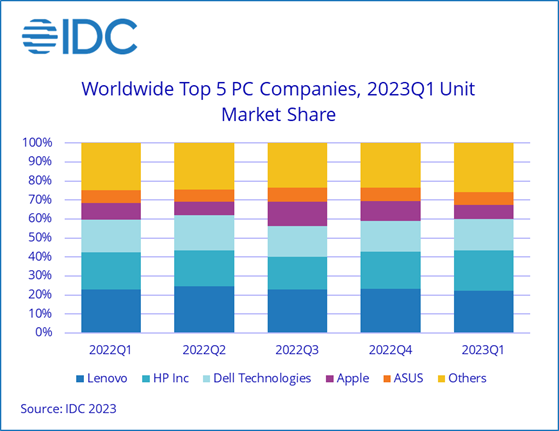

Global shipments of traditional PCs declined by 29% in the first quarter of 2023 due to weak demand, excess inventory, and a worsening macroeconomic climate. This marks a return to pre-COVID patterns and is lower than the shipment volume of the first quarters of 2018 and 2019.

| Company | 1Q23 Shipments | 1Q23 Market Share | 1Q22 Shipments | 1Q22 Market Share | 1Q23/1Q22 Growth |

| 1. Lenovo | 12.7 | 22.40% | 18.3 | 22.80% | -30.30% |

| 2. HP Inc. | 12 | 21.10% | 15.8 | 19.70% | -24.20% |

| 3. Dell Technologies | 9.5 | 16.70% | 13.7 | 17.10% | -31.00% |

| 4. Apple | 4.1 | 7.20% | 6.9 | 8.60% | -40.50% |

| 5. ASUS | 3.9 | 6.80% | 5.6 | 6.90% | -30.30% |

| Others | 14.7 | 25.90% | 19.9 | 24.80% | -26.00% |

| Total | 56.9 | 100.00% | 80.2 | 100.00% | -29.00% |

PC makers are re-evaluating their plans for the rest of the year and are pulling in orders for Chromebooks in anticipation of an expected increase in licensing costs. The pause in growth and demand is also giving the supply chain some room to make changes, with factories exploring production options outside of China. However, elevated inventory is expected to persist for several months, despite heavy discounting.

According to International Data Corporation (IDC), the aging installed base of PCs will start to refresh by 2024. If the global economy is trending upwards by then, significant market growth is expected as consumers upgrade and businesses move to Windows 11. If the recession in key markets continues into next year, however, the recovery could be a slog.