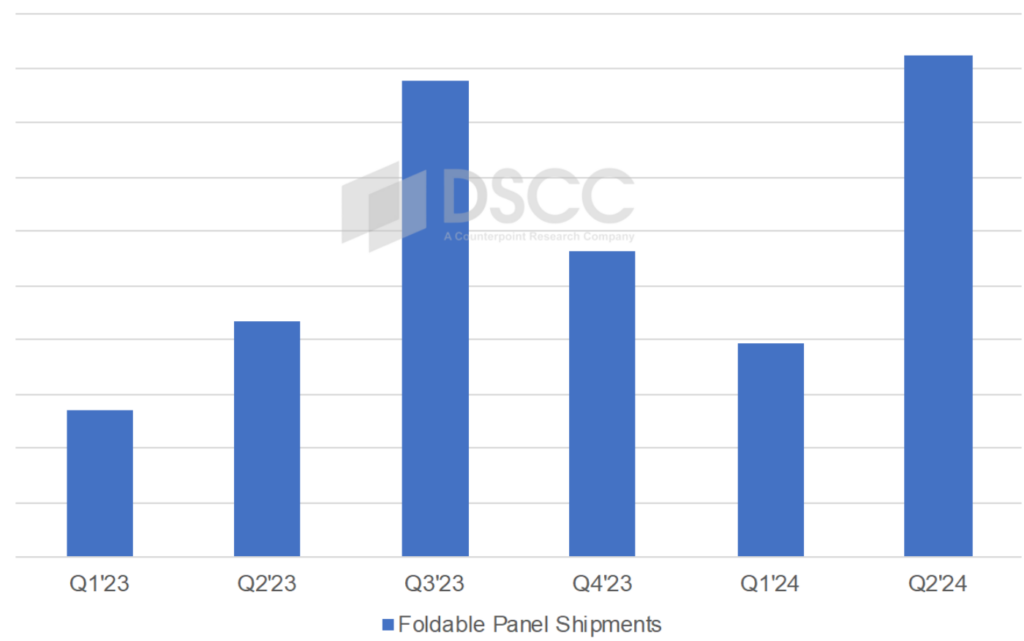

Foldable smartphone panel shipments are poised to hit an all-time high in the second quarter of 2024, with a projected year-over-year increase of 113% to 9.25 million units. This surge is driven by Samsung’s accelerated procurement and production for its new Z Flip and Z Fold models and continued strong demand from Huawei.

