According to IDC, device usage habits of Filipinos are rapidly changing and it is reshaping connected device trends in the country. Its smartphone shipments declined 7% to approximately 15 million units in 2017, while tablet shipments posted a 30% year-on-year drop to 1 million units. On the other hand, PC shipments in 2017 amounted to around 2 million units, showing flat growth of 1% year-on-year.

Smartphone shipments recorded their first decline since being introduced into the local market as intense competition from top brands, such as Samsung, Oppo and Vivo resulted in some vendors being ousted from the market. Tablets continued to decline as their significance in the market waned due to the lack of practical use cases and cannibalisation by smartphones with larger screen sizes. Traditional PCs continued to grow due to increased education-related purchases and the growing traction of eSports in the country, among other things.

A clear trend has recently emerged in the Philippine smartphone market, where end users are shifting to handsets with higher specs and better features. The Philippines has historically been among the most price-sensitive markets in the Asia Pacific region and still is. Despite this, the average selling price of smartphones in 2017 grew to $134, a 13% year-on-year increase. Ultra low-end smartphones still hold the lion’s share of the market, accounting for 59% of all smartphones in 2017 compared with 67% in 2016. Meanwhile, the combined share of low-end and mid-range smartphones grew to 35% from 28% in 2016.

Samsung and Chinese brands such as Oppo and Vivo were the key driving brands that led to the growth of the low-end and mid-range segments in 2017. IDC ASEAN senior analyst Jensen Ooi said:

“Heavy marketing campaigns and lucrative sales promoter incentives enabled these brands to strengthen their mind-share in the local market, increase their shipments and grow their respective market shares. The assault of these brands affected the sales of some of the players, resulting in them reducing their supplies, which ultimately impacted overall smartphone shipments”.

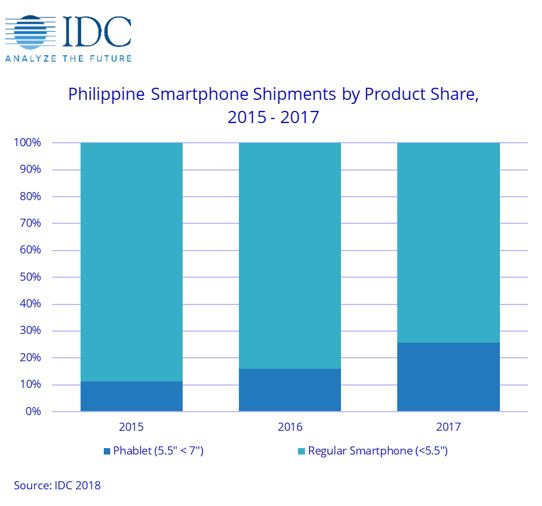

From a screen size perspective, phablets recorded significant growth in recent years, accounting for about a quarter of smartphone shipments in 2017. Ooi continued:

“As mobile content continues to grow, smartphones have become the primary device for basic productivity and everyday media consumption and this fuels the need for larger screens and higher specs”.

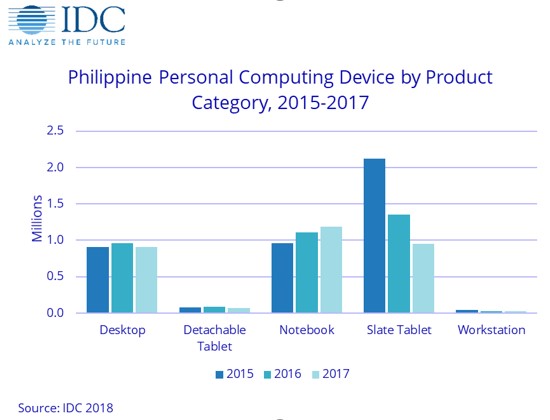

On the other hand, slate tablets, which used to be popular at one point, have begun to suffer from decreasing sales because they cannot offer the same level of practicality that phablets provide. Detachable tablets have also not caught on well in the Philippine market. Filipino end users find the relatively low specs but high price of detachables unappealing and opt for laptops within the same price range, which provide better overall utility.

The Philippines is among the few remaining bright spots for traditional PCs in the Asia Pacific region. Looking closer, it is the only region in Southeast Asia that still shows PC adoption growth. Over the past five years, the Philippine PC market has been growing at a CAGR of 3%, while its ASEAN neighbors have been declining at CAGRs of around -3% to -12%. The Philippines’ growth trend has been driven primarily by the country’s slow technology adoption but in the past few years, the mobility trend and large millennial Filipino population are also propelling traditional PC adoption to even higher levels. IDC Philippines market analyst Sean Paul Agapito also commented:

“Despite smartphones having drawn away a portion of consumer demand in recent years, desktop and notebook PCs remain viable personal computing devices, especially for heavy workloads and higher-level entertainment”.

While the growing on-the-go culture has fueled the PC-versus-smartphone trend among Filipino consumers, it has also influenced form-factor trends within the PC domain. Laptops have already overtaken desktops as the traditional PC of choice among consumers, with the latter increasingly being relegated to commercial and gaming uses.

The smartphone market in the Philippines is expected to rebound in 2018 as competition between popular brands—which will continue to strengthen their positions, and local and minor brands, which will continue to struggle to stay relevant—intensifies. Ooi also said:

“We expect smartphone vendors to continue shipping in more phablets and equipping their new models with enticing features, such as dual cameras, thin bezels, and on-device artificial intelligence”.

Meanwhile, the Philippine PC market is expected to grow in the coming years, driven by the hype and popularity of PC gaming and eSports, growing momentum of telecommuting and shift toward digital education. Agapito concluded:

“As the Philippine economy matures, internet services and coverage improve, and more Filipinos realise the potential of the internet beyond social interaction—such as for education, work, and business among others—demand for PCs in the country is expected to grow even further”.