The global virtual reality (VR) headset market recorded its third consecutive annual decline in 2024, according to the latest findings from Counterpoint. Shipments fell by 12% year-over-year (YoY), weighed down by continued weak consumer demand, hardware limitations and insufficient compelling content.

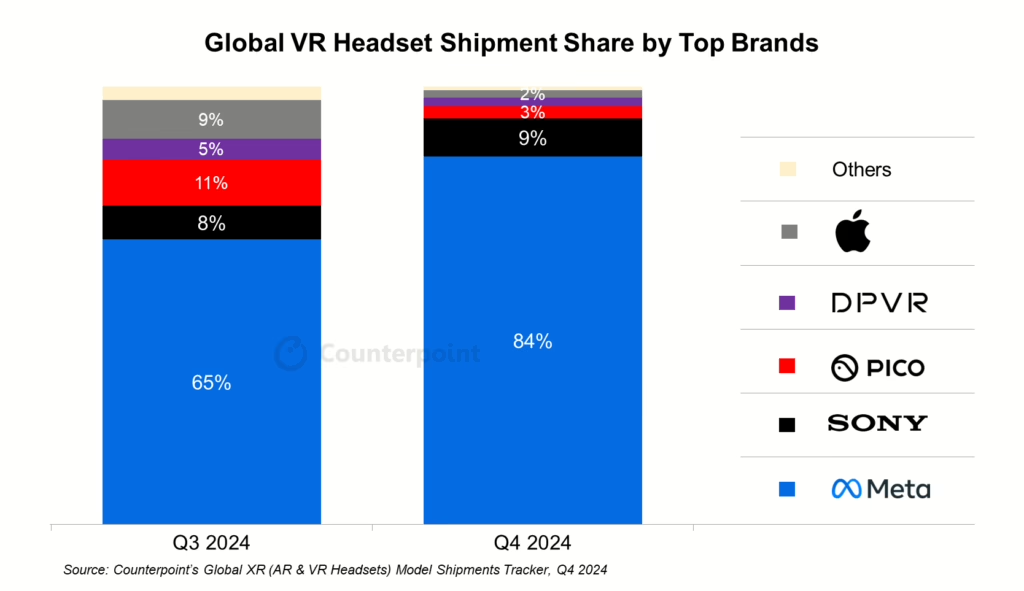

Despite the ongoing slump, Meta maintained its dominant position, securing 77% of total VR shipments for 2024. In the fourth quarter, the introduction of the more affordable Quest 3S raised Meta’s share to 84%,. Sony’s PlayStation VR2 captured 9% of Q4 shipments following a series of aggressive promotions during the holiday season, while Apple’s Vision Pro experienced a slowdown after early excitement subsided, showing a 43% quarter-over-quarter (QoQ) drop. The enterprise market, according to Counterpoint, offered a brighter spot, with Vision Pro’s business-focused sales picking up toward the end of the year.

Chinese OEMs Pico and DPVR also benefited from enterprise demand. Pico’s shipments to enterprise customers overtook its consumer-focused volumes, and DPVR grew by over 30% YoY in 2024. Both companies leveraged opportunities in sectors such as education, healthcare and location-based entertainment.

Counterpoint’s projections indicate that the global VR market will likely face continued headwinds over the next two years. Limited content outside of entertainment, ongoing trade-offs between headset weight and performance, and issues such as eye fatigue remain significant barriers to broader adoption. Although spatial computing holds promise, breakthroughs in hardware design and content development will be critical to energizing the VR category.

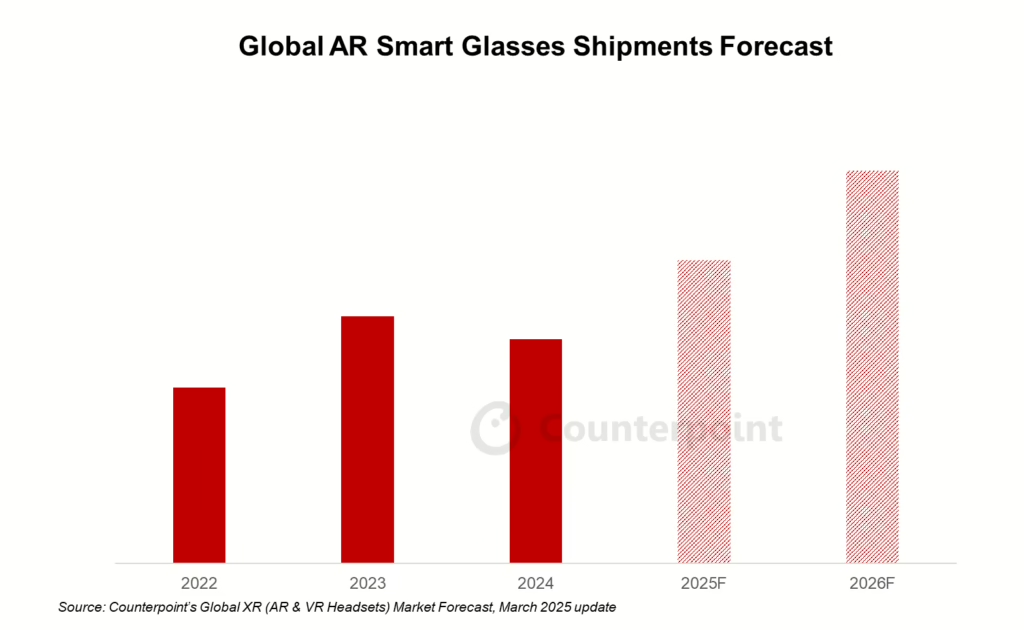

On the augmented reality (AR) front, Counterpoint reports that global AR smart glasses shipments declined by 8% YoY in 2024. Birdbath-based video-watching AR glasses grew by 27% and remained the dominant category, while waveguide-based products, such as INMO’s glasses, faced a stark 67% YoY drop due to softer consumer demand.

Counterpoint forecasts over 30% YoY growth for AR glasses through 2026 with thge integration of AI features into AR. As generative AI technologies mature, more companies are framing AR glasses as a crucial tool for delivering artificial intelligence experiences. Google’s planned release of Android XR OS is anticipated to unlock new software possibilities, thanks to integration with its large AI models and a broad suite of Android apps.

Ultimately, while the near-term outlook remains challenging for VR, the industry as a whole is poised for an upswing, driven by breakthroughs in AR+AI technologies and renewed enterprise demand. Counterpoint’s analysis suggests that the next wave of immersive tech will hinge on whether key players can broaden use cases, refine hardware and tap into the growing synergy between AI and XR experiences.