EMEA PC shipments fell 23% YoY in Q3’15, to 18.4 million, according to IDC. Ongoing currency fluctuations in several countries, as well as political instability in Eastern Europe and the Middle East, affected the result.

In addition to the currency and political woes, retailers across the region focused on clearing low-cost ‘Windows 8.1-with-Bing’ inventory, in preparation for the end-of-year shopping period. While Windows 10 shipments began to rise in September, Microsoft’s free upgrade programme meant that demand did not significantly increase.

“Bringing inventory levels under control has proven to be very challenging but there has been clear progress and this should facilitate new shipments in the coming quarter”, said research manager Maciek Gornicki.

All three EMEA sub-regions exhibited a decline. Shipments fell 18.4% in Western Europe; 28.4% in MEA; and 31.3% in CEE. Last year, Bing notebooks boosted consumer portable PC shipments, while the commercial market benefited from Windows XP replacements; this meant that the YoY comparison was unfavourable for Q3’15. Consumer PC shipments were down 28.1% and the commercial market down 17.2%. Retailers priced consumer products aggressively in an attempt to clear Bing inventory.

Desktop demand remained weak, as the trend towards mobile devices continued. Overall demand was relatively low in the commercial segment, as most XP renewals have now been completed. IDC expects many businesses to delay new PC purchases until early 2016, when they can benefit from new CPU technologies. Overall, desktop shipments in EMEA fell 23.3% YoY, while portables were down 22.8%.

PC shipments in Western Europe reached 11.8 million units. The consumer market, falling 24%, drove the contraction. As with the wider EMEA region, inventory levels of Bing units were high and limited new shipments. However, vendors worked with channel partners throughout Q3 to help reduce stock. Q4’15 is likely to see lower impact and more new products shipped. The commercial market also remained constrained, with shipments falling 12.7% YoY. Currency fluctuations and a cautious outlook by businesses inhibited shipments.

All major Western European countries posted declines. Shipments in France and Germany fell 21.2% and 23.3%, respectively, while the UK fared slightly better witth an 11.1% decline. Spain outperformed the regional average, falling 3.3%. Due to capital controls imposed in Greece shipments fell to record low levels, declining 50% YoY. The overall sub-regional decline was slightly higher than expected.

The CEE and MEA (CEMA) regions posted the worst result for years – lower than IDC’s prediction. The market was affected by political instability, currency fluctuations, low oil prices, a lack of projects and weak IT spending, as well as high Bing inventory.

A 31.3% decline in CEE was the sub-region’s worst fall in 13 quarters: only a few countries reported a somewhat lighter decline. Poland, the Czech Republic, Romania and Hungary were supported by public and corporate sector projects; they experienced a single-digit fall of sub-8%. The portable PC market across the region fell 33%, while desktops were down 27.9%. As for MEA, the PC market declined 28.4%, with portable shipments again falling faster than desktops. Portable PCs continued to be cannibalised by tablets and smartphones.

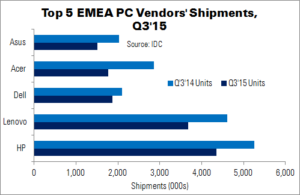

| Top 5 EMEA PC Vendors’ Shipments, Q3’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q3’15 Units | Q’3’14 Units | Q3’15 Market Share | Q3’14 Market Share | YoY Change |

| HP | 4,353 | 5,254 | 23.7% | 22.0% | -17.1% |

| Lenovo | 3,684 | 4,610 | 20.1% | 19.3% | -20.1% |

| Dell | 1,863 | 2,099 | 10.1% | 8.8% | -11.3% |

| Acer | 1,770 | 2,854 | 9.6% | 12.0% | -38.0% |

| Asus | 1,510 | 2,026 | 8.2% | 8.5% | -25.5% |

| Others | 5,185 | 7,004 | 28.2% | 29.4% | -26.0% |

| Total | 18,365 | 23,847 | 100.0% | 100.0% | -23.0% |

| Source: IDC | |||||

All of the top five vendors posted declines. HP led the market, with shipments falling in commercial and consumer segments. A strong Q3’14 and a focus on inventory depletion led to steep consumer decline. However, HP’s commercial vendors performed ‘significantly’ better than the market, thanks to attractive product portfolios and effective pricing strategies.

Lenovo performed slightly above the market average, affected by high inventory levels in both consumer and commercial shipments. Dell, in third place, outperformed the market thanks to its focus on the commercial space (avoiding high Bing inventory).

Acer took fourth place, focusing on stock clearance. Asus was in fifth; the need to reduce inventory led to cautious sell-in and a decline in shipments.