There are two warranty trends in the global OEM computer industry that Warranty Week has examined in its most recent report. First, the migration from desktop to laptop to handheld, causing relative warranty costs to rise; and second, the computer industry has undergone rapid consolidation in the past few decades, a development that took a hundred years to take place in the automotive trade.

In 2003, the US computer industry consisted of 25 manufacturers; over the years these companies have merged or gone private, leaving three major publicly quoted players (IBM, HP and Apple) and three smaller companies (Unisys, Silicon Graphics and Xplore Technologies).

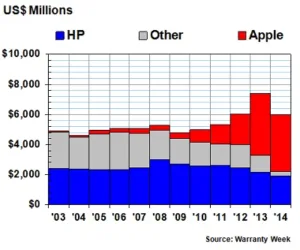

Despite the relatively small number of companies, the computer industry is still the second-largest warranty-providing category (behind automotive). The industry’s claims total in 2014 was about $5.97 billion, down $1.4 billion from 2013. Why did this happen?

Worldwide Warranty Claims of US-based Computer ManufacturersLooking at the ‘big three’, Warranty Week data shows that everybody paid fewer claims. Apple was down $341 million YoY, HP $215 million and IBM $89 million. The largest decline, though, was caused by Dell leaving the public warranty-provider industry after it went private.

HP, Apple and IBM were responsible for less than half of the $1.4 billion decline; the rest came from Dell. There was an accompanying 2% rise in product sales, but also a wide divergence in trends. Apple’s hardware sales were up 26%, HP by almost 2%, and IBM down by 23% (almost matching its decline in claims payments).

Accruals

Accruals were similar. The industry’s total accruals fell by $1.77 billion. About half came from Dell, but in general all companies put less money aside to deal with warranty expenses. Apple’s accruals were down $796 million; HP $167 million; and IBM $106 million.

Warranty Week notes that Apple’s accruals in 2008 and 2009 were actually lower than preceding years, despite the fact that this was shortly after the launch of the iPhone. However, it set aside more than $1 billion in 2010 – when the smartphone rose to prominence.

When a computer becomes smaller, its relative warranty costs rise. Apple’s emergence in the warranty market is partly due to the growth of the iPhone, and partly due to the overall shift from desktops and notebooks to handhelds.

Meanwhile, HP has been steadily reducing its annual accruals since their peak of $3.35 billion in fiscal 2008. Some of that is due to falling sales, but mostly it is because of rising product reliability.

IBM’s accruals in 2014 were less than 25% of the 2003 total, due to a 10-year shift away from hardware sales and towards service provision. Hardware represented less than 10% of IBM’s revenue in Q4’14, while global services was 56%.

Reserves

Accruals go into warranty reserve funds, which is also where claims are paid from. Due to currency fluctuations, acquisitions and other factors, reserve funds’ balances never quite equal the addition of accruals and subtraction of claims.

Among the big three, only IBM made any sizeable warranty reserve adjustments in 2014, removing $126 million in Q4. Officially this is called a change of estimate, which is what happens when a company concludes that its past accruals have been excessive. These funds are counted towards net income, instead. This – and the departure of Dell – caused the non-HP and -Apple reserve category to shrink to $197 million (compared to Apple’s $5.2 billion and HP’s $2 billion).

Despite the withdrawal of Dell and IBM’s lower reserve, 2014 was the fifth consecutive year that warranty reserves rose in the US computer industry, mostly due to Apple.

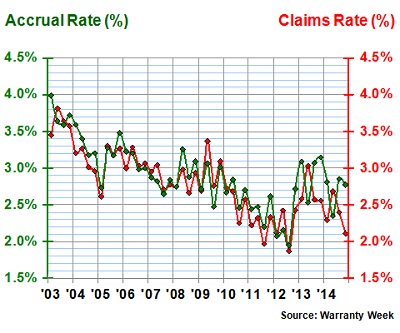

Claims and Accruals Rates

Warranty Week calculates companies’ claims rates by taking the claims total and dividing them by sales; accruals rates are calculated by dividing accruals by sales.

Two trends are seen in the data. From 2003 – 2012, both rates rates fell slowly. From 2013 they began to rise, or at least stopped falling. Warranty Week believes that the data is showing the influence of HP and Apple.

All US-based Computer Manufacturers Average Warranty Claims & Accrual Rates (as a % of product sales, 2003-2014)HP has been one of the most successful warranty cost-cutters of any industry. In 2003 it was paying 4.2% of its product revenue into warranty claims – almost $2.4 billion per year. By 2008 that exceeded $3 billion – but the actual claims rate was down to 3.3%, due to rising revenue. It fell below 3% in 2013 and 2.6% in early 2014. To put it another way, by lowering its claims rate, HP is saving more than $1 billion per year.

All US-based Computer Manufacturers Average Warranty Claims & Accrual Rates (as a % of product sales, 2003-2014)HP has been one of the most successful warranty cost-cutters of any industry. In 2003 it was paying 4.2% of its product revenue into warranty claims – almost $2.4 billion per year. By 2008 that exceeded $3 billion – but the actual claims rate was down to 3.3%, due to rising revenue. It fell below 3% in 2013 and 2.6% in early 2014. To put it another way, by lowering its claims rate, HP is saving more than $1 billion per year.

Apple, on the other hand, as seen its expenses rates rise thanks to its shift to mobile products. Claims rates varied from 1% to 2% from 2003 – 2012 – but as the product mix shifted, accruals went as high as 3.9% in 2013.

Effectively, the chart shows the transformation of the industry average – from HP’s cost-cutting to Apple’s rising expenses.