The Europe, Middle East, and Africa (EMEA) traditional PC market (desktops, notebooks, and workstations) recorded slight growth in the fourth quarter of 2017, with the market going positive (+1.2%) and totalling 20.9 million units, according to IDC. The commercial space grew 3.9% due to enterprise renewals and a strategic focus on mobility and security, while holiday season promotions and gaming increased volume in the consumer segment.

Notebooks performed positively across EMEA (+2.1%) with very strong growth in MEA (+12.1%), continued growth in Central and Eastern Europe (CEE) (+1.8%), and stabilising to flat in Western Europe. Once again, desktops have strengthened in EMEA and show positive signs toward stabilisation (-0.8%) due to increased commercial demand across all regions.

Malini Paul, Senior Research Analyst of European Personal Computing Devices at IDC, said:

“After a strong decline in 2015, the traditional PC market in Western Europe gradually recovered over the past few years to reach a more stable situation in 2017, with overall shipments recording a flat to slight decline of -0.2% year-on-year.

The overall recovery was strongly supported by the growing demand from enterprises, especially for notebooks, driven by a ramp up in mobility adoption as part of their digital transformation strategies. Security related concerns was one of the key drivers of hardware renewals in the second half of 2017.

On the other hand, gaming emerged from a niche category to become more mainstream in Western Europe to drive some optimism in the consumer space”.

In Western Europe, the overall traditional PC market contracted (-1.5% year-on-year). Notebooks were weaker than in previous quarters, but managed to remain flat year-on-year. Although remaining negative, desktops showed some strength and decreased just 5.1% year-on-year.

Southern Europe showed the strongest signs of growth, with France and Iberia growing at 4.1% and 1.8% respectively. The UK remained negative, but performed slightly above expectations with a 4% decrease.

Volume in Benelux decreased slightly (-0.6%) due to a weaker performance in Belgium, while the Netherlands posted 4.7% growth. The Nordics declined 3.6%, with Sweden decreasing 11.2%, while DACH also performed negatively, with Germany declining in volume by 2.0%.

The consumer PC market declined by 3.7%, although vendors’ increased strategic focus on gaming is driving resilience in the segment. In addition, seasonal promotions helped boost volumes for consumers. The commercial space increased by 0.6%, driven by continuous demand for more premium, ultra-mobile thin and light devices, as well as a greater focus on the security benefits brought about by renewing older hardware to newer, more secure models.

Stefania Lorenz, CEMA Associate VP at IDC, stated:

“After four consecutive years of strong PC market decline, the CEMA region reported annual growth of 2.6% in 2017 with an unexpectedly strong performance in the MEA region in the last quarter of the year. The fourth quarter of 2017 ended with the overall CEMA PC market recording growth of 6.5% year-on-year, boosted by healthy demand in both the consumer and commercial sectors.

The biggest surprise is the results in the MEA region with the overall PC market reporting an annual increase of 9.6% in the fourth quarter of 2017. Demand was boosted by the overdue PC replacement across many countries in the region. The commercial sectors recorded very strong double-digit growth. In addition, the expected implementation of value-added tax (VAT) in the Gulf region from the start of 2018 has helped to increase sales-in in the consumer space in the past couple of months of the year”.

Nikolina Jurisic, CEMA Product Manager at IDC, also commented:

“In the fourth quarter of 2017, the PC market in the CEE region performed in line with the forecast, an increase of 4.0% year-on-year. The desktop market was above expectations with growth of 8.1% year-on-year, benefiting from renewals in the public, corporate and SMB sectors.

Notebooks, on the other hand, only reported overall growth of 1.8%, also driven by the commercial sector, while the consumer space reported a slight decline of 0.5% due to some build-up in inventory in the key markets. A few smaller CEE markets increased in consumer notebooks thanks to the push of entry-level products for the holiday season and the low base in the fourth quarter of 2016.”

Vendor Highlights

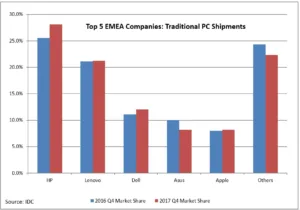

Traditional PC market consolidation has slowed but continues to progress, and the top three vendors’ share continued to grow in the fourth quarter of 2017. The top three players accounted for 61.3% of total market volume, compared with 60.2% in the same quarter of the previous year.

-

HP retained the top spot in EMEA, gaining 2.5% market share year-on-year to reach 28.1%. Strong notebook shipments combined with solid desktop performance boosted its results.

-

Lenovo was in second spot, reporting 21.2% market share (up 0.1% year-on-year), driven primarily by commercial shipments, both desktops and notebooks, clearly outpacing the market in the region.

-

Dell held third position with a market share of 12.0% (up 0.9% year-on-year). In addition to a solid performance in the commercial space, success in the consumer space boosted growth.

-

Asus and Apple were fourth with 8.2% market share. Asus had another tough quarter, except in CEMA where it maintained its position in the notebook space. Apple had a good holiday season with 0.2% year-on-year growth in market share.

-

Acer closed the top ranking, with a share of 7.8%, driven down by WE and MEA. CEE emerged as a relatively stronger subregion, however, with the vendor declining at a much softer rate.