I’m very grateful to the GfU in Germany for sending out a release that reminded me that on December 4th 1970, Hoffmann-LaRoche filed for the first patent for LCD technology in Switzerland, so today the technology celebrates its 50th birthday!

As it happens, in the summer of 1970, I left school and after going to the rock festival on the Isle of Wight in the summer and spending some weeks hitchhiking with a guitar, long hair and a rucksack around France, in September 1970, I joined the pioneering electronics company, Marconi, in Chelmsford, Essex, in the UK, to become an apprentice. I spent a year with the firm before going to university.

Early in 1971, as part of my training I was working in the prototype production area and as part of that, I was shown around the research department, which I remember as being in the small village of Writtle (famous as the location of 2MT ‘Two Emma Toc’, the first radio station in Britain in 1922), although it’s possible at this distance in time that the lab was in Baddow, where I also worked for a while.

Anyway, back to LCD… In the research lab, we were shown a very crude monochrome passive LCD. I remember the engineer explaining to us that the performance was so slow and it was so dim, that it wasn’t clear what the real application was. Marconi made a lot of low volume equipment, so he suggested that it might be an alternative to metal labels on the back of equipment, which were expensive to make in small numbers in those days. How things have changed!! (We also saw a rudimentary inkjet printer mechanism, but that’s for another day!)

Early prototype of an alpha-numeric LCD based on the twisted nematic field-effect as realized in the laboratories of the Central Research Laboratories of F. Hoffmann-La Roche Ltd. by Martin Schadt and Wolfgang Helfrich. Photo: M. Schadt.

Early prototype of an alpha-numeric LCD based on the twisted nematic field-effect as realized in the laboratories of the Central Research Laboratories of F. Hoffmann-La Roche Ltd. by Martin Schadt and Wolfgang Helfrich. Photo: M. Schadt.

The early applications to use LCD were watches (1972) and calculators, where the low power advantages and reflective properties were critical enablers. (I had an early programmable calculator that used RED LEDs as the display – a PP3 battery would last one hour!!). The LCD mode used was Twisted Nematic (TN) where the stack of molecules untwist under the influence of a voltage. There were other liquid crystal modes, such as ferroelectric, which had advantages.

Developers of ferroelectric highlighted their advantages, such as bistability (which maintained the image with zero power), but according to a scientist from Thorn EMI I heard at an SID meeting some 20 years ago, TN LCD was able to develop in a very incremental way, while ferroelectric needed some relatively big technology steps and investment decisions. The TN LCDs were able to gain sales all the time, while steadily improving, so eventually driving ferroelectric out of the market (despite gallant efforts by Canon who developed active matrix monitors based on the technology. However, nobody else adopted it and it hit a dead end.)

Sharp Leads Development & Production

Anyway, Sharp was one of the major companies that really took up LCD production and became a key company in the industry. Manufacturing developed mainly in Asia, initially mainly in Japan, and has stayed in Asia despite several attempts to establish supply chains in the US and Europe.

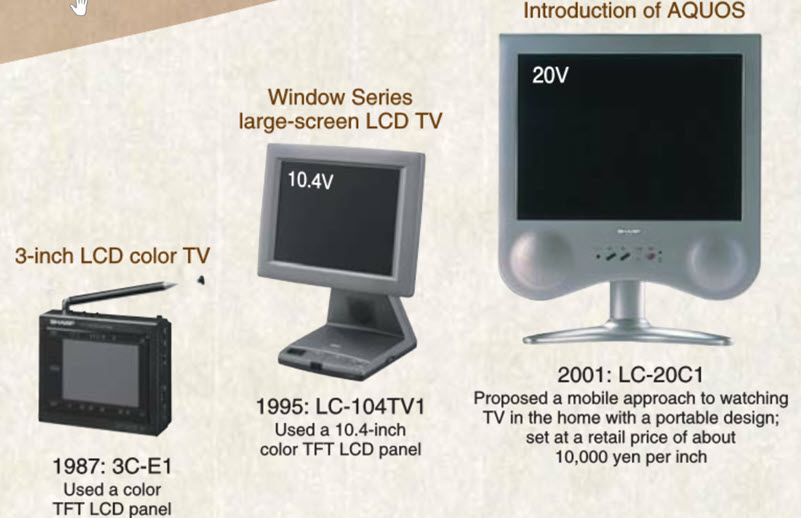

A key breakthrough was the development of active matrix technology, an idea that was conceived by Bernard Lechner of RCA Laboratories in 1968. The active matrix meant that the pixel could be maintained when not being addressed so that faster materials could be used, opening the way for video display. However, making active matrix displays was tricky (to put it mildly), and especially in large sizes. When I started Display Monitor some 25 years ago, it was widely accepted by analysts that the maximum size of TFT LCD would be around 20″ to 25″ because of the difficulty! Sharp made its first 3″ TFT LCD TV in 1987, and had pushed up to 8.6″ by 1991.

Sharp was a pioneer of LCD TVs. Image:Sharp

Sharp was a pioneer of LCD TVs. Image:Sharp

Notebooks are the Killer App

Battery-driven notebook computers had been really enabled by passive LCDs, originally monochrome, then colour. Before that, the ‘luggable’ computers used CRTs and had to be mains-powered. However, the LCDs, although low power, were very slow – there were ‘mouse trails’ in Windows so that you could see where the cursor had been! (that feature is still in Windows and can still be useful in finding a small cursor in a very high resolution display) Plasma display-based notebooks were faster and smaller/lighter, but only monochrome and had relative high power consumption, so were only on the market a short while.

