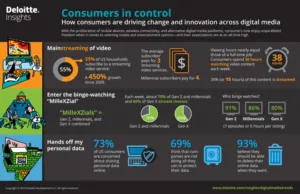

American consumers’ appetite for streaming video continues to grow and they have no qualms shelling out cash for original content, according to Deloitte, whose report found that 55% of US households now subscribe to at least one video streaming service, a 450% increase since 2009.

The survey found that, on average, Americans watch 38 hours per week of video content (39% of which is streamed), nearly the equivalent of a full-time job. With over 200 SVOD options in the US, the average streaming video subscriber is paying for three services, resulting in US consumers collectively spending $2.1 billion per month on SVOD services. High-quality, original content appears to be driving an increase in streaming with nearly half (48%) of all US consumers streaming television content every day or weekly, up 11% year-on-year.

Conversely, the report found pay TV subscriptions declined for the first time in recent years with 63% of households still subscribing to a traditional Pay TV service, down from 75%. Pay TV’s decline is especially pronounced among Generation Z (ages 14-20), millennials (ages 21-34) and Generation X (ages 35-51). Deloitte’s Kevin Westcott said:

“Consumers now enjoy unparalleled freedom in selecting media and entertainment options and their expectations are at an all-time high. The rapid growth of streaming services and high quality original content has created a significant opportunity to monetize the on-demand environment in 2018”.

With video streaming enabling unprecedented choice and access to content, consumers perceive a widening gap between their expectations and what pay TV companies deliver. According to the report:

- Nearly half (46%) of all pay TV subscribers said they are dissatisfied with their service and 70% of consumers feel they get too little value for their money.

- Among respondents who said they no longer have a pay TV subscription, 27% reported they cancelled their service within the last year.

- Furthermore, 22% of millennials say they have never subscribed to a pay TV service.

- 22% of all consumers without pay TV say they don’t watch enough TV to justify the expense and another 19% say they simply cannot afford it.

- 56% of current pay TV subscribers say they keep their pay TV because it’s bundled with their home internet access.

Westcott continued:

“As video streaming and demand for original content continue to grow, traditional and premium cable broadcasters will continue to rethink their business models. Media companies are increasingly going direct-to-consumer with their own digital streaming services and snackable content. Ultimately, one challenge we see is that consumers may be reluctant to pay for exclusive content on top of their other paid subscription services and this may lead to some form of re-aggregation as limits on consumer spending could potentially hinder the growth of content platforms”.

This year’s data indicates a convergence of media behaviour across three key demographics. Gen X emerged as cutting-edge adopters of digital media, embracing the digital media behaviours already adopted by Gen Z and millennials. Deloitte calls this combined demographic group “The MilleXZials”.

- 70% of Gen Z households had a streaming subscription, closely followed by millennials at 68% and Gen X at 64%, respectively.

- About 70% of Gen Z and millennials stream movies compared with 60% of Gen X on a weekly basis.

- Binge-watching behaviour also witnessed a convergence among “MilleXZials”:

- 91% of Gen Z, 86% of millennials and 80% of Gen X binge-watch TV shows.

- More than 40% of millennials binge-watch weekly and they watch an average of seven episodes and six hours in a single sitting. 96% of “MilleXZials” multitask while watching TV.

Deloitte’s Dr Jeff Loucks also commented:

“

Millennials were the first generation to embrace streaming media and watching video content on smartphones. Some hoped that as millennials got older, they would settle down and watch pay TV. Instead, their Gen X parents are acting more like millennials, using streaming services, watching TV shows, movies and sports on smartphones, and binge-watching”.

Consumers are increasingly concerned about putting their personal data online. The study found 69% of consumers believe that companies are not doing everything they can to protect their personal data. However, 73% of all consumers said they would be more comfortable sharing their data if they had some visibility and control and 93% of US consumers believe they should be able to delete their online data when they want.