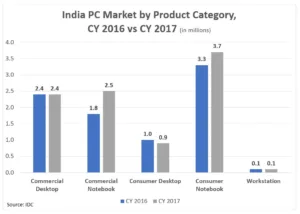

Traditional PC shipments in India during 2017 stood at 9.56 million units, with a 11.4% year-on-year growth, according to IDC. This growth was primarily driven by the increase in the number of large projects and a surge in shipments following the introduction of GST reforms. The country’s traditional PC market declined by 5.2% year-on-year in the first half of 2017.

The overall consumer PC market registered a 48% shipment share in 2017. The consumer category also recorded a growth of 8.5% in unit shipments compared to last year. IDC India’s Manish Yadav commented:

“Consumers were somewhat hesitant during the GST implementation phase in the first half of 2017. However, upbeat demand towards discretionary spending off the back of seasonality and the re-building of inventories post-festive season drove growth in the second half of 2017”.

The overall commercial PC market recorded a 52% shipment share in 2017, while the category grew by 14.1% in unit terms year-on-year. Yadav continued:

“Commercial spending seems to be leaving the GST-related glitches behind with increased demand across segments like SMB and enterprise”.

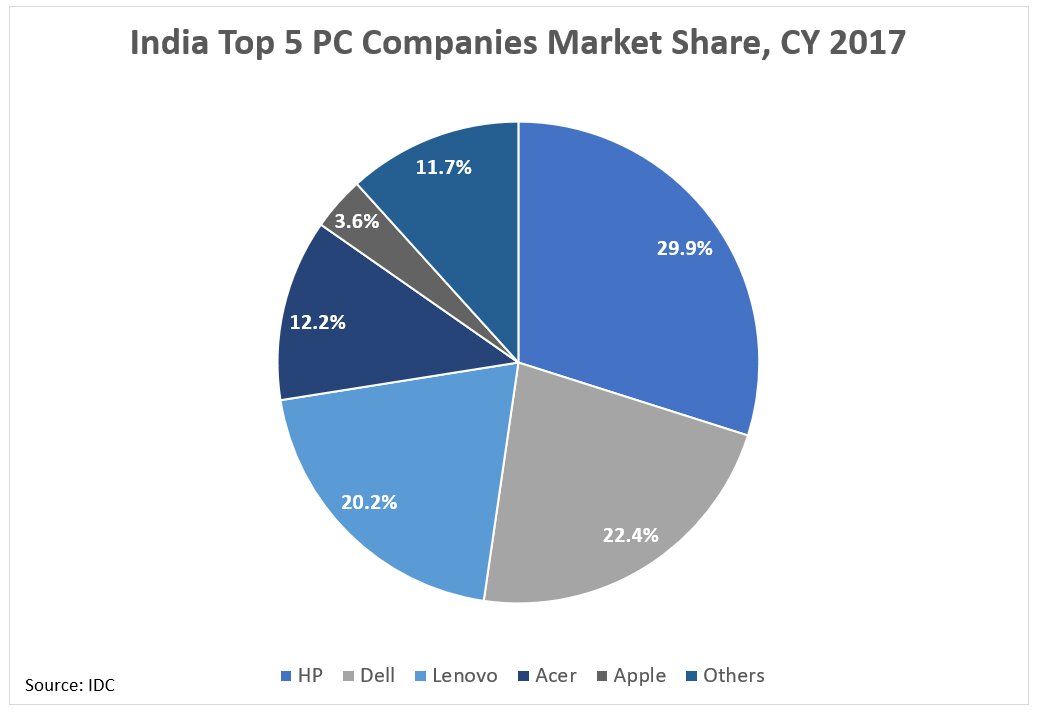

HP maintained its leadership position in the overall India traditional PC market with a 29.9% share and recorded an overall growth of 17.4% year-on-year in 2017. The vendor remained dominant in the overall consumer PC business with a 29.2% share and an 18% year-on-year growth in 2017, owing to its growing brand image and depth penetration via its growing partner base. The vendor also led the commercial segment in the last two years by clinching volumes in special projects and maintaining a strong presence in enterprise, which assisted the company in recording a 30.6% market share along with a growth of 16.9% year-on-year in 2017.

Dell took the second spot, with a 22.4% share in 2017. The vendor was impacted by GST and BIS certification in 2017. However, with increased shipments and differentiated channel programs, the vendor bounced back with a 7.3% growth year-on-year in 2017. The company continues to dominate categories like gaming notebooks with a 26.8% year-on-year growth. The vendor also recorded a 22.1% shipment share in 2017 in the overall commercial PC business, with increased investments in the channel, supported by both distribution and partner-led GTMs. Also, its growth in verticals like BFSI and government in the second half of 2017 are a welcome sign of a growing customer base for the vendor.

Lenovo holds on to third spot, gaining 2.6% year-on-year to record a market share of 20.2% in 2017. In the overall consumer category, the vendor recorded a 16.7% market share for 2017, off the back of its growing online presence, innovative products and efforts to improve its after-sales services. Additionally, with the execution of state-owned manifesto projects, offering bundle services along with new products helped the vendor achieve a strong growth of 40.1% year-on-year with a market share of 23.4% in 2017.

IDC expects the overall India PC market to decline in 2018 due to sluggish enterprise demand along with low SMB refresh. IDC’s Navkendar Singh said:

“In the consumer business, opportunity is ripe for vendors to drive penetration and increase presence in growing categories like gaming and convertibles. We expect e-tail channels to contribute to the increase of PC penetration by growing their presence in lower-tier cities and employing pricing strategies to address new PC buyers”.

The overall India traditional PC market for the fourth quarter of 2017 stood at 2.6 million units, a quarter-on-quarter decline of 14%, but a year-on-year growth of 35.2%. Increased spending through special projects and spill-over shipments drove overall sales in the fourth quarter of 2017.