Earlier this week, I was corresponding with Ross Young about the release of his firm’s latest forecast on the foldable smartphone market (more than $100 billion by 2025) and he commented on the excitement in the flexible display market at the moment. That reminded me that I hadn’t reported on his talk from the DSCC/SID Business Conference during Display Week, and available online until December.

Young started by saying that at one point, DSCC had more reports on foldables than there were products on the market, but that is not the case any more. DSCC aims to dig deep into the foldables market, materials and technologies and he forecast that there will be a lot of new products in the second half of 2020.

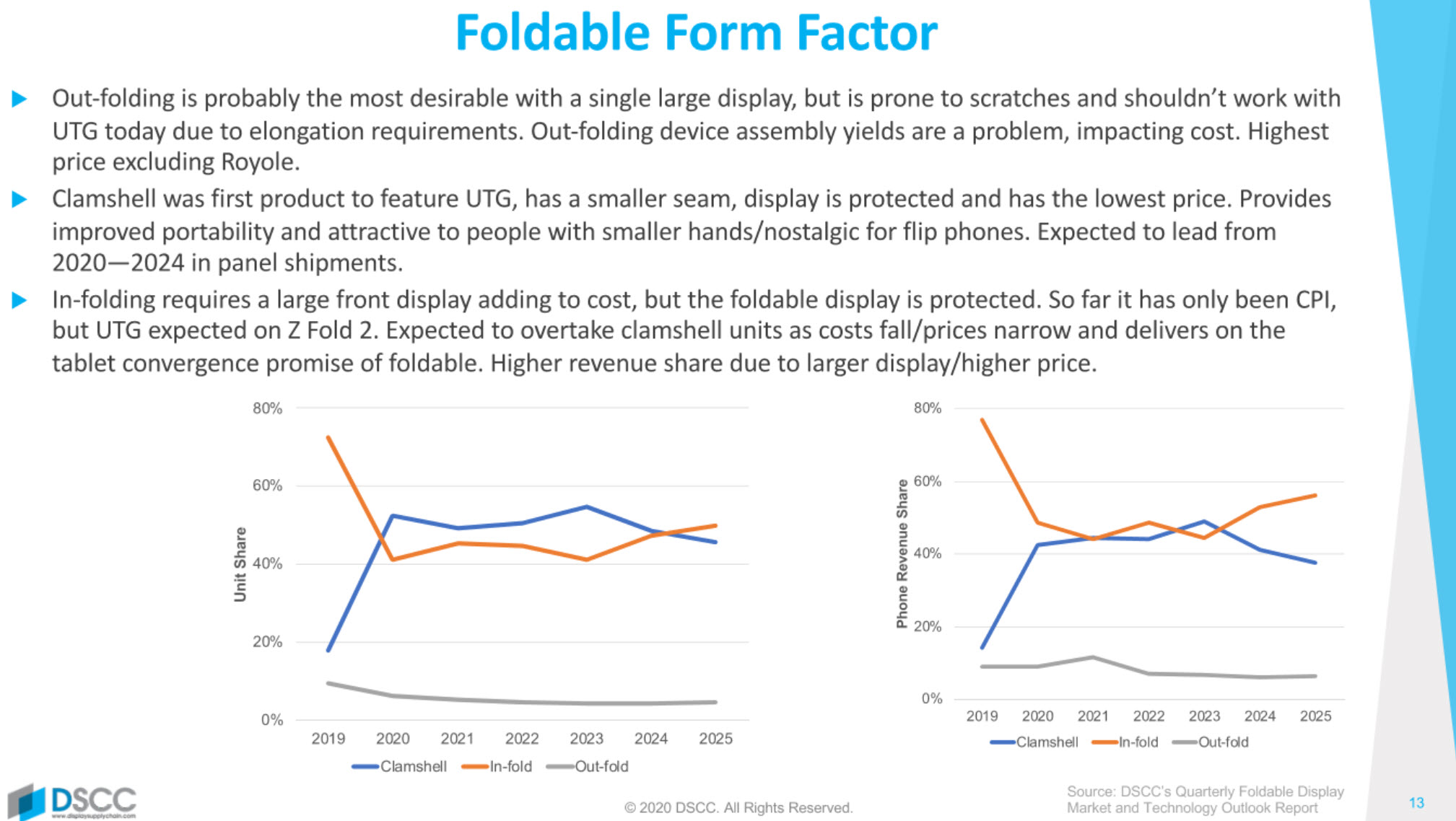

The market is primarily based on clamshell and in-fold designs because of lower costs/prices and because there is less risk of display damage. Displays are getting bigger and shipments are eating into tablet sales.

Samsung Has UTG Exclusivity

Samsung is the monopoly supplier for Ultra Thin Glass (UTG)-based displays at the moment, but capacity is constrained, although it should nearly quadruple from 2020 to 2022. There are a lot of questions, though? Will others enter that segment and how will the supply chain evolve? When will Apple enter and with what products? Will there be foldable notebooks or tablets? When will Windows 10X (with support for flexible displays) be available?

