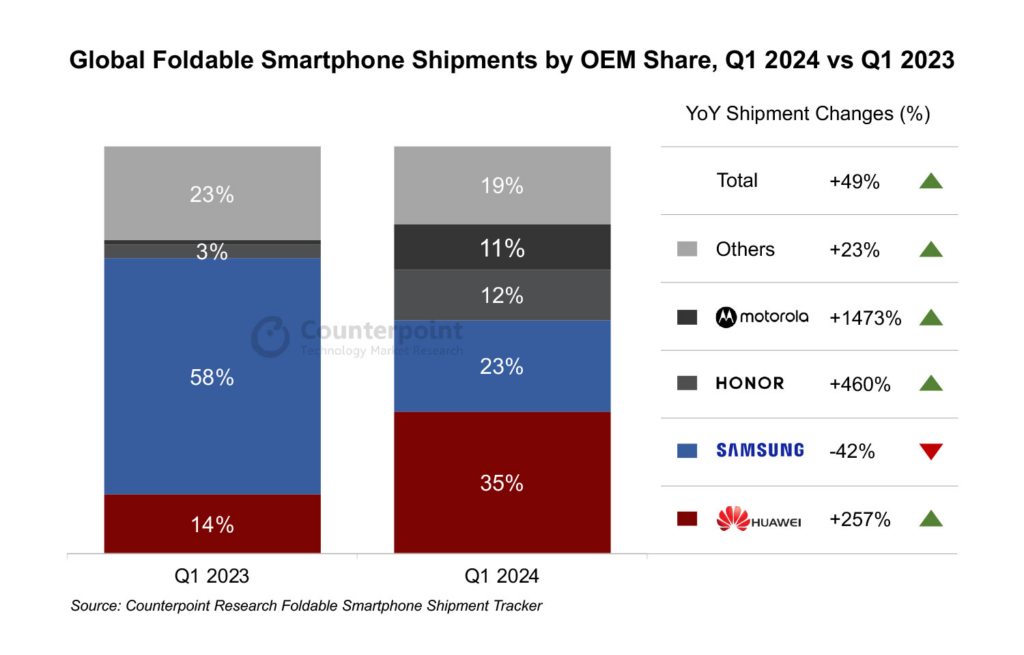

The global foldable smartphone market experienced 49% year-on-year increase in Q1 2024, the highest growth rate observed in six quarters. This surge was largely driven by substantial shipment increases from several Chinese original equipment manufacturers (OEMs), according to the latest data from the Counterpoint.

Huawei emerged as a key player, taking the top spot in quarterly global shipments for the first time, surpassing Samsung, which had previously dominated the market. Huawei’s transition to 5G foldable devices significantly contributed to its 257% year-on-year growth this quarter. A year ago, Huawei’s foldable lineup was limited to LTE models. By Q1 2024, 84% of Huawei’s foldable shipments were 5G-enabled.

Huawei’s first 5G book-type foldable, the Mate X5, launched in September last year, has consistently been a bestseller in China’s foldable market for three consecutive quarters. The recent release of Huawei’s first 5G clamshell model, the Pocket 2, in April 2024, further boosted the company’s shipments. Despite facing supply chain challenges for its self-developed 5G System on Chip (SoC), Huawei continues to prioritize foldables due to their higher price positioning.

Honor and Motorola have also achieved notable growth, particularly in international markets. Honor’s global market share in foldables jumped from 3% a year ago to 12% in Q1 2024, positioning it as the third-largest player. This growth was driven by the Honor Magic V2, the slimmest infolding book-type model, which became the most shipped foldable phone in Western Europe during the first quarter of 2024. Motorola, now holding an 11% global market share, ranked fourth with its Razr 40 model, which saw significant success in North America.

The first quarter of 2024 marked a shift in consumer preferences, with book-type foldables accounting for 55% of global shipments, surpassing clamshell models for the first time since 2021. This change is attributed to the consistent launch of new book-type products by Chinese OEMs, including Huawei, Honor, OnePlus, and vivo. In contrast, the growth of Samsung’s clamshell segment has slowed, contributing to this market shift.

Despite the rise of book-type foldables, the clamshell market is expected to see continued growth this year, driven by upcoming product launches. Samsung aims to regain its market leadership with the anticipated release of the Z Flip 6, promising enhanced performance and reliability. Huawei plans to expand its clamshell lineup with a lower-priced model, while both Honor and Xiaomi are set to enter the clamshell competition for the first time, intensifying market dynamics.