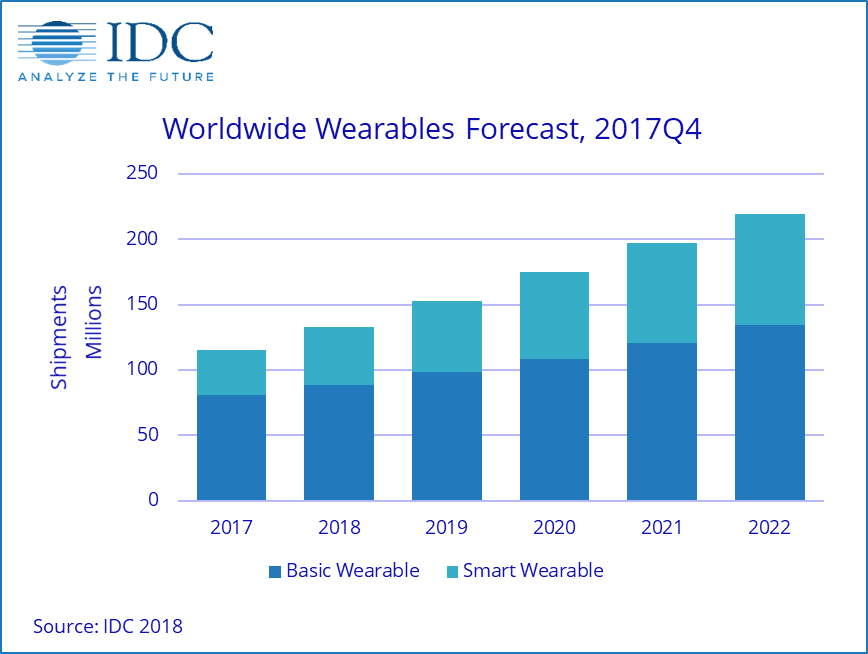

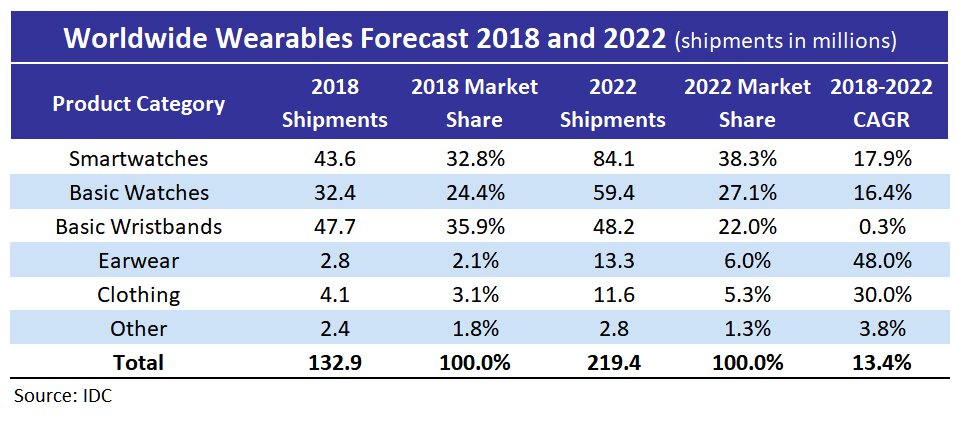

Worldwide shipments of wearable devices is on-track to grow 15.1% in 2018, totalling 132.9 million units over the course of the year. The overall market is also expected to deliver a CAGR of 13.4% over the next five years, culminating in 219.4 million units shipped in 2022, according to IDC. With cellular connectivity on the rise and shifting consumer preferences, IDC believes smartwatches will account for almost two out of every five wearable devices shipped in 2022. IDC’s Jitesh Ubrani commented:

“Consumers are finally starting to understand and demand the utility of a smartwatch. At present, fitness uses lead by a mile but mobile payments and messaging are starting to catch on. The addition of cellular connectivity is also starting to resonate with early adopters and looking ahead, the emergence of new use cases like music streaming or additional health sensors will make cellular connectivity pivotal to the success of the smartwatch”.

Research director Ramon T. Llamas, also said:

“

The appetite for wristbands and basic watches will not go away. Both products will enjoy sustained popularity as users’ first wearable, thanks to their simplicity and lower price points, and will reach new audiences as part of digital health solutions or for those who want wearable technology but prefer the traditional look and feel of a hybrid watch”.

With watches and wristbands in the spotlight, wearables in other form factors will capture a minority share of the market, although this share will continue to grow during the forecast period. Earwear and clothing are expected to be the leading underdog categories as smart assistants slowly become indispensable and are incorporated into headphones, and as athletes and workers adopt sensor-laden clothing.

Over half of all smartwatches in 2017 were shipped by Apple, and while the company will maintain its lead in this category, competing products from the likes of Fitbit, Garmin and all the Wear OS (previously Android Wear) vendors will gain traction over time. Another growing sub-segment within this category is smartwatches dedicated to kids, though these will largely be relegated to China. Smartwatches are also expected to have the highest ASP and are forecast to account for more than two-thirds of the dollar-value of the entire wearables market.

Basic watches are expected to grow over the course of the forecast with a CAGR of 16.4% as new vendors and fashionable designs drive the category forward. However, the category does face challenges as vendors have struggled to educate users around the benefits of these devices. Many consumers still view these devices as timepieces rather than as wearables that are part of a larger ecosystem and as a result, IDC expects this category to remain secondary to its smart counterpart.

The low-cost, commoditised hardware of basic wristbands will continue to hold their place in emerging markets. These wearables are expected to account for 22% of all wearables shipped in 2022, down from 36% in 2018. However, the ease of use and overall accessibility of these devices positions them as the perfect starter device for the remainder of the wearables category.

Earwear wearables are forecast to ship 13.3 million units by the end of 2022 with a 48.0% CAGR from 2018–2022. With the rise of smart, voice-enabled assistants, hardware developments from chip makers like Qualcomm and the growing popularity of wireless headphones, IDC anticipates this form factor to be the most popular outside of wristbands and watches.

Sensor-laden clothing is on track to grow from 2% share in 2017 to 5.3% share by 2022. To date, this category has been driven by step-counting shoes from the likes of Li-Ning or Under Armour, that mostly cater to average consumers. However, going forward, IDC anticipates other, niche brands to start gaining traction as they target professional athletes or enterprise workers in hazardous environments.

The Others category—devised of lesser-known wearables, such as those that can be clipped to different parts of the body, head-worn devices like the Muse headband or even smart wristbands that can run third-party apps—is expected to maintain a very small portion of the overall market. The non-standard form factors will make these devices a tough sell to the mass market, but their ability to cater to very specific needs may make them a somewhat lucrative business.