According to IDC, the India smartphone market saw shipments of 30 million units in the first quarter of 2018 — the market’s strongest start to a year — maintaining a healthy year-on-year growth of 11%. However, the market remained almost flat compared to the previous quarter.

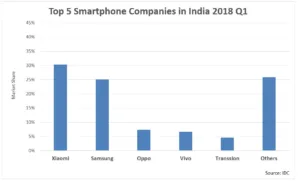

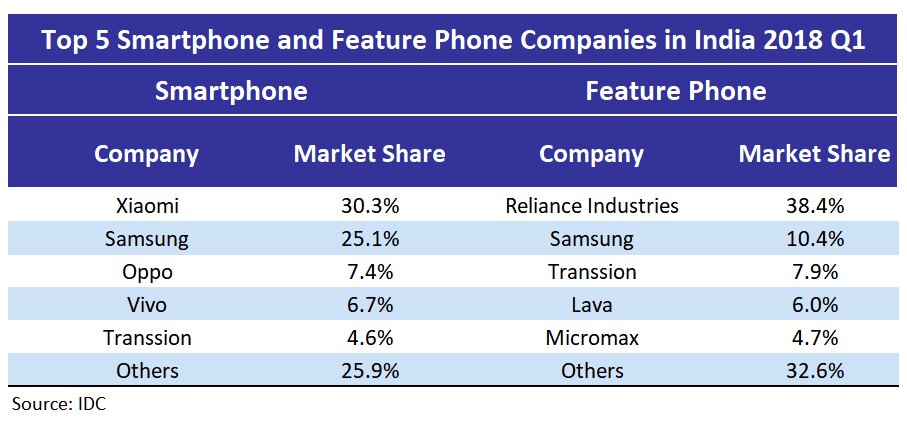

Xiaomi maintained its lead in the market for the second quarter in a row with further expansion in the offline channel and the popularity of its Redmi 5A and Redmi Note 5 models. Various other companies used the online channel to expand their share in the market, including Honor, iVOOMi and Tenor.

This led to share growth of the online channel within the smartphone market from 34.2% in the fourth quarter of 2017 to 36% in the first quarter of 2018. Xiaomi increased its share of total e-tailer shipments from 32% a year ago to 53% in the first quarter of 2018. IDC’s Jaipal Singh commented:

“Xiaomi is in a unique position with a diversified channel approach and strong demand in each of the channels. Huawei’s Honor 9 Lite also made into the top five online models in the first quarter of 2018”.

On the offline front, Transsion continued to drive growth through its brands Itel and Tecno, expanding aggressively to smaller towns and cities by focusing on channel management and after-sales service. The ultra-high-end segment saw a strong year-on-year growth of 68%, largely due to strong shipments of Samsung’s Galaxy S9 series, which arrived a quarter earlier this year, and led with a 77% share in this segment. OnePlus, owing to its popular 5 and 5T models, continued to keep more than 50% share in the high-end segment. IDC’s Upasana Joshi said:

“The recent import duty hike on PCBs, camera modules and connectors by the Indian government definitely puts cost pressure on the smartphone companies, until such time that they set up lines for the CKD (Complete Knock Down) type of manufacturing to reduce this impact. This will increase the challenges for smaller companies even more.

As companies continue to reel under margin pressure due to rising custom duty and raw material prices, retailers and distributors in the offline channel fear a cut in their commissions to absorb the impact of price hikes. Having said that, these partners will have to chalk out a way to mitigate some of the additional burden through special offers or schemes to the end buyer”.

