IDC has released a new report predicting that augmented and virtual reality will grow by at least 100% each year from now until 2021.

In terms of revenue, this represents an increase from the $11.4 billion spent on AR/VR this year to a staggering $215 billion by the year 2021, a CAGR of 113.2%.

The company have also highlighted the individual sectors that are expected to use this kind of technology.

The US will be the region with the largest AR/VR spending total in 2017 ($3.2 billion), followed by Asia/Pacific (excluding Japan)(APeJ) ($3.0 billion) and Western Europe ($2.0 billion). Then APeJ jumps ahead of the U.S. in total spending for two years before its growth rate starts to slow in 2019. The U.S. then pushes back into the top position in 2020 driven by accelerating growth in the latter years of the forecast. Meanwhile, Western Europe is expected to overtake APeJ for the number two position in 2021. The regions that will experience the fastest growth over the 2016-2021 forecast period are Canada (145.2% CAGR), Central and Eastern Europe (133.5% CAGR), Western Europe (121.2% CAGR) and the US (120.5% CAGR).

The consumer segment will be the largest source of AR/VR revenues in each region in 2017. In the US and Western Europe, the next largest segments are discrete manufacturing and process manufacturing. In contrast, the next largest segments in APeJ in 2017 are retail and education. Over the course of the forecast, the consumer segment in the U.S. will be overtaken by process manufacturing, government, discrete manufacturing, retail, construction, transportation, and professional services. In APeJ, the consumer segment will remain the largest area of spending throughout the forecast, followed by education, retail, transportation, and healthcare in 2021. Consumer spending will also lead the way in Western Europe, with discrete manufacturing, retail, and process manufacturing showing strong growth by the end of the forecast.

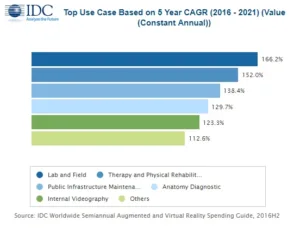

The industry use cases that will attract the largest AR/VR investments are also expected to evolve over the five-year forecast. In 2017, the largest industry use cases will be retail showcasing ($442 million), on-site assembly and safety ($362 million), and process manufacturing training ($309 million). By the end of the forecast, the largest industry use cases in terms will be industrial maintenance ($5.2 billion) and public infrastructure maintenance ($3.6 billion), followed by retail showcasing ($3.2 billion). In contrast, the consumer segment will be dominated by AR and VR games throughout the forecast, with total spending reaching $9.5 billion in 2021. The use cases that will see the fastest growth over the forecast period are lab & field (166.2% CAGR), therapy and physical rehabilitation (152.0% CAGR), and public infrastructure maintenance (138.4% CAGR).

Marcus Torchia, research director of IDC Customer Insights & Analysis said,

“The consumer, retail, and manufacturing segments will be the early leaders in AR & VR investment and adoption. However, as we see in the regions, other segments like government, transportation, and education will utilize the transformative capabilities of these.

With use cases that span both AR & VR environments, we see a significant opportunity for companies to re-cast how users interact in business processes and everyday tasks”.