The OLED Association (OLED-A) expects the OLED market to grow at a 22% CAGR between 2014 and 2018 – with capacity growth from 1 million m² in 2009 to 6.8 million m² by the end of the forecast. The full report, covering OLED fab capacity, is available to OLED-A members.

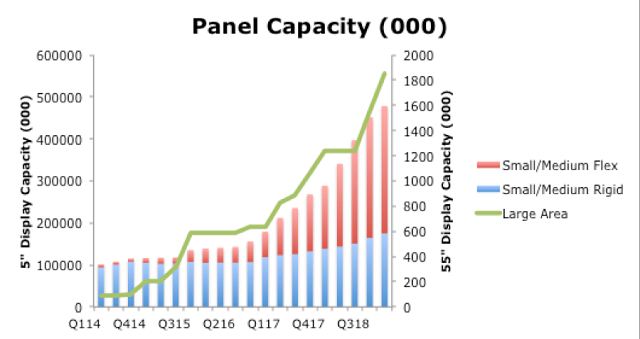

2016 sees the stagnation of the small/medium rigid OLED segment. Modest growth will begin in 2017. Overall growth, from Q1’14 to Q4’18, will be 7% CAGR, as many small players will raise their capacity, although not achieve high volumes. SDC is also not expected to increase its capacity by much. In 2018, nine companies will be producing these panels, led by Samsung (62%), JDI (8.8%), AUO (8.3%) and LG Display (5.4%). Capacity will be 1.5 million m² per quarter by the end of 2018.

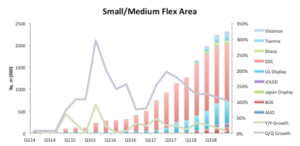

The main reason for SDC’s lack of growth is that it will turn its attention to flexible OLEDs – forecast to then be the fastest-growing OLED market segment (52% CAGR). SDC will remain the dominant player, at a 50.6% share, followed by LGD (18.7%), Sharp (6.5%) and JDI (3.2%). By the end of 2018, capacity will reach 2.6 million m² per quarter.

Another fast-growing segment will be large-area OLED production (mainly TV panels), at a 40% CAGR. Capacity is forecast to reach 1.7 million m² per quarter. LG Display will lead this market; however, the OLED-A believes that Samsung will overtake LGD as the market leader by the end of 2018 (despite no growth forecast for LGD after 2016). The only other company with serious plans in the large-area OLED space is BOE, which has a small pilot line, and might begin production in 2017.

Based on the run rate in Q4’18, the OLED-A expects 5″ OLED panel capacity to be 1.1 billion panels per year, or approximately 75% of expected smartphone production. 637 million of these will be flexible displays. Capacity for 55″ OLED panels is predicted to be 4.7 million, or less than 10% of demand for high-end TVs.