The Middle East and Africa (MEA) personal computing devices (PCD) market, which is made up of desktops, notebooks, workstations and tablets, declined 6.2% year-on-year in the fourth quarter of 2017, according to the latest insights from IDC. The new data shows that shipments fell to around 5.9 million units during the three-month period, which represents the lowest quarterly volume recorded for more than five years. IDC’s Fouad Charakla said:

“While the overall decline was almost exactly in-line with forecasts, there was a stark difference between the individual product categories, with PC shipments growing healthily and tablet shipments declining faster than expected. Kenya suffered huge declines in its tablet market after a massive education project that boosted shipments in the fourth quarter of 2016 was not repeated during the same quarter in 2017”.

With end users continuing to shift to large-screen smartphones, demand for slate tablets is declining across the region, although the delivery of a large education project in Ethiopia saw an increase in shipments to IDC’s ‘Rest of Africa’ grouping of countries. Charakla continued:

“These devices are increasingly losing significance in the market, with a large portion now being purchased for use by children. The low prices of these devices, together with their touchscreen interface and the availability of numerous free applications, make them particularly attractive for children’s infotainment”.

The recent introduction of 5% VAT in both the UAE and Saudi Arabia had a considerable impact on the market, with some vendors pushing a much higher sell-in for both countries during the fourth quarter of 2017. Additionally, Charakla says various market players shipped more aggressively into the UAE during the quarter as the implementation of VAT inevitably complicates the country’s position as a re-export hub.

“As a result of these factors, both the UAE and Saudi PCD markets are expected to experience a slow start to 2018. Consumer spending is expected to be hit harder in Saudi Arabia, particularly due to the additional hike in prices of various goods and services since the start of 2018, caused by the doubling of petrol prices. Saudi Arabia has also introduced a so-called ‘dependent tax’ that is applicable to all non-citizen residents, a development that has tightened disposable income even further and caused many expatriates to consider leaving the kingdom”.

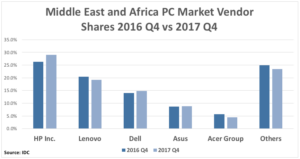

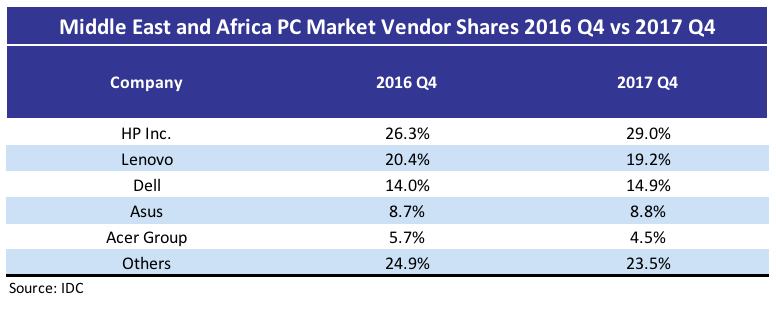

Looking at the PC market in isolation, each of the top five vendors maintained their respective positions when compared to the corresponding quarter of 2016:

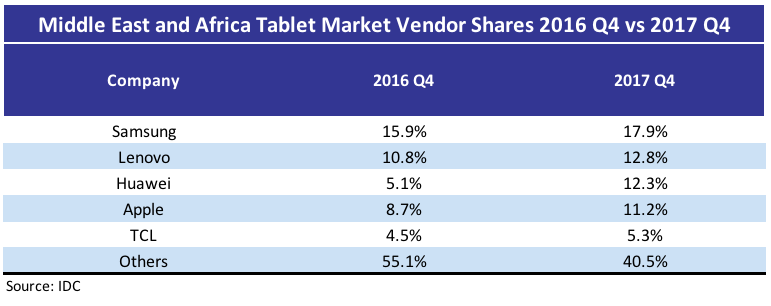

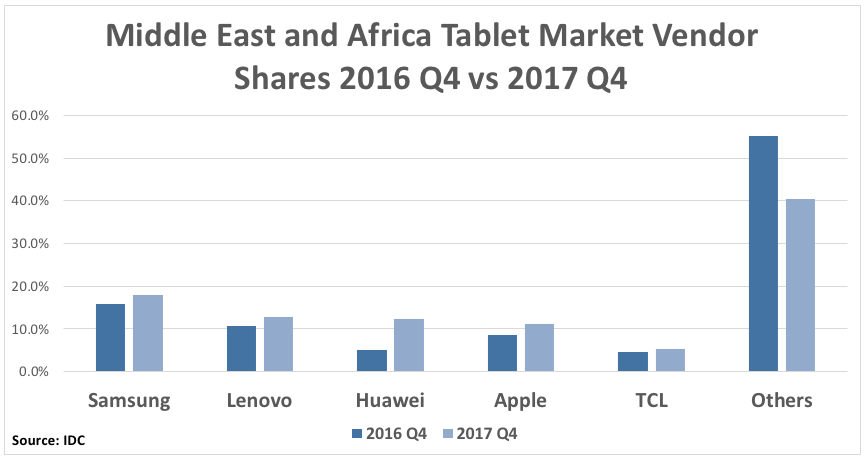

The top five tablet market players also maintained their respective positions in the final quarter of 2017, although their individual performances varied. Samsung, Lenovo and TCL all experienced year-on-year declines in their tablet shipments, while Apple recorded moderate growth. The big winner was Huawei, which saw its tablet shipments to the region grow significantly year-on-year in the fourth quarter of 2017.

It is worth noting that, together, HP, Lenovo and Dell accounted for around 75% of overall commercial PCD shipments in the region during the fourth quarter of 2017, with the rest of the market’s players primarily focused on serving consumers. Charakla concluded:

“Looking ahead, the MEA PCD market is expected to experience a significant year-on-year decline for the first quarter of 2018, and will continue shrinking over the coming years as well, albeit at a much slower pace. Slate tablets will experience the sharpest fall in shipments, while traditional desktops and traditional notebooks will decline at more moderate rates. By contrast, IDC expects all-in-one desktops, convertible notebooks, ultraslim notebooks, and detachable tablets to all show healthy shipment growth over the coming years.

In the shorter term, large volumes of notebooks are expected to be delivered into the education sectors of both Pakistan and the UAE over the coming quarters. It is also important to note that massive education projects, exceeding millions of units, are currently at the early discussion phase in countries such as Turkey and Pakistan and have not yet been incorporated into IDC’s forecast due to the lack of certainty around their scale and timing”.