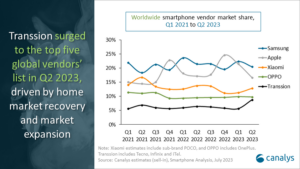

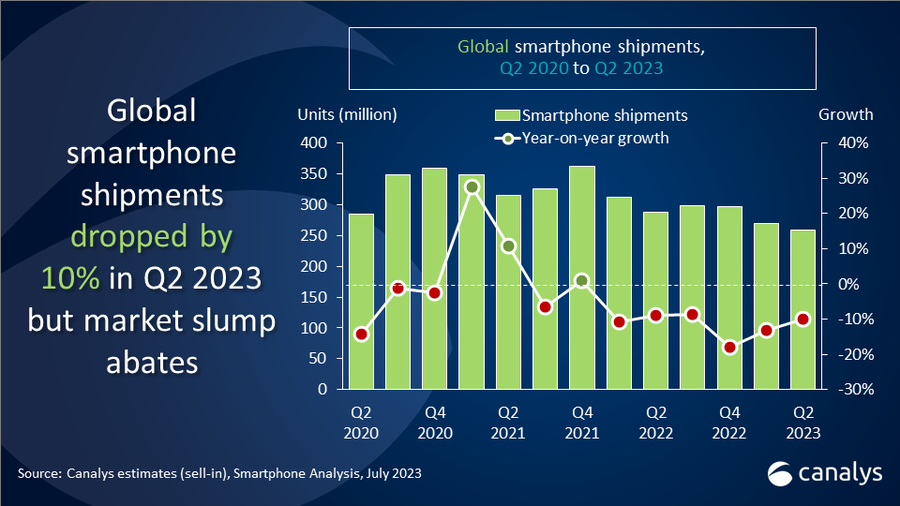

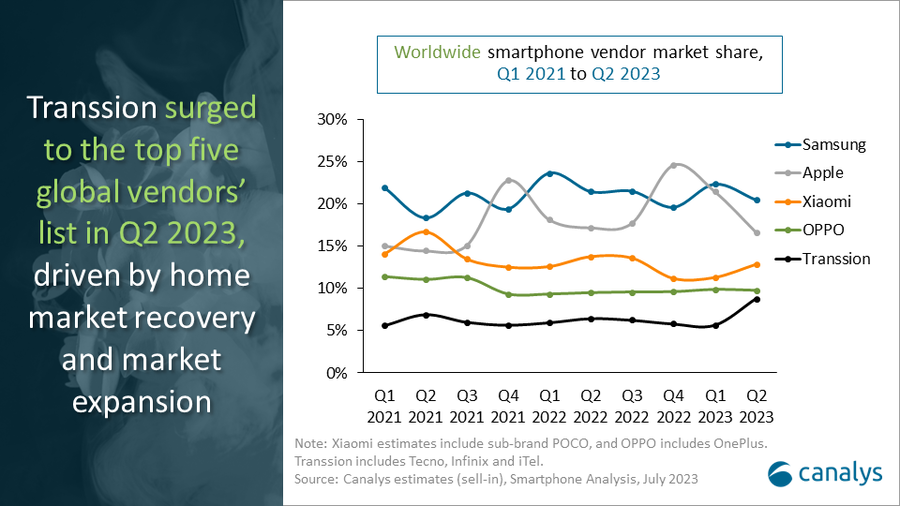

In Q2’23, the worldwide smartphone market experienced a 10% decline, with a total of 258.2 million units shipped. The decline showed signs of slowing down compared to previous periods with Samsung emerging as the top dog, shipping 53 million units, while Apple retained its second position with 43 million units and a 17% market share. Emerging vendors such as Xiaomi and Transsion Group also made significant strides.

However, Samsung’s Q2 performance was its lowest since 2013, likely due to profitability pressures and the semiconductor industry’s general slow recovery. The company showcased its ambitions to compete with Apple in the premium market with its launch of the Galaxy Z Flip and Fold models in a worldwide PR extravaganza. Apple maintained a strong position, securing the second spot with a 17% market share.

Xiaomi, with a normalized inventory level, ranked third by shipping 33.2 million units. Oppo, which includes OnePlus, held the fourth position with a 10% market share. Meanwhile, the Transsion Group (Itel, Tecno, Infinix phone brands) experienced remarkable growth, entering the top five for the first time by shipping 22.7 million units, driven by recovery opportunities in the African market and other emerging regions where they expanded.

The pace of recovery in the global smartphone market varied significantly across regions. In the Middle East and Southeast Asian markets, vendor investments and increasing consumer demand drove positive growth. The Latin American market also exhibited steady shipment recovery as vendors expanded into open channels, creating pressure for leading operators facing challenges in their core subscription business.

Canalys analysts anticipate a moderate decline in the global smartphone market for the rest of 2023. The first half of the year witnessed warming up of the smartphone supply chain, boosted by higher component prices and reduced channel inventory levels. Emerging vendors demonstrated agility and openness to new market opportunities, positioning themselves for potential growth in the second half. Companies that strike a balance between short-term market fluctuations and long-term structural changes are likely to thrive in this round of the market down cycle.

| Vendor | Q2 2023 Shipments (million) | Q2 2023 Market Share | Q2 2022 Shipments (million) | Q2 2022 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Samsung | 53.0 | 21% | 61.8 | 21% | -14% |

| Apple | 43.0 | 17% | 49.5 | 17% | -13% |

| Xiaomi | 33.2 | 13% | 39.6 | 14% | -16% |

| OPPO | 25.2 | 10% | 27.3 | 10% | -8% |

| Transsion | 22.7 | 9% | 18.5 | 6% | 22% |

| Others | 81.1 | 31% | 90.7 | 32% | -11% |

| Total | 258.2 | 100% | 287.4 | 100% | -10% |