Quantum Dot (QD) display technology has the potential to be a disruptive force to enable next generation LCD, MicroLED and OLED. It can ultimately create an emissive display to compete directly with OLED display.

Can technology innovation, cost reduction, price/performance improvements meet market requirements and reach mass market potential? Will high cost, environmental concerns, manufacturing challenges and supply chain constraints limit it to only high-end niche products? Let us analyze.

1. Technology innovations & new solutions are coming:

Quantum dot enhancement films are already commercialized and mostly used in the high-end TV and gaming monitor markets. Quantum dot display can meet BT 2020 color gamut requirements; bring high brightness and energy efficiency. In future, many more new technology solutions are coming as shown below.

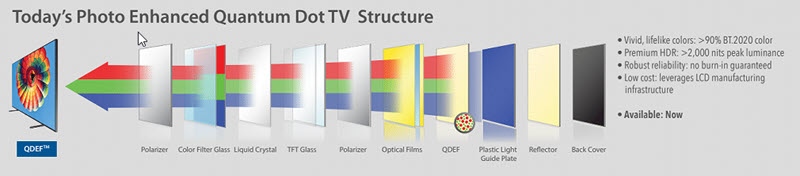

• QD enhancement film: QDEF: enabling current quantum dot display products

QD enhancement film contains trillions red and green emitting quantum dots. QD film sheets can be dropped into a blue LED LCD backlight in place of a diffuser sheet, creating quantum dot enhanced display with high brightness, wide color gamut and energy efficiency. QDEF process needs barrier films that can be higher costs.

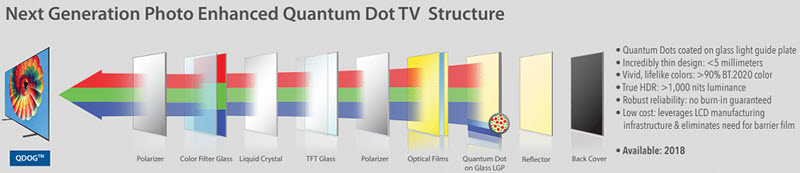

• QD on glass Light Guide Plate (LGP), thinner, lower cost solutions

QDs on a glass LGP can enable thinner, better and possibly lower cost solutions for the TV market (Will QDOG Have its Day?). Nanosys has introduced QDOG materials that can be made on master glass sheet LGP, and then cut into panel sizes. This process can lead to higher yield rates and much thinner products, with higher efficiency. Panel suppliers can offer QDOG LCD panels to TV brand manufacturers, reducing supply chain complexity. TV based on QD glass LGP is expected in the 2nd half of 2018. With higher volume, cost can go down and increase QD TV adoption rates. If QD TV can reach the sweet spot of a below-$1000 price, it could greatly increase mainstream market adoption.

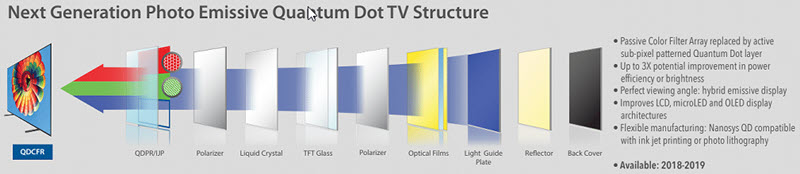

• Photo emissive QD: color filter replacements, higher brightness, wider viewing angle

Photo emissive products can replace the color filter array in LCDs with a layer of active QD emitters, increasing efficiency even further with wider viewing angles and higher brightness (up to 5000 cd/m² peak luminance) without increasing power. It can improve LCD, MicroLED and OLED architecture. Products are expected to be available by 2019. But the need for an in-cell polarizer for LCD can be a challenge.

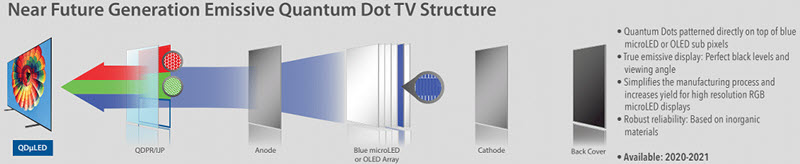

• QDs enabling MicroLED production

MicroLED is considered to be next generation display technology for small size displays as well as TV. They are more reliable, produce brighter image and have faster response time. But manufacturing is a challenge due to the difficulty of mass transfer of microLED onto the backplane. With Photo emissive QDs, display makers can start with blue MicroLED array and then pattern red and green QDs on top, improving the process and yield. This type of MicroLED display is expected to come in two or three years. It may still have challenges with full color conversion, and manufacturing process.