There have been a lot of different designs tested on the market but the Z Flip clamshell from Samsung was the current best seller. 2020 clamshell shipments should exceed two million with three models (Z Flip, Z Flip 5G, Z Flip 2). Interest in UTG is high among brands, but reviews and teardowns have shown that foldables can be damaged, which has reduced demand.

The Galaxy Z Fold 2 is the first to use LTPO with 120Hz refresh and has a 6.23″ front display as well as the 7.6″ main display. Motorola will have a 5G version of its Razr and Huawei will move to in-folding for the Mate X2, with BOE supplying some of the panels – the first in-folding panels supplied by someone other than Samsung.

There may be a new Galaxy Fold SE at $1,099, ZTE may adopt the Royole panel and Xiaomi may work with Visionox to create an in-folding handset with an 8″ main display and 6.5″ front display. Samsung is launching a new foldable in the Z Flip (clamshell) or Fold (in-folding) lines every six months, with display sizes increasing by 0.3″ or 0.4″ in each line each year. In Q1 21, there could be a 7.1″ Flip 2 and in Q3 next year a 7.9″ Fold 3.

2021 should see a Motorola Razr 2 with a 6.7″ display from BOE/CSOT and a 3.x” front display. LGE may enter the supply chain and is even talking about a rollable display (it has teased with a video about this, since then – Editor).

