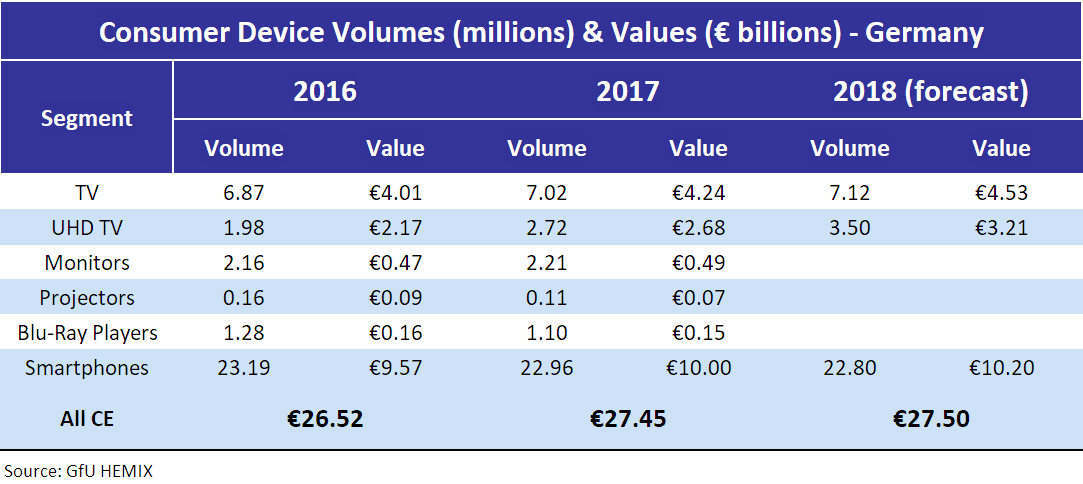

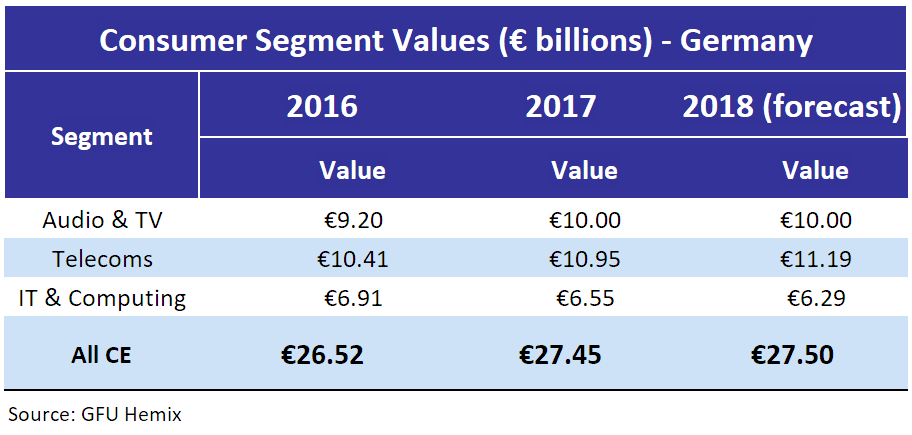

The GfU has released its latest data for the German consumer electronics market which includes data for the whole of 2017. Overall, the total market for electrical and electronic devices was up in value from €40.343 billion in 2016 to €41.571 in 2017. Consumer electronics (without appliances) was up by 3.5% from €26.515 to €27.447 and is forecast to be flat in 2018.

