According to IDC, 717,000 tablets were shipped in India in Q4 of 2017, a quarter-on-quarter decline of 32%, and registered similar shipments when compared to the same time a year ago. After a big spike in the previous quarter and completion of the Gujarat State government tablets deal, the commercial segment declined by 35% in the fourth quarter. However, it saw a strong 75% growth compared to the same quarter last year.

For the entire year of 2017, the Indian tablet market witnessed a total shipment of 3.2 million units, declining 11% from the 3.6 million units shipped in 2016. The strong demand from the commercial segment has marginalised the overall decline to an early double-digit number. However, the consumer segment witnessed a consecutive decline for the second year in a row.

In terms of product categories, slate tablets continued to dominate the Indian market with 96% of total shipments, while the share of detachable tablets remained limited to 4% in 2017. Average screen size also increased when compared to 2016. In contrast, the 7″ segment saw a 22% annual decline, though it has remained a dominating segment in 2017. IDC’s Ashweej Aithal said:

“The 7″ slate segment is facing strong pressure from the popularity of phablets and vendors have started focusing more on larger screens now. The comfort of a large screen for media consumption is attracting users to migrate to 10″ tablets. It also works better for users who read and edit documents on the go”.

Meanwhile, IDC’s Jaipal Singh also commented:

“Government buying will continue to drive momentum in the tablet category in 2018. The continued focus on Digital India will invite more government departments to participate in digitalising their processes, which will further spur growth in this category. BFSI, pharmaceutical, automotive and hospitality sectors will continue to buy more tablets as they progress on standardising their POS and KYC operations”.

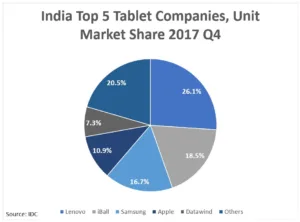

Lenovo continues to lead the Indian tablet market with a 26.1% market share as its shipments grew 34.2% year-on-year. However, the vendor saw a decline of 31.7% from the previous quarter. Lenovo’s strong focus on the commercial segment has helped it to remain in first position for three consecutive quarters.

iBall came second, replacing Samsung for the first time, as its shipments grew by 15.2% year-on-year. It also became a leader in the consumer segment as it was quick to gain share from vendors who had shifted their focus to commercial segment.

Samsung slipped to the third place, as its shipments declined by 17% year-on-year and 22.1% from the previous quarter. Samsung’s Galaxy J Max remains their best-selling model, followed by its newly-launched Galaxy Tab A8.

Apple came in fourth position with a healthy 30.5% annual and 9.1% sequential growth in the fourth quarter of 2017. The strong demand for Apple’s 2017 iPad and iPad Pro models, coupled with attractive cashback offers, has helped the brand to quickly gain share in the market.

Datawind maintained its position in the top five, despite a decline in shipments to almost half of its volume when compared with the same time period a year before.