Volumes Rise & Prices Fall

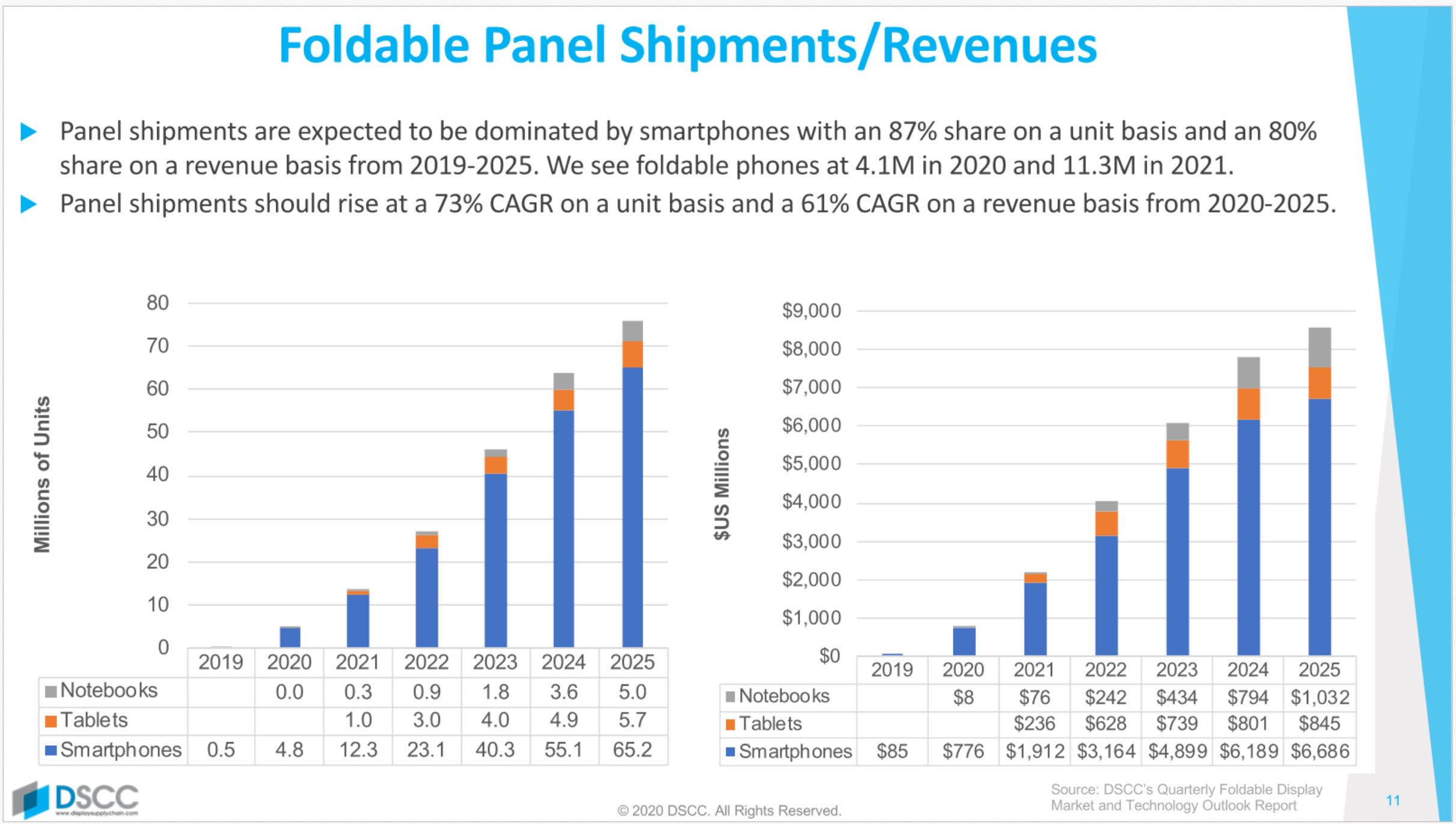

DSCC forecasts that panel shipments will be dominated by smartphones, with tables and notebooks well back in volume. Smartphone shipments will hit 4.1 million this year and 11.3 million next year. The panel volumes will rise at a 73% CAGR and panel revenues at 61% to $8.4 billion by 2025 (compared to a total display market of $110 billion).

Prices are expected to fall at around 9% CAGR from around $160 to $100 by 2025, although the average size will be bigger, resolutions higher etc. Smartphone prices are expected to decline by 7% CAGR from $1600 this year to less than $1200. Smartphone sales value will rise to $69 billion which is significant revenue growth to the smartphone market which has been relatively stagnant.

(In the latest forecast, values are forecast to rise even faster).

Young believes that outfolding displays are probably the most desirable (I’m not convinced – Editor) but can’t be made with UTG today and are prone to damage as well as needing complex assembly processes. Young said that one brand is buying two panels for every phone that ships as they break so easily during assembly. (Ouch! – Editor)

DSCC expects clamshell will lead in panel shipments up to 2024, but will drop behind in-folding by 2024 because of the attraction of ‘tablet convergence’ and because costs will converge. In size, the sweet spot is probably 7″ to 7.9″, with the average around the middle.

