Worldwide shipments of AR and VR headsets were down 30.5% year-on-year, totalling 1.2 million units in the first quarter of 2018, according to IDC. Much of the decline occurred due to the unbundling of screenless VR headsets during the quarter.

For much of 2017, vendors bundled these headsets free with the purchase of a high-end smartphone but that practice had largely come to an end by the start of 2018. Despite a poor start to the year, IDC anticipates the overall market will return to growth over the remainder of 2018 as more vendors target the commercial AR and VR markets and low-cost standalone VR headsets such as the Oculus Go make their way into stores.

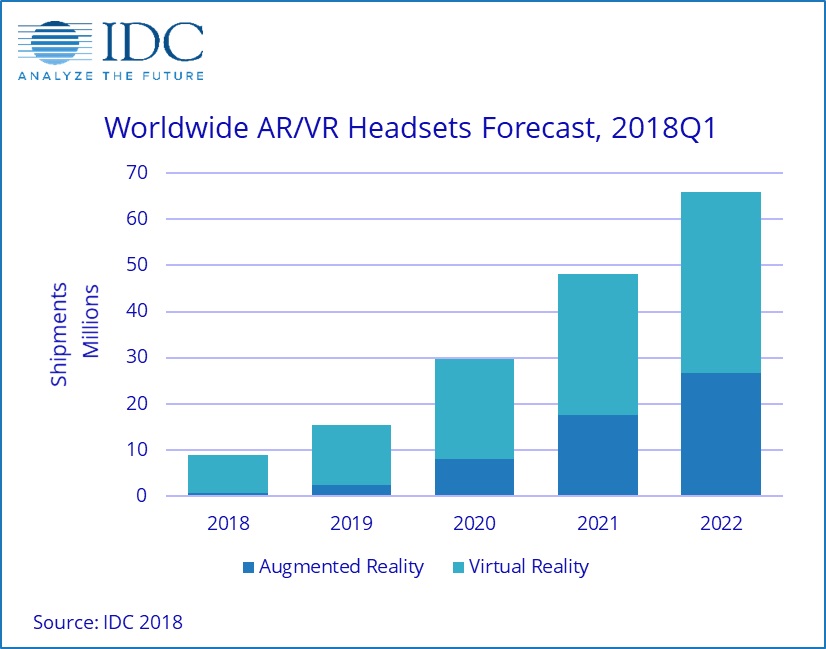

IDC forecasts that the overall AR and VR headset market will grow to 8.9 million units in 2018, up 6% from the prior year. That growth will continue throughout the forecast period, reaching 65.9 million units by 2022. Senior research analyst Jitesh Ubrani said:

“On the VR front, devices such as the Oculus Go seem promising, not because Facebook has solved all the issues surrounding VR, but rather because they are helping to set customer expectations for VR headsets in the future.

Looking ahead, consumers can expect easier-to-use devices at lower price points. Combine that with a growing line-up of content from game makers, Hollywood studios and even vocational training institutions, and we see a brighter future for the adoption of virtual reality”.

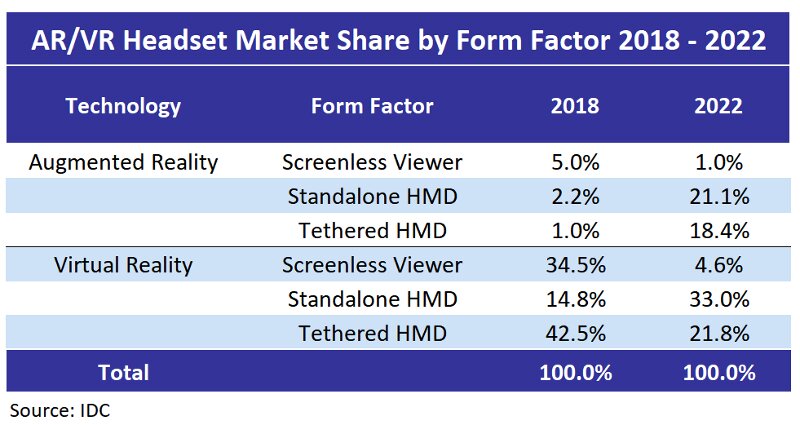

When it comes to AR headsets, many consumers have already had a taste of the technology through screenless viewers such as the Star Wars: Jedi Challenges product from Lenovo. IDC anticipates these types of headsets will lead the market in shipment volumes in the near term.

However, non-smartphone-based AR headsets should begin to see greater market availability by 2019 as commercial uptake continues to rise and existing brands launch next-generation products. Analysts predict triple-digit growth in this space between 2019 and 2021. IDC’s Tom Mainelli also commented:

“Momentum around AR continues to grow as more companies enter the space and begin the work necessary to create the software and services that will drive AR hardware. Industry watchers are eager to see new headsets ship from the likes of Magic Leap, Microsoft and others.

But for those devices to fulfil their promise we need developers creating the next-generation of applications that will drive new experiences on both the consumer and commercial sides of the market”.

Many consumers’ first experience with an AR headset will be in the form of a screenless viewer. While large movie properties such as Star Wars helped move significant volumes of these headsets during the recent holiday season, uptake for the remainder of the year is likely to slow as the headsets have limited functionality beyond their core applications.

In the latter years of the forecast, IDC expects such products to decline in relevance, although they are likely to remain in the market, often sold as toys. Meanwhile, standalone AR HMDs should grow to reach 194,000 units in 2018 and will experience a CAGR of 190.9% over the five-year forecast.

More advanced headsets such as Microsoft’s Hololens and Magic Leap’s One will help drive adoption in commercial and consumer markets. Finally, tethered headsets will grow at a five-year CAGR of 241.8%. This last category will be the eventual home of products with lower-cost headsets based on Apple’s ARKit and Google’s ARCore that tether to smartphones or tablets.

IDC forecasts that VR headsets will grow from 8.1 million in 2018 to 39.2 million by the end of 2022, representing a five-year CAGR of 48.1%. While many think of VR as a consumer technology, IDC believes the commercial market to be equally important and predicts it will grow from 24% of VR headset shipments in 2018 to 44.6% by 2022.

From a platform perspective, the market has been dominated by Oculus, largely due to the initial volumes around Samsung’s Gear VR. This will likely continue in the near term as the Go brings VR to more consumers. However, the Oculus platform is likely to face pressure from both HTC’s VIve platform and Microsoft’s Windows Mixed Reality.

The latter should see strong opportunities in the commercial market as brands such as HP, Dell and Lenovo bring their years of experience catering to enterprise buyers to the market.