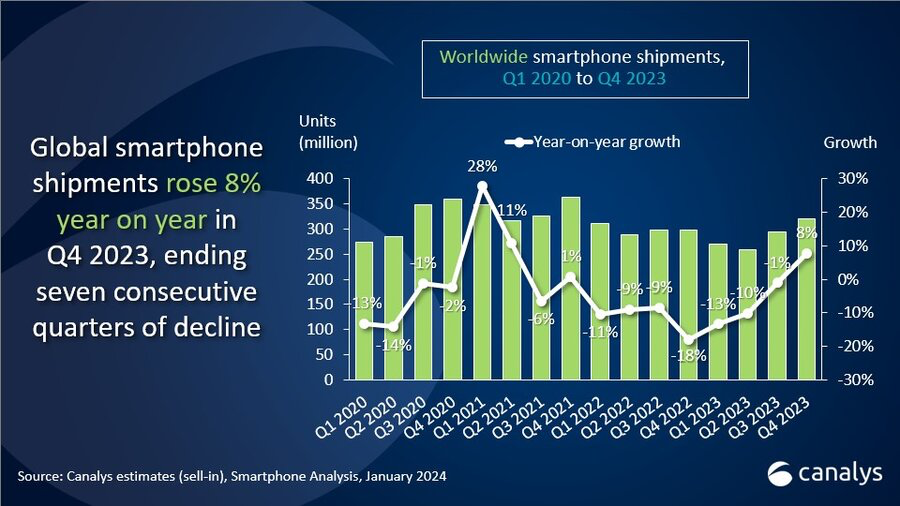

In a significant shift in the global smartphone market, the fourth quarter of 2023 marked an 8% YoY increase in worldwide smartphone shipments, totaling 320 million units. This growth, according to the latest research from Canalys, ended a streak of seven consecutive quarters of decline.

| Vendor | Q4’23 market share | Q4’22 market share | ||

| Apple | 24% | 25% | ||

| Samsung | 17% | 20% | ||

| Xiaomi | 13% | 11% | ||

| Transssion | 9% | 6% | ||

| vivo | 7% | 8% | ||

| Others | 30% | 30% | ||

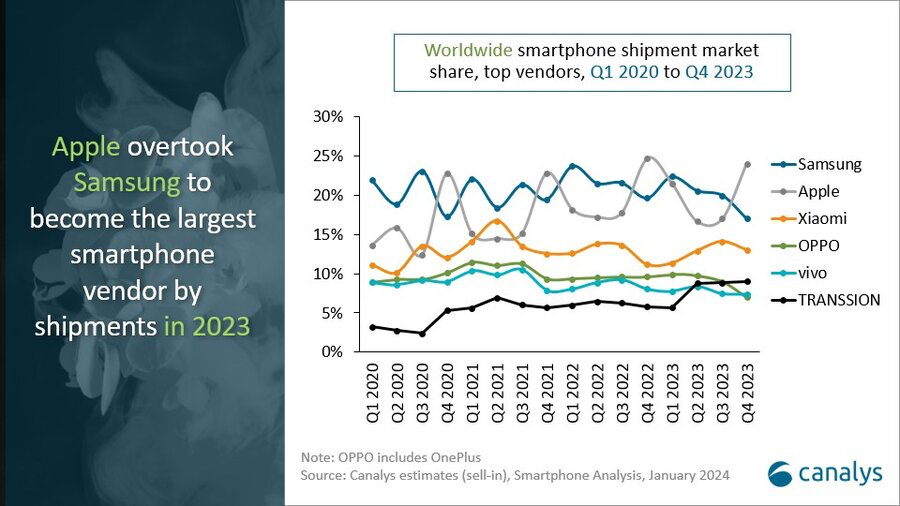

Apple emerged as the market leader in Q4, capturing a 24% share of shipments, largely attributed to its latest iPhone launches. Samsung followed, securing second place with a 17% share. The much underrated Xiaomi claimed third place, experiencing over 20% YoY growth in the same quarter. For the first time, Transsion ascended to fourth place, benefiting from the recovery in emerging markets. Rounding out the top five was vivo, with a 7% market share.

Despite the Q4 upswing, the full-year 2023 figures painted a different picture. Global smartphone shipments reached approximately 1.1 billion units, marking a 4% decrease from the previous year. In a notable shift, Apple overtook Samsung as the top vendor for the year, with both companies rounding to 20% market shares. Xiaomi, Oppo, and Transsion held respective market shares of 13%, 9%, and 8%.

The market was helped by increased demand during the holiday season, particularly for mid-to-low-end price range products. This trend was bolstered by a resurgence in demand across emerging markets in regions such as the Middle East and Africa, Asia Pacific, and Latin America. The easing of inventory pressure and global inflation has also allowed vendors to shift their focus towards product innovation and long-term strategic development.

The report further highlights that top players like Samsung and Apple are actively seeking new growth drivers for their smartphone businesses. Samsung’s focus in 2023 on the mid-to-high-end segment for profitability led to a loss in market share, particularly in the low-end segment, as well as its leading position globally. However, Samsung’s upcoming 2024 product launches, especially in the high-end segment with an emphasis on on-device AI, are expected to reinforce its position as an innovation leader.

On the other hand, Apple has demonstrated resilience over the past two years, particularly in the high-end segment. The iPhone 15 series’ expanded positioning indicates Apple’s strategy to reach a broader range of consumer segments. However, Apple faces challenges in sustaining its growth trajectory, especially in mainland China due to increasing competition from local brands like Huawei, and leveling off of high-end replacement demand in major markets like North America and Europe. Canalys suggests that Apple’s continued growth may depend on exploring new market opportunities and leveraging its ecosystem strength.