Samsung is the brand leader, with volumes limited by UTG supply constraints. Huawei’s sales are limited by the US sanctions and its out-folding design has to use colourless polyimide (CPI). Later, with panels from Samsung and BOE it will do better, Young said, although it will still use CPI as all the UTG displays will go to the Galaxy range. Motorola is committed to foldables, backed by its parent, Lenovo, which is very interested in foldable notebooks (and has just started taking pre-orders for one Editor). Young believes that Apple cannot avoid entering this premium segment, because of the value, and it will probably jump in with clamshell and infolding designs, possibly based on UTG from Corning, if the materials are suitable.

Samsung Displays will dominate both volumes and revenues of panels with only BOE above 5% up to 2025 and with around 20% of the market. Sales by price band will move down as costs come down.

The Supply Constraints

Looking at the constraints for UTG, it was pioneered and commercialised by Schott, but the glass is cut, treated and processed by Dowoo Insys (which is majority controlled by Samsung). Capacity will be constrained going forward although other suppliers could come in by 2023 or so. Volumes could be boosted if Samsung offered a CPI-based phone. There is a big gap between capacity and output because yield is very low. Fundamentally, it’s hard to handle and process glass that is just 30um thick. DSCC believes that Dowoo combines up to 10 sheets in early processes to make it easier to handle. Later steps, including chemical strengthening are done on single sheets.

CPI is not so constrained in supply and Kolon and Sumitomo can expand their capacity. Further, there are plenty of other applications for CPI. Suppliers have different approaches to the integration of hardcoats etc. A big factor in the future is who gets selected as the supplier of CPI to Samsung and that’s not clear yet.

The glass-like feel of UTG is important for some brands. Folding needs to be reliable at up to 200K folds as the calculation is of 200 folds per day for around three years. Young said that

“We really fold our phones a lot when we have them”.

He then went through the pros and cons of CPI vs UTG.

There are different tests for durability but the JIS standard test is usually used and Young described the impact and scratch tests. There are new hard coat processes coming to the market this year and there are significant improvements coming. DSCC has analysed six suppliers for a variety of factors.

Looking at advances, there is work being done to reduce the cover window thickness down towards the UTG solutions. There are lots of layers above and below the OLED itself. There is an opportunity to reduce the thickness of polarisers, but extremely thin polarisers are hard to produce. Foldable polarisers are in the range of 50?m to 100?m and are expensive.

An alternative is to pattern colour filters on top of the Y-OCTA and TFE layers (COE). Combined with a black matrix, this reduces the reflections. However, it needs more masks in manufacturing, with five masks required. The processes have to be at low temperature, too, to avoid damaging the OLED. That means hardening using photolithography rather than a hard bake, adding to the tooling costs. DSCC calculates that seven additional litho tools would be needed for a throughput of 30K sheets per month. A full stack of flexible OLED, Y-OCTA, LTPO and COE would require 25-27 litho tools for 30K sheets per month.

The concept will probably not be on foldables initially, but may be introduced on future fabs, which might be optimised around this concept.

Integrating Touch

Integrating touch has a number of advantages, but also has disadvantages. Samsung has Y-OCTA, but other panel makers have their own names. It’s a four mask process and there are a lot of yield challenges, but the industry is adopting the concept with volumes growing. F-OCTA replaces a foldable version of Y-OCTA. It has a number of benefits, but it increases the thickness.

Finally, Young looked at how to eliminate notches or holes in displays for cameras. As well as ensuring improved transmissivity (by improving the aperture ratio or boosting the transmissivity of all the layers in the stack), you have to be able to process the images to compensate for colour shifts and blurring. The aim is to improve transmissivity from around 10% to around 30% and for the panel area from 20% to around 70%. The anode and cathode might have to use different materials. Ideally you create a transparent segment on the display where the camera is and add to this by using laser-drilled holes around the pixels.

In summary:

- Foldable devices are a growth market with rapid growth in demand but

- UTG capacity is constrained and limits Samsung’s sales. Samsung is expected to continue to dominate in panels and devices.

- Scratch resistance and the cover window experience are improving

- The average size is growing towards 7.5″

- There are performance improvements in Y-OCTA, F-OCTA, COE and under display cameras.

(BR)