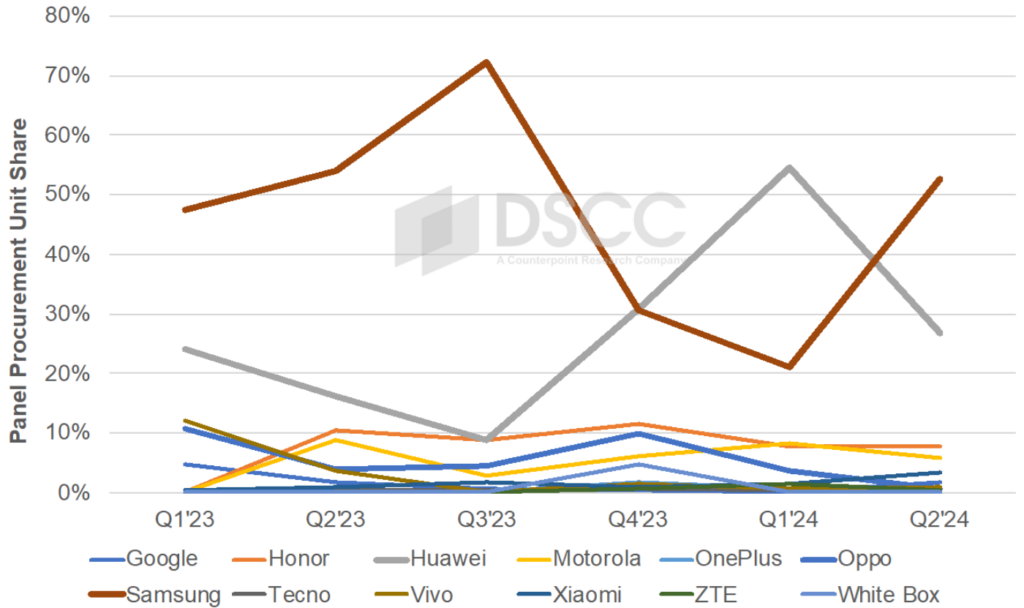

In the first quarter of 2024, foldable smartphone panel shipments rose 46% year-over-year to 3.94 million units. Huawei led panel procurement with a 55% share, marking its highest ever and maintaining its leadership from the previous quarter. The Huawei Mate X5 and Pocket 2 were the top models for foldable panel procurement in Q1’24.

Samsung Display is set to challenge Huawei’s dominance in Q2’24, with the Galaxy Z Flip 6 and Z Fold 6 expected to be the top models. Samsung’s procurement is anticipated to give it a 52% to 27% advantage over Huawei in Q2’24. Despite this, Huawei is still projected to lead on a sell-in basis for the quarter.

For the entirety of 2024, Samsung and Samsung Display are expected to maintain significant advantages, although narrower than in 2023. Samsung’s share of foldable smartphone panel procurement is forecasted to decrease from 54% to 48%, while Huawei’s share is expected to rise from 18% to 28%. The market will see procurement for 38 different models, up from 35 in 2023.

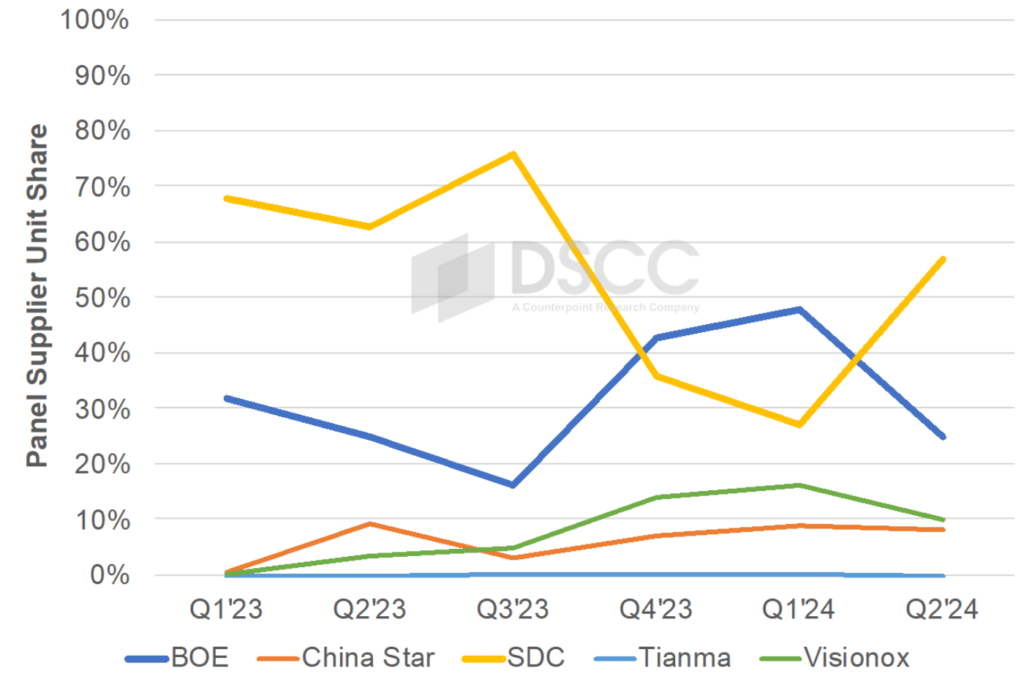

In the panel supplier sector, Samsung Display is predicted to hold a 57% to 25% lead over BOE in Q2’24, widening in Q3’24 as the Z Flip 6 and Z Fold 6 ramp up. For 2024, Samsung Display’s share is projected to be 54%, down from 62% in 2023, while BOE’s share is expected to increase from 27% to 28%. Visionox and TCL CSOT (China Star) are also expected to gain market share, reaching 11% and 7% respectively.