Battery-driven notebook computers had been really enabled by passive LCDs, originally monochrome, then colour. Before that, the ‘luggable’ computers used CRTs and had to be mains-powered. However, the LCDs, although low power, were very slow – there were ‘mouse trails’ in Windows so that you could see where the cursor had been! (that feature is still in Windows and can still be useful in finding a small cursor in a very high resolution display) Plasma display-based notebooks were faster and smaller/lighter, but only monochrome and had relative high power consumption, so were only on the market a short while.

TFT TN LCDs were a breakthrough product, as they enabled higher speed operation and good performance in notebooks by the mid-90s. That, in turn, drove much higher volume production, despite high prices ($2,500 OEM price for volume VGA panels at one time!). The race to bring down prices started with notebooks as the ‘killer app’. LCD makers started to invest in making bigger and bigger substrates. Each generation of factory cost more than the previous one, but had a significantly higher yield. From Generation 1 for 10.4″ panels, we have now got to Gen 10.5, where the glass substrates are over 3 metres per side. (and probably at a limit as they can’t be transported by road at any bigger sizes, but again a discussion for another day!)

Next Desktop Monitors

As costs came down and LCDs were made bigger, the next key market was desktop monitors. A key breakthrough was the introduction of production IPS panels. TN had done well, but the viewing angles were poor (and very poor on early ones). IPS had much better viewing angle performance and was developed by Hitachi in the mid-90s, (we reported that Hitachi had won the patent in February 1997 in Display Monitor) and introduced at volume into the monitor market with the development of G5 fabs in the early noughties. By then, it was clear that cheap money was going to be the driver of the industry and we had a front page story when NEC announced that it was going to give up as ‘the business is about money, not technology’, or words to that effect.

Finally TV in Volume

G6 (with each substrate producing eight 32″ panels or six 37″ panels) was the key step in enabling TV panel production. Sharp’s first plant came on line in January 2004 with substrates of 1500 x 1800mm – the so-called ‘Tatami’ plant as the substrates are about the same length as the Japanese mats of that name. Since then, LCD has killed off CRT and PDP completely and kept OLED confined to the high end of the market. It will continue to dominate the volume end of the market for some time.

Key Area Markets

LCD now had the three key markets for display volume (and, more importantly, area) of notebooks, monitors and TV. PDP developers put up a good fight, but the downside that PDP pixels could not be made small or low power really killed the opportunity and PDP disappeared from production. IPS was a bit slow, and with limited on-axis contrast, so most TV panels are based on another LCD mode, VA.

Very High Volume with the iPhone

With the arrival of smartphones after the launch of the iPhone in 2007, LCD then took over the highest volume market to add to the highest area and really completed its dominance from the smallest displays up to around 100″. That size has been the effective limit partly because of driving difficulties and partly because once you get to that size, the logistics of delivering and installing monolithic displays becomes very, very tricky, so any market starts to get very small. (Of course, LCD makers developed narrow bezels to allow ’tiling’!)

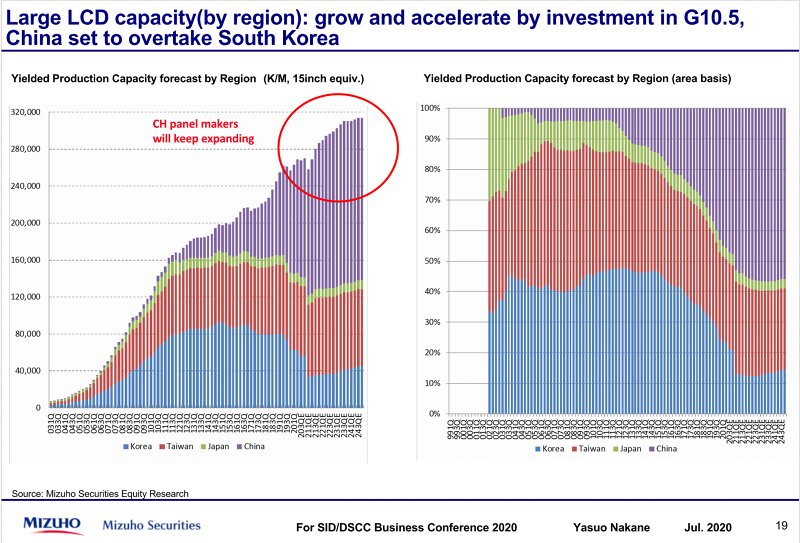

These charts from Mizhuo give a sense of the huge long term growth in (mainly) LCD. Click for higher resolution.

These charts from Mizhuo give a sense of the huge long term growth in (mainly) LCD. Click for higher resolution.

OLED Starts to Compete

The next phase has been real competition, from OLED technology. If you thought LCD making was difficult, OLED is much harder. However, as by ten or more years ago it was obvious that the LCD market would be dominated by those that made the most large panels, and that this was likely to be the Chinese, who had huge government financial support, the Korean makers started to try really hard to switch away from LCD. Their technology choice was OLED, partly because it was so difficult. So difficult, that Samsung failed in a huge attempt to make TV OLEDs. LG used technology developed by Kodak to make large TV panels, but couldn’t make the small high resolution panels that now dominate the premium smartphone market. Samsung could make those and it dominates the market for flexible OLEDs for smartphones and tablets.

So, from 50 years ago, the LCD industry has followed an amazing arc, from ‘what could we do with it’?, to hit a peak with dominance of smartphones, notebooks, monitors, TVs and digital signage. However, the technology is now past its historic peak share and QDOLED, QNED and microLED, as well as OLED, are all being developed to challenge its dominance. If the cost and production barriers can be overcome, the next technology to potentially have the same dominance is microLED, but that is (and has been) a subject for another Display Daily!

LCD makers continue to develop the technology, with dual layer, miniLED, QDs, new backlights, manufacture on polymers and improvements in materials and driving which will make competition incredibly difficult for others. (BR)