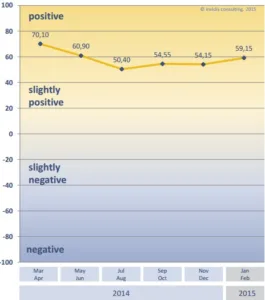

OVAB Europe’s latest Digital Signage Business Climate Index (DBCI) (presented with Invidis) for the DACH market shows that sentiment in the region’s signage market rose slightly in January/February, from the previous November/December survey.

Overall, the industry rose five base points, to 59.15. The business situation is ‘very positive’, and optimism about the near-future has risen slightly. Lower energy costs, caused by the oil price fall, has buoyed the market. Between 250 and 300 new jobs were created in the DACH signage market.

Market players were enthusiastic about entry-level signage, but technical performance was still an issue. Entry-level signage, point-of-sale and small and large signage will be the major trends in 2015.

On a country basis, Germany enjoyed a successful year, with lower energy costs being leveraged by companies for new investments. Future optimism is tied to the devaluation of the euro, and subsequent positive effects on exports. Austria also benefited in a similar fashion.

The signage climate has fallen in Switzerland, as the Swiss franc rises against the euro, negatively affecting the export-depending economy. Corporate investments have stalled because of this. OVAB believes that this change may be nullified by an import price drop – including signage hardware.

Display vendors’ business sentiments have fallen since the last survey, although 60% of companies still rate their current situation as ‘good’ or better. 66% expect business to be better over the next six months. OVAB believes that this represents rising demand for small and medium signage.

System integrators have a positive outlook, with more than 90% of companies saying that they are satisfied. However, more than 50% do not see any opportunities for growth in the near-future. Software vendors, by contrast, have a very positive outlook, with almost 70% expecting more favourable business in the first half of the year.