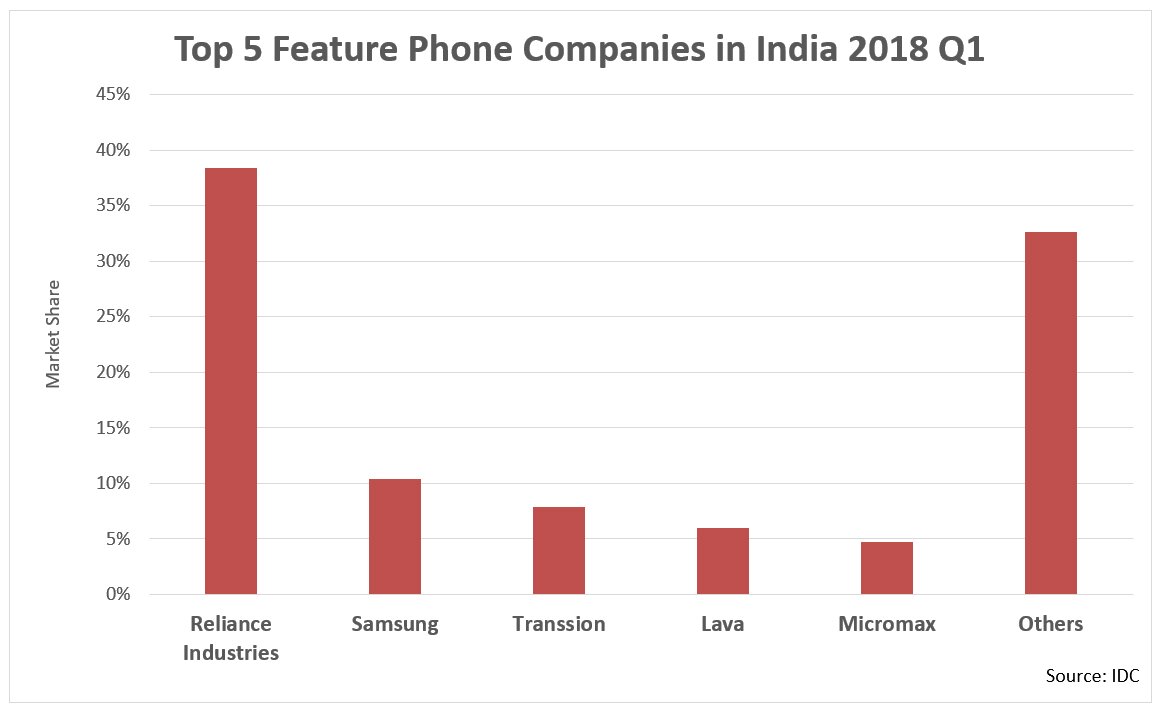

The 4G feature phone market continued to grow at more than 50% quarter-on-quarter, driven primarily by Jio Phone. The operator disrupted the market by introducing aggressively-priced data plans in the initial weeks of the quarter, acting as a catalyst for growth.

Xiaomi continued to lead the smartphone market in the first quarter of 2018 by doubling its volume year-on-year. Also, its continuous efforts to expand its offline footprint has helped promote visibility for the brand, ensuring availability in more places. In line with the duty hike on populated PCBs, Xiaomi announced its big move towards local manufacturing by setting up its first SMT (Surface Mount Technology) facility in Tamil Nadu in April 2018.

Samsung remained in the second spot with flat annual growth in the first quarter of 2018. Samsung’s two-pronged approach, with a focus on the low-to-mid range J-series and the latest flagship, the Galaxy S9 series — along with the Galaxy S8 series and Note 8 in the premium segment — drove shipments for the vendor.

Oppo climbed to third position from fifth in the last quarter. While it launched the F7 in the first quarter of 2018, the bulk of its shipments came from the mid-ranged A-series with upgraded variants in 2018. The channel’s realignment to focus on its partners, primarily with high sales contributions, continued to build deeper relationships. In a bid to capture the online space, Oppo did its first flash sale exclusive on Flipkart, ahead of the F7 launch. The smartphone maker is also expected to launch its new online exclusive series under the brand Realme.

Vivo slipped to fourth position as its shipments declined by 29.4% year-on-year in the first quarter of 2018. However, the brand grew by 2.1% compared to the previous quarter. The company’s Y-series continued to generate demand close to 70%.

Transsion made its debut in the top five, more than tripling its annual shipment growth in the first quarter of 2018. The China-based group has four brands under its umbrella — namely Itel, Tecno, Infinix and Spice. With its primary focus on offline channels, Itel and Tecno-branded phones are doing well in the highly price-sensitive India market.