Newly released data from IDC’s Worldwide Quarterly Mobile Phone Tracker shows that shipments of mobile phones to the Gulf Cooperation Council (GCC) region grew 8.3% quarter on quarter (QoQ) in Q4 2021 to total 6.10 million units.

Smartphone shipments were up 6.3% QoQ to 5.39 million units, while feature phone shipments grew 26.8% over the same period to 0.7 million units. In terms of value, the GCC smartphone market was worth $2.17 billion in Q4 2021, an increase of 12.5% QoQ, while the feature phone market totaled $15.07 million, up 32.1%.

While supply shortages continued throughout Q4 2021, the launch of new iOS devices in the high-premium range ($1,000<$1,600) and Android devices in the mid to high-end range ($400<$600) helped drive significant QoQ growth in both units and value. Saudi Arabia accounted for 56.0% of all smartphone shipments to the GCC in Q4 2021, with shipments to the country increasing 7.8% QoQ. The region’s second largest market, the UAE, saw smartphone shipments increase 7.2% QoQ in Q4 2021 to account for 22.6% of the region’s total.

“Saudi Arabia continued to receive better supply than its GCC neighbours and remains a priority for both incumbents and new entrants to the mobile phone market,” says Akash Balachandran, a senior analyst at IDC. “The UAE smartphone market’s growth was driven in particular by an improved supply of Apple devices toward the end of the year. A number of new and upcoming brands are also increasingly targeting the UAE and Saudi Arabia markets as they pursue growth strategies to establish themselves further in the Middle East.”

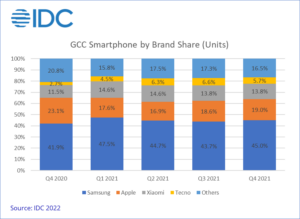

Samsung led the GCC smartphone market in terms of shipments in Q4 2021 with 45.0% share. The vendor posted 9.4% QoQ growth in shipments as supply improved, especially for key entry-level models. Second-placed Apple, with 19.0% share, saw shipments increase 8.6% QoQ on the back of strong demand for its new 13 series devices. Rounding out the top three, Xiaomi accounted for 13.8% of the GCC smartphone market in Q4 2021, with its midrange and mid-to-high-end devices driving a 5.9% QoQ increase in shipments to the region.

The GCC smartphone market is forecast to decline 3.8% QoQ in Q1 2022, with consumer demand set to fall as inflation increases. While travel and tourism continues to normalize, the negative impact of supply shortages will prevent a significant pickup.

“Greater 5G penetration is inevitable as the technology becomes more widely available on consistently cheaper devices,” says Ramazan Yavuz, a senior research manager at IDC. “5G devices accounted for 37.6% of the GCC smartphone market in Q4 2021, with shipments increasing 13.6% QoQ. 5G shipments will continue to see rapid growth as the technology becomes standard in mid-tier price bands among Android vendors, and we expect them to make up 79.1% of the total GCC smartphone market by the end of 2026.”