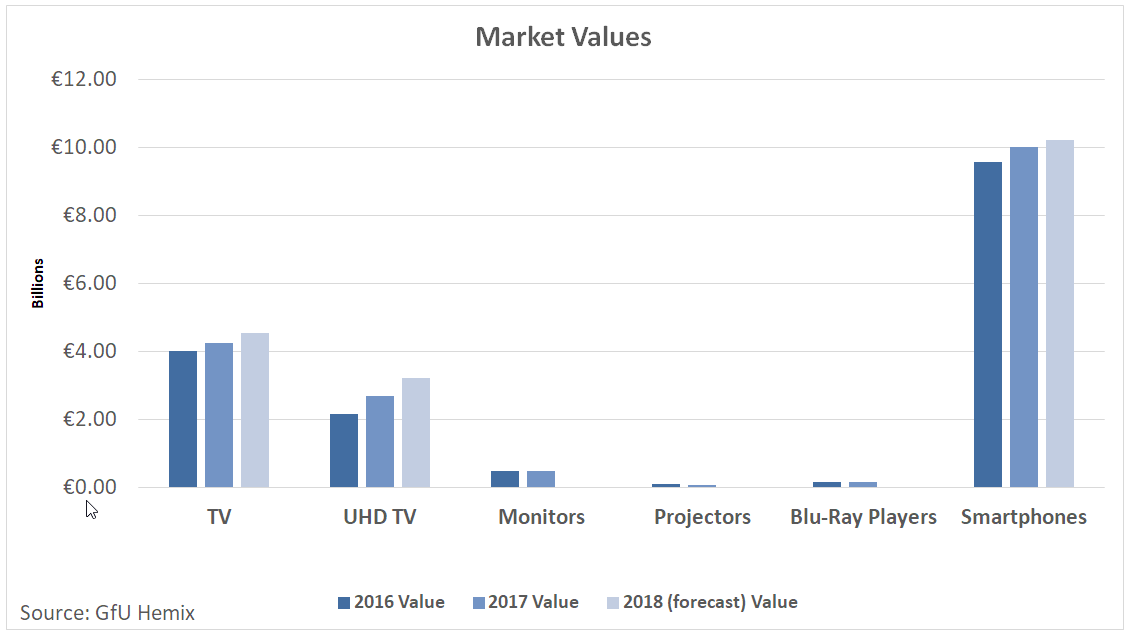

Consumer TV rose by 2.2% in volume and 5.6% in value to reach 7.02 million and €4.24 billion and is forecast to rise again in 2018 by 1.4% and 6.9%. The UHD segment is a key part of the market and volumes reached 2.72 million in 2017, up 37%. while value was up 24%. A sharp rise is expected again in 2018 with a forecast of 29% volume growth and 20% value. “Large” sets of 37″ and above were 85% of all sales. OLED sets hit 111,000 units with value of €300 million.

The overall ASP of TV sets in Germany rose 3.4% to €604.

Set Top Boxes saw very good growth of 87.7%, with sales rising from 2.845 million in 2016 to 5.341 million in 2017, driven by the switch to DVB-T2 terrestrial broadcast. However, satellite box sales were also up from 648K in 2016 to 694K.

Physical media suffered with Blu-ray players dropping in volume from 1.277 million to 1.098, a drop of 14.1% which was a bigger drop than seen in DVD players, which dropped 6% to 437K and media boxes and sticks fell by 9.5% to 790K.

Videogame consoles also saw solid growth, rising 26.6% from 2.137 million to 2.705.

In audio, all-in-one systems were flat, but all other categories, apart from connected audio, were down. With Home Cinema audio and ‘traditional audio’ systems both down over 30%. Personal audio also dropped, although headsets were and docking speakers were both up. All automotive electroncs categories were sharply down.

Smartphone sales to consumers, on the other hand, were down 1% in volume and are expected to drop again by 0.7% in 2018. However, ASPs are rising and values were up 4.6% in 2017 with an expected rise of 1.9% in 2018. Wearables were up by 17.8% from 3.037 million to 3.579 million and value went up by 28.5%.

IT spending by home buyers was down by 5.3% from €6.909 billion to €6.546. Consumer computing devices sales volumes were down in all segments, with desktops falling by 13.5%, notebooks falling by 11% and tablet PCs by 14.8% although in all cases values fell by less than volume.

Monitors were an exception and saw growth of 2.3%, GfU said with ASPs rising 1.5%, meaning overall value growth of 3.8%. However, consumer projectors were badly down by 27.5%, from 157k to 114k and with value falling almost as much.

Analyst Comment

The numbers that I noticed particularly were the Blu-ray players and projectors/home cinema and the monitors. It seems that the very high quality of UltraHD OLED TVs may mean that consumers no longer see the need to go to projection and home cinema for compelling visual experiences.

On the other hand, monitors went against the trend for other IT devices. There is, clearly, no substitute for a monitor in many applications. Although classified as IT devices, HDMI monitors could also be used with STBs (which were up) to enable small screen TV viewing and represent a very good alternative to a traditional small TV set. (BR)