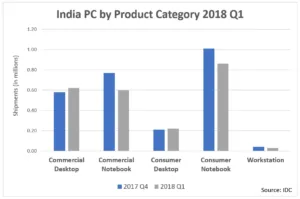

According to IDC, the India traditional PC shipments for the first quarter of 2018 stood at 2.35 million units, with a 9.9% decline quarter-on-quarter and 8.2% growth over the same period last year.

The consumer PC market recorded an overall shipment of 1.08 million units in the first quarter of 2018, with a 10.9% sequential decline and 3.2% increase compared to the same period last year. Associate research manager Manish Yadav commented:

“The general economic and employment scenario continues to remain pessimistic, which has impacted the consumer spending”.

The overall traditional commercial PC market stood at 1.26 million units in the first quarter of 2018 with a decline of 9.1% quarter-on-quarter but saw a growth of 13% year-on-year compared to the first quarter of 2017 on the back of a few state-owned education projects. Yadav continued:

“The pro-business policies have boosted India’s attractiveness and the lull period post-GST and demonetisation appear to be giving way to a positive overall business sentiment”.

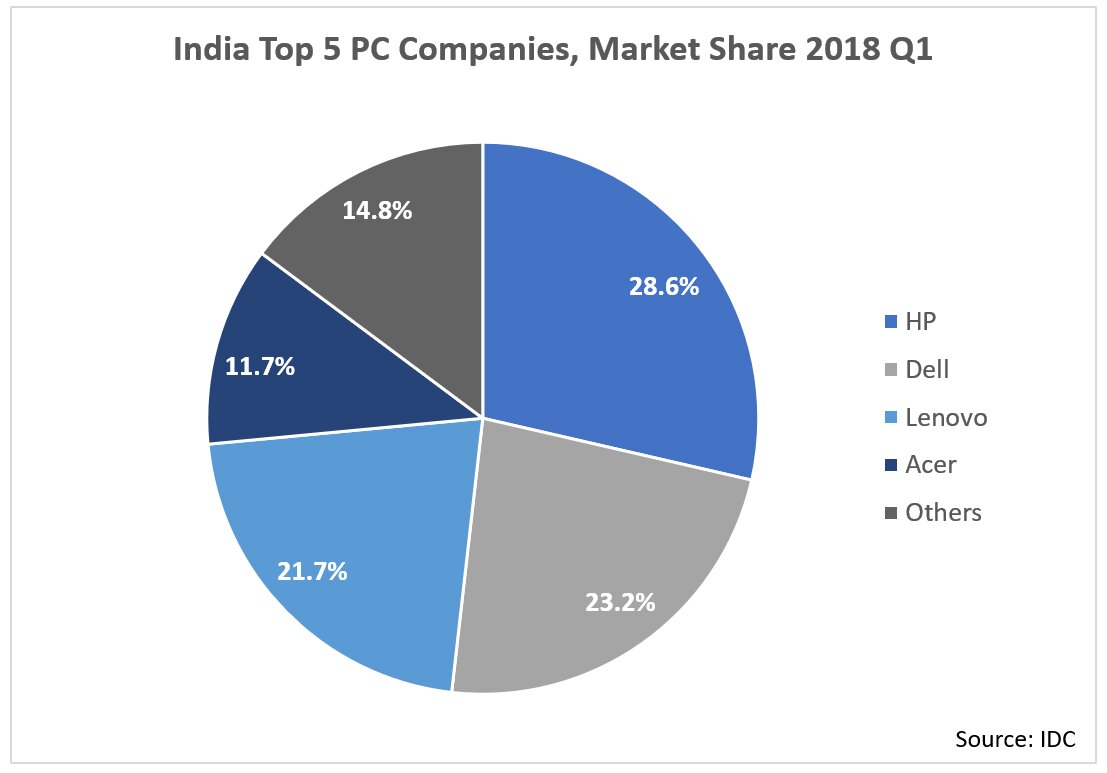

HP took an early lead in 2018 and achieved a market share of 28.6% in the first quarter of 2018. The company reclaimed its top spot in overall India traditional consumer PC market with a 29.9% market share, with 7.5% sequential growth and 6.7% year-on-year growth driven by strong consumer-focused initiatives, widespread retail presence and continued focus on gaming systems which has injected growth for the vendor in the category.

Dell slipped to the second spot with a 23.2% market share in the first quarter of 2018, clocking a year-on-year growth of 11.9% and sequential decline of 26.1%. The commercial business in the first quarter of 2018 contributed 54.8% share, which was driven primarily by re-energised GTM approach with channel-enabling initiatives to strengthen channel and partner-led business. The vendor’s efforts to enable digitisation and assist in the deployment of new applications in newer areas of the offering has contributed to the growth in verticals like Government and BFSI in the first quarter of 2018

Lenovo took the third spot, recording a market share of 21.7% in the first quarter of 2018. Increasing focus on social media engagement driven by dedicated service campaigns, along with channel support initiatives with better incentives, has brought in confidence in the channel partner community. This led to a 16.7% growth year-on-year and 16.9% growth quarter-on-quarter in the first quarter of 2018. The vendor’s efforts around enterprise-focused customer solutions coupled with new generation devices helped retention of key accounts, which led to a 45.1% year-on-year growth in the commercial segment.

IDC anticipates the PC market to get a boost in 2018 on the back of positive business sentiment and expected rise in consumer spending in addition to upcoming manifesto projects across few states.

The consumer spending is anticipated to rise across innovative form factors like convertibles and ultra slim. Consumer segment is also expected to see traction around gaming devices as OEMs will be looking to invest and create excitement around the gaming category. In the commercial segment, IDC anticipates growth over the next few quarters as the industry will look to deploy new and powerful devices to meet the evolving technology requirements across verticals. With pro-business policies, the emerging industries in the medium and large segment will look to increase their commercial spending