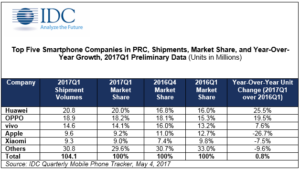

According to International Data Corporation (IDC), 104.1 million smartphones were shipped to China in 2017Q1. This was a mere 1% year-on-year (YoY) growth, in part the result of high inventory from the previous quarter. 2017Q1 was also relatively quiet aside from a few product launches like Huawei’s new P10, P10 Plus, and Honor V9. This, along with strong momentum for the Honor brand, helped Huawei reclaim the top position from OPPO.

“Despite a soft first quarter in China, the second quarter should pick up sequentially given not only JD.com’s June promotions, but also activity around a number of new products like vivo with its Y53, Xiaomi with its Mi 6, Meizu with its E2, and Gionee with its M6S Plus,” says Tay Xiaohan, Senior Market Analyst with IDC Asia/Pacific’s Client Devices team.

“Apple has been seeing double-digit YoY declines for the fifth quarter in a row, but we believe that Chinese consumers are holding out for the launch of Apple’s 10-year anniversary iPhone at the end of the year, and this will help Apple to see a rebound in the China smartphone market,” according to Tay.

These are some key highlights in the China smartphone market in 2017Q1 and some points on what we can expect to see for the coming year:

- The top five smartphone companies now dominate 70% of the market. We expect their share to continue to rise and to see more consolidation from the smaller companies in the coming year. We also do not expect to see any new smartphone companies entering the market that will be able to make a significant difference to the smartphone scene in China.

- Android ASPs continued to increase QoQ and YoY. This was largely due to the top Chinese smartphone companies Huawei, OPPO and vivo seeing an increase in their ASPs, as consumers seek to purchase their key flagship models. Consumers are also seeking to upgrade their smartphones to seek a better user experience, and these companies offer models that can meet their needs. Additionally, with key flagships by these Chinese companies having more upgraded specifications such as dual cameras and OLED screens, the price of smartphones has continued to increase.

- Huawei’s Honor 8, OPPO’s R9s and vivo’s X9 were the popular models from these companies in the quarter. Apart from the continued reliance in celebrity endorsers for these models, one other common factor these models share is the strength of the phones’ cameras which was clearly highlighted across all their advertisements. These models also had batteries with the capacity of around 3000 mAh, highlighting the importance of phones having a powerful camera and strong battery life.

- Smartphone companies will be focusing more on their offline retail expansion. Huawei has committed to opening more experience stores in key cities while OPPO will be opening more stores in Tier 1 and Tier 2 cities. Xiaomi, who used to focus on its online channel, has targeted to open 1,000 Mi Home stores in the next 3 years across China.

“Having one star flagship model that is marketed successfully is sufficient to significantly propel a company’s shipments in the right direction. This can be aptly exemplified in OPPO’s key flagship R9s which comprised close to half of its overall shipments. In light of the foregoing, whilst the Chinese companies can continue to innovate and try to outshine one another in the coming year, they can also consider focusing their resources on one or two key models with clear key messages than to stretch themselves thin and try to diversify their portfolio,” ends Tay.

Notes:

- Data is preliminary and subject to change.

- The “Company” represents the current parent company (or holding company) for all brands owned and operated as subsidiary.