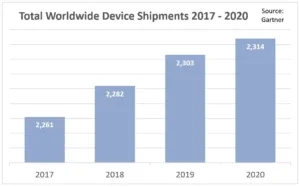

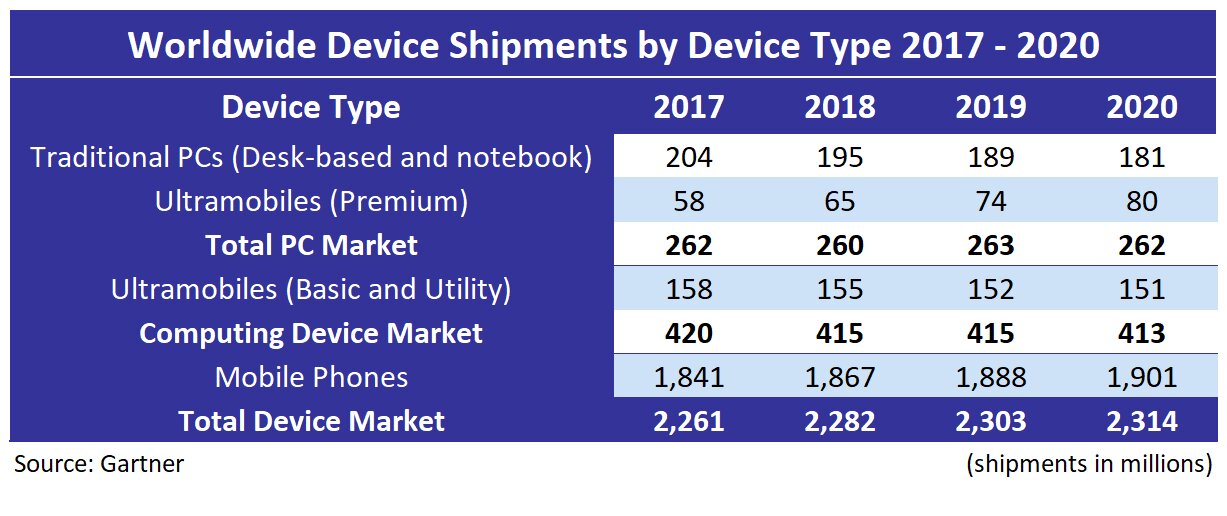

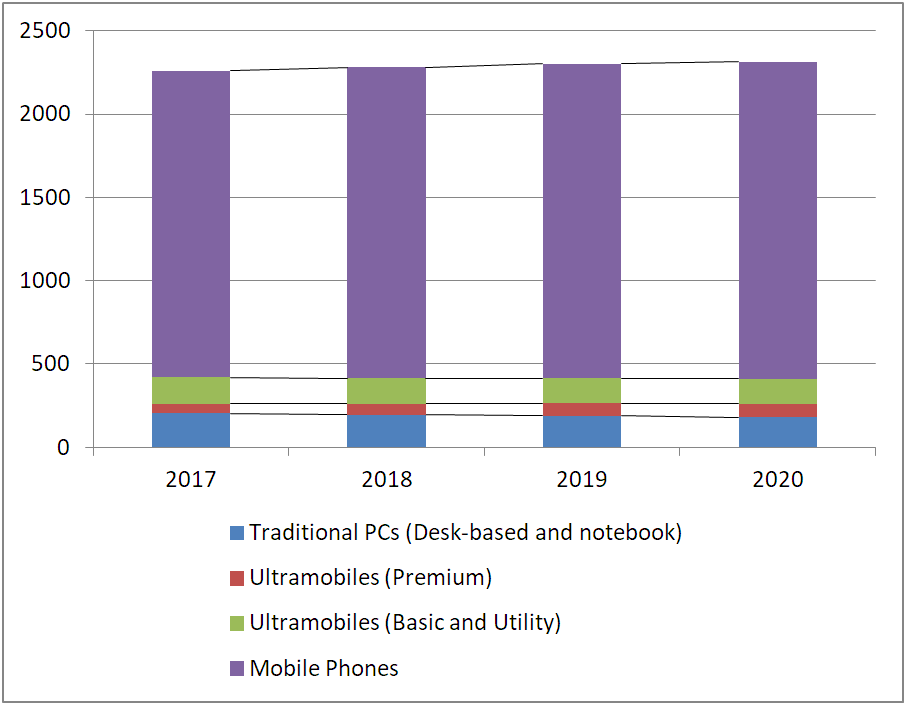

Worldwide shipments of devices — PCs, tablets and mobile phones — are on pace to record 0.9% growth to reach 2.28 billion units in 2018, according to Gartner. The PC and tablet market is estimated to decline 1.2% in 2018, while the mobile phone market is predicted to record an increase of 1.4%. Research director Ranjit Atwal commented:

“

The PC market is still hindered by the undersupply of the DRAM market for all of 2018, due to the lack of new wafer capacity coming online. As a result, PC vendors will continue to increase their prices throughout 2018. Larger screens and more graphic boards also mean rising costs, adding to the bill of hardware materials for businesses and household buyers”.

While the PC market is price-sensitive, Gartner is witnessing business demand migrating to high-end PCs such as ultramobile premium devices, where value is seen as higher. The company estimates shipments of ultramobile premium units to increase by 12% in 2018. The next major shift in the PC market will be marked by the end of support for Windows 7 in January 2020. Atwal continued:

“It is becoming paramount for businesses to migrate to Windows 10 as soon as possible, and certainly by the end of 2019”.

North America kicked off the first Windows 10 migration phase in 2015, which will complete during 2019. Western Europe is increasing its adoption in 2018.

However, in China, Japan and other emerging regions, migration plans are shifting from 2018 to 2019 as they continue to prepare for inherent complications in changing processes and procedures for Windows as a service.

While the global device market is affected by macro-economic factors and technology developments, it can also be influenced by the Chinese device market alone. Atwal also said:

“China accounts for over 20% of global spending on devices, so any changes occurring there can have a significant ripple effect globally”.

With nearly 1.9 billion units estimated to ship in 2018, mobile phones are the main influencer of global device market growth. In China, mobile sales declined 8.7% in 2017 to 428 million units but are estimated to grow 3.3% in 2018, representing 23% of total mobile phone sales this year.

The traditional PC market in China is set to decline 1.7% to 38.5 million shipments in 2018, representing 21% of global traditional PC shipments.

The drop will come despite China being business-dependent, with two-thirds of PC shipments coming from this segment. Atwal concluded:

“The downward trend that China is experiencing is undoubtedly affecting the worldwide device market. China is an interesting country to watch this year. The continued roll-out of a Chinese version of Windows 10 in the second half of 2018 — as well as the iPhone replacement cycle expected through 2019 — will generate demand”.