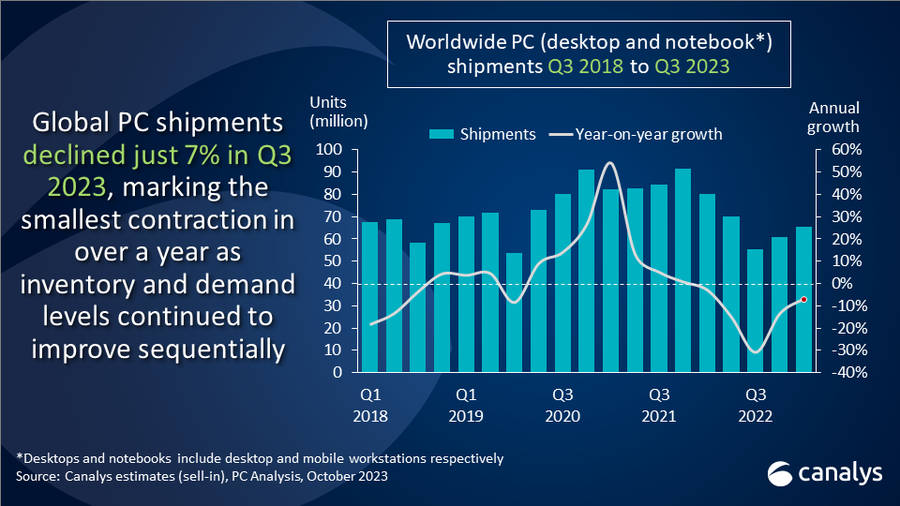

Global PC shipments totaled 65.6 million units in Q3’23, down 7% YoY but up 8% QoQ, according to the latest data from Canalys. This was the smallest decline in over a year, indicating the market is recovering. Both notebook and desktop shipments declined but showed improvement compared to the first half of 2023. Notebooks dropped 6% annually while desktops fell 8%.

Several major PC vendors like Lenovo, HP, and Dell saw sequential shipment growth, suggesting inventory correction efforts have been successful and demand is picking back up.

| Vendor (company) | Q3’23 shipments | Q3’23 market share | Q3’22 shipments | Q3’22 market share | Annual growth |

|---|---|---|---|---|---|

| Lenovo | 16,031 | 24.5% | 16,698 | 23.8% | -4.0% |

| HP | 13,512 | 20.6% | 12,689 | 18.1% | 6.5% |

| Dell | 10,255 | 15.6% | 11,963 | 17.0% | -14.3% |

| Apple | 6,421 | 9.8% | 9,063 | 12.9% | -29.1% |

| Asus | 4,882 | 7.4% | 5,466 | 7.8% | -10.7% |

| Others | 14,445 | 22.0% | 14,372 | 20.5% | 0.5% |

| Total | 65,546 | 100.0% | 70,250 | 100.0% | -6.7% |

Lenovo maintained its top position with 16 million units shipped and 24.5% market share, despite a mild 4% shipment decline versus last year. HP grew shipments 6.5% annually to take second place with 13.5 million units and 20.6% market share. Dell shipments declined 14% YoY but remained at number 3. Apple saw the biggest drop at 29% due to tough prior year comparisons.

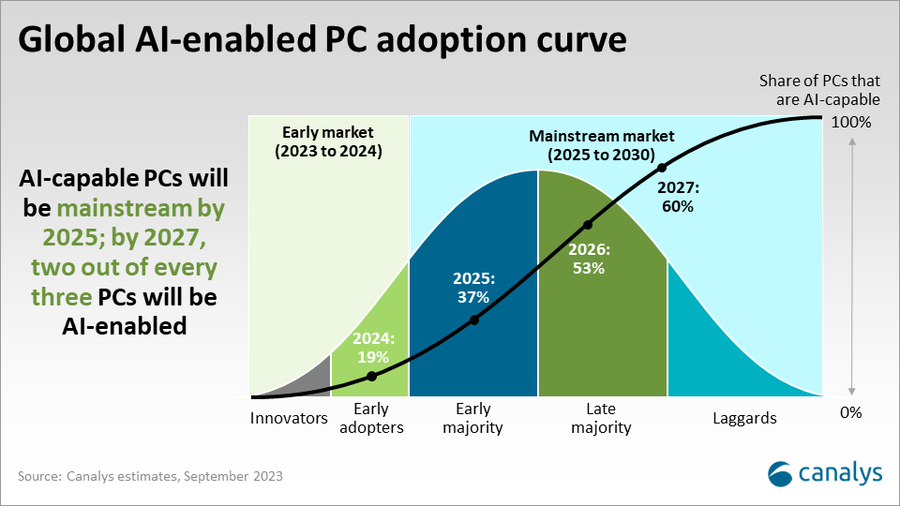

Canalys expects the positive trends to persist, predicting a return to PC market growth over the important holiday season. The analyst is also saying that in looking ahead, integration of on-device AI capabilities will drive a new refresh cycle starting around 2025. AI-enabled PCs could make up 60% of shipments by 2027.