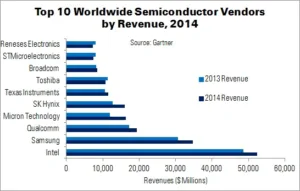

Gartner, meanwhile, recorded total sales of $340.3 billion last year – a 7.9% YoY rise from 2013’s $315.4 billion. The combined revenue of the top 25 companies was up 11.7% and accounted for 72.4% of the total market revenue up from 69.9%).

| Top 10 Worldwide Semiconductor Vendors by Revenue, 2014 ($ Millions) | ||||

|---|---|---|---|---|

| Vendor | 2014 Revenue | 2013 Revenue | YoY Growth | 2014 Market Share |

| Intel | 52,331 | 48,589 | 7.7% | 15.4% |

| Samsung | 34,742 | 30,636 | 13.4% | 10.2% |

| Qualcomm | 19,291 | 17,211 | 12.1% | 5.7% |

| Micron Technology | 16,278 | 11,918 | 36.6% | 4.8% |

| SK Hynix | 15,997 | 12,625 | 26.7% | 4.7% |

| Texas Instruments | 11,538 | 10,591 | 8.9% | 3.4% |

| Toshiba | 10,665 | 11,277 | -5.4% | 3.1% |

| Broadcom | 8,428 | 8,199 | 2.8% | 2.5% |

| STMicroelectronics | 7,376 | 8,082 | -8.7% | 2.2% |

| Renesas Electronics | 7,276 | 7,979 | -8.8% | 2.1% |

| Source: Gartner | ||||

All device categories rose, unlike 2013, when ASICs, discretes and microcomponents all fell. DRAM was the best performer for the second consecutive year.

Intel returned to growth after two years of revenue declines, thanks to recovering PC production. The company’s sales rose 7.7% and it retained the number one market share position for the 23rd year, with a 15.4% share. Samsung (10.2%), Qualcomm (5.7%), Micron (4.8%) and SK Hynix (4.7%) completed the top five.

Several mergers and acquisitions were announced in 2015 – significantly more than 2013 – with some still to close this year. Among the most significant were Avago’s acquisition of LSI, MStar’s merger with Mediatek and ON Semiconductor’s acquisition of Aptina Imaging.