Defying the COVID-19-driven decline in overall smartphone display shipments in 2020, the global market for flexible active-matrix organic light-emitting diode (AMOLED) is set to rise by 51 percent this year.

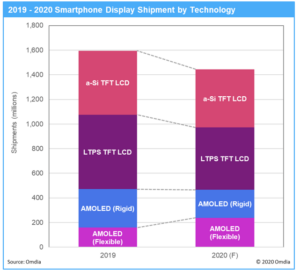

The COVID-19 pandemic has severely impacted the smartphone and display market in 2020, by shutting down many cities, damaging the supply chain for phone and display production and cutting smartphone sales throughout in the world. As a result, annual smartphone display shipments are expected to total 1.4 billion units in 2020, down 10 percent from 1.6 billion in 2019, according Omdia’s Smartphone Display Market Tracker.

Despite this, shipments of flexible AMOLEDs for smartphones are expected to rise to 238 million units in 2020, up from 158 million units in 2019. This growth will come as the expense of rigid AMOLED displays, whose shipments are expected to drop to 227 million in 2020, down 27 percent from 2019.

“Even in the pandemic year of 2020, smartphone set makers are focusing on offering 5G models to meet rising demand for replacement handsets,” said Hiroshi Hayase, small and medium display analyst for Omdia. “As they introduce new 5G smartphones, brands are aggressively adopting form factors with narrow bezels and rounded-edge displays, which are made possible only through the use of flexible AMOLED technology. For example, Apple is expected to employ flexible AMOLEDs in all new iPhone 5G models starting in the second half of this year. This is driving up shipments of flexible AMOLED displays in the smartphone market.”

Smartphone displays face COVID-19 downturn

The decline in smartphone display demand is negatively affecting every display technology besides flexible AMOLEDs. Low-temperature polysilicon (LTPS) TFT LCDs have been the most impacted display technology because of rising competition with AMOLEDs in mid-to-high-end smartphones. Shipments of LTPS TFT LCDs for smartphones are expected to total 506 million units in 2020, down 16 percent from 2019.

Shipments of a-Si TFT LCDs for smartphones are expected to total 472 million in 2020, down 9 percent from 2019.

Total AMOLED shipments for smartphones are set to total 466 million in 2020, down by just 1 percent from 2019. With their high performance—including high-contrast and low-power consumption—AMOLED shipments grew strongly in 2019, garnering demand from premium and high-end smartphones.

In the meantime, AMOLED products have changed in 2020. In 2019, rigid, glass-substrate AMOLEDs dominated the market for smartphone AMOLED displays. However, in 2020, flexible, plastic substrate, AMOLEDs are taking the place of rigid AMOLEDs.

Looking at the flexible AMOLED suppliers, Samsung Display has been the leader, with a more than 90 percent share in 2018. In the meantime, supported by China’s government, Chinese display makers such as BOE, Visionox, Tianma and China Star have aggressively invested in the mass-production of flexible AMOLED to supply for Chinese smartphone makers. LG Display in the fourth quarter of 2019 started mass-production of flexible AMOLEDs for Apple’s iPhone 11 Pro. Amid rising competition in the flexible AMOLED market, Samsung Display’s share declined to 80 percent in 2019.

Unfortunately, the COVID-19 pandemic is keeping the market in critical condition. As a result, the market situation for flexible AMOLED may change in the second half of 2020. However, flexible AMOLEDs may play a key role in re-starting the smartphone market in 2021.

About Omdia

Omdia is a global technology research powerhouse, established following the merger of the research division of Informa Tech (Ovum, Heavy Reading and Tractica) and the acquired IHS Markit technology research portfolio*.

We combine the expertise of over 400 analysts across the entire technology spectrum, analyzing 150 markets publishing 3,000 research solutions, reaching over 14,000 subscribers, and covering thousands of technology, media & telecommunications companies.

Our exhaustive intelligence and deep technology expertise allow us to uncover actionable insights that help our customers connect the dots in today’s constantly evolving technology environment and empower them to improve their businesses – today and tomorrow.