC) latest Quarterly Mobile Phone Tracker.

Smartphone shipments in India reached a record high of 39 million units in the third quarter of 2017, with a substantial growth of 40% from the previous quarter and a healthy 21% growth from the same period last year as per International Data Corporation’s (IDC) latest Quarterly Mobile Phone Tracker.

This has led to several firsts for the India smartphone market. One, Indian smartphone shipments accounted for 10% of global quarterly smartphone shipments for the first time ever. Two, the overall smartphone sector registered a 30% quarter-on-quarter growth, India’s highest sequential growth ever, with more than 80 million mobile phone shipments in the third quarter of 2017.

The online festivals and sales in the months of August and September led to robust growth in the smartphone category. 13 million smartphones were purchased via e-tailers with 35% annual growth and 73% growth from the previous quarter. Xiaomi’s sales through its website continued its growth and helped boost the share of overall online channel sales from 32% to 37% year-on-year. Jaipal Singh, Senior Analyst with IDC India, said:

“E-tailers have popularised many trends in the Indian smartphone market, like making devices more affordable through easy financing options or attractive exchange offers on existing smartphones. On the back of a fresh infusion of funds and focus on India’s market, the e-tailers are expected to remain aggressive in 2018 as well. The online channel in India sees a seasonal spike peaking in the third quarter, off the back of multiple rounds of online sales during festival months in India. However, it is gradually becoming an integral part of the omni-channel strategy for almost all vendors to have online-exclusive model launches and partnerships with e-tailers during these sales”.

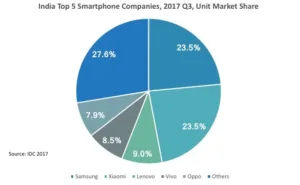

The competition among the top five vendors further intensified to capture a larger share of 72% of the smartphone market compared to 50% a year ago. Samsung and Xiaomi led the smartphone market in the quarter, with each having 24% market share. Xiaomi’s aggressive pricing made the brand a clear winner in selling devices via e-tailers and direct internet platforms. The brand’s offline expansion through its preferred partner program and Mi stores is also getting a good response as its shipments doubled from the last quarter. Upasana Joshi, Senior Analyst with IDC India, commented:

“In the coming few quarters, both Samsung and Xiaomi will need to further strengthen their channel play and significantly differentiate their products on technology and quality to sustain and fight for leadership in this hyper-competitive smartphone market. The offline channels were enjoying good growth in the past few quarters due to high retail spend by China-based vendors to create pull for their brands. But now, while the channel margins and incentives are getting normalised and a few other previously online-heavy vendors are getting aggressive in offline channels, the fight for the retail shelf space is expected to further intensify”.

- Samsung is tied with Xiaomi as the leading brand. However, this has been a record-breaking quarter for Samsung after they registered 39% sequential growth quarter-on-quarter and 23% year-on-year. Galaxy J2, Galaxy J7 Nxt and Galaxy J7 Max were the key models that contributed to almost 60% of Samsung’s volume.

- Xiaomi almost tripled its shipments year-on-year and doubled quarter-on-quarter in the third quarter, as the vendor increased its focus on the traditional channel for marketing its products. Redmi Note 4 continues to be the best-selling smartphone in India as Xiaomi shipped approximately four million units in this quarter.

- Lenovo (including Motorola) made it back to the third position after two quarters, as its shipments increased 83% from the previous quarter. A couple of new launches under the Motorola brand reversed its internal brand share and now Motorola contributes to two-thirds of its portfolio.

- Vivo slipped to fourth position as its shipments declined after a record-breaking second quarter, although it registered a healthy 153% annual growth. The vendor started to bounce back from September onwards as its newly-launched V7 Plus and Y69 gained strong initial traction in the market.

- Oppo had the biggest sell-in quarter so far in India as vendor shipments increased by 40% sequentially and 81% from the same period last year. Its vendor share also noticeably increased as it started participating in the e-tailer platform to sell its devices.

Navkendar Singh, Associate Research Director of Client Devices with IDC India, concluded:

“After an online dominated pre and post-Diwali period, the offline channel went through a rather soft festive period. E-tailers will continue to be a big driving force for smartphone growth in India, although vendors’ offline focus will continue to keep retail as the dominant channel in India. It will be interesting to see how exclusive partnerships between telcos and vendors, e-tailers launching their own smartphone brands, and the availability of dual cameras and bezel-less screens at more affordable price points shape up in the coming quarters”.