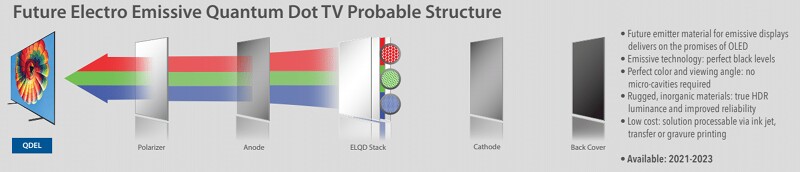

• Electro Emissive QD display; OLED competition in future

Electro emissive QD display will have similar properties to OLED (perfect black and viewing angle), but with higher color gamut and higher brightness. It uses solution-printed QD as the emitter material to make AM QLED displays. Printable, low cost QD materials with superior performance have the potential to directly compete with OLED displays even in the flexible segment. Electro emissive printed QD displays may come to market in three to five years. There are still many challenges. Blue emitting materials still have efficiency and lifetime issues.

• QD Ink jet printing can lower cost and increase production

The biggest advantage of Ink jet printing is its lower production cost. Nanosys and DIC recently reported a breakthrough in producing quantum dot color conversion devices. These could be used for LCD as well as MicroLED. The process would require LCD panel markers to add new inkjet machines to mass production lines, which could be a roadblock for adoption rates. Printed QD can help manufacturing yield issues in MicroLED, accelerating its path to production. If successful, this could lead to low cost mass production of QD display.

• QD Materials are improving

Nanosys is the leader in QD display materials with commercialized products. It also licenses its technology to Samsung. It introduced its low cadmium Hyperion product in 2017 and is also producing non-cadmium products. Its current partners are Hitachi chemical, Exciton, DIC and others. Nanoco is focusing on only non-cadmium materials and is in the process of commercializing products with partners (Merck, Dow Wah Hong industrial). QD materials are moving away from cadmium, which is considered to be an environmental hazard. Some non-cadmium based materials are lagging in cost and performance even though it is constantly improving.

2. Technology innovations are not enough: need lower cost and price

The first generation QD enhancement film enabled LCD to have better color purity, wider color gamut, brighter and more immersive HDR experience while maintaining power efficiency for TV applications. But challenges such as higher price, narrow viewing angle, relatively slow switching speed, lower black level and environmental concern about cadmium-based products have resulted in low adoption rates. Samsung has been focusing on QLED TV. QD TV has lost market-share to OLED in 2017 due to high price. Vizio’s introduction of 65″ QD TV with competitive price of $2190, compared to $3000 for a 65″ OLED TV, may open up some new opportunities in 2018. Samsung also introduced higher performance QLED TV in 2018 with more aggressive prices (75″ for $2999 and 65″ for $2099). Chinese brands, TCL and Hisense have also joined in. New lower pricing, better performance and more products from more brands might help sales in 2018.

Nvidia introduced the idea of a G-Sync HDR PC gaming 4K QD monitor with stunning wider color gamut, higher contrast, better color saturation and higher brightness in 2017. Philips, HP, ASUS, Acer, Samsung, and others have now introduced 4K HDR gaming monitors with QD technology. These high-end monitors were geared towards gamer, video editors, graphic designers, and professional photographers available in different sizes and price points. Harman-Samsung has shown a prototype of cadmium free automotive grade QD display that can meet design needs.

Mainstream application markets such as notebook, tablets, and smart phones still have very little or no presence of QD display. This may be due to the need for thinner form factors, higher performance and more environmental friendly QD products at a lower cost. If these challenges can be resolved, QD could be ideal for the mobile market (due to energy efficiency/low power consumption, higher brightness and better HDR). These features can even help LTPS LCD to compete with OLED for smartphones.

3. Can QD display reach mainstream market potential?

QD display technology definitely has the potential to be a disruptive force in the industry as an enabler for next generation, LCD, MicroLED and even OLED. If it can create emissive QD flexible display and it can have mass market appeal. But technology innovations, and new solutions are not enough. They must be combined with lower cost, a more efficient supply chain, mainstream product offering and mass market pricing. Otherwise it will stay as a high-end niche solution serving a limited market. – Sweta Dash

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com

Click on this image to see a high resolution version