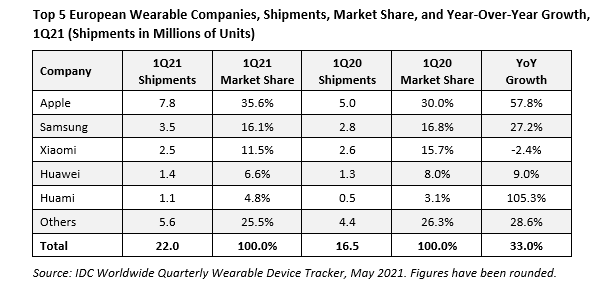

In the first quarter of 2021, the wearable market in Europe grew 33.0% compared with the same period in 2020, according to the latest IDC Worldwide Quarterly Wearable Device Tracker. Between January and March, 22.0 million units were shipped to the region.

“A year after disruptions in supply chain and consumer confidence, the wearable market showed signs of recovery with 35.0% YoY growth due to stronger interest in fitness and wellness tracking in the consumer segment,” said Kyla Lam, research analyst for wearable devices for Western Europe. “The watch form factor grew 38.7% YoY, with smartwatch makers entering new partnerships with local telco operators and launching more durable and innovative functionalities such as sports mode, watch faces, longer battery life, and more accurate sensors to encourage new users to join their digital ecosystem.”

“The wearable market in CEE grew a healthy 27.9% YoY,” said Milos Vuckovic, senior researcher for the CEE market. “While the earwear category showed steady and continuous growth of 41.5%, the watch category has flourished, with 92.2% growth in the smart category and 110.6% YoY growth in the basic category. Samsung regained first position in the smart category, but Apple, with 126.4% growth, showed the full potential of its wide portfolio.”

In the basic watch category, Huami took first place with very strong 341.4% YoY growth, followed by Huawei, which announced the HarmonyOS. Vuckovic said this is expected to further enrich its smart category.

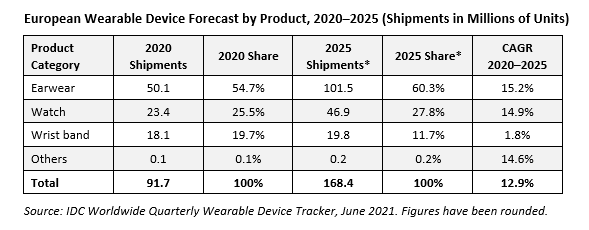

In 2025, the wearable market is expected to reach 168.4 million units in Europe and grow at a compound annual growth rate (CAGR) of 12.9% for 2020–2025.

“Wearable products will continue to grow as consumers enjoy miniaturization of smart devices with multifunctionalities in the age of self-tracking autonomy,” said Lam.

Product Highlights

Watches accounted for 31.2% of the market, reaching 6.9 million units, for growth of 51.2% year over year. Apple’s WatchOS yet again surpassed market expectations. Its brand reputation and consumer loyalty have boosted purchases from both returning consumers and first-time buyers, and its decision to cut the price of the Watch Series 3 and Watch SE led to stronger demand. Other vendors are channeling their sales both online and offline, driving more opportunities in cross-border sales.

Glasses grew 133.4% YoY due to greater interest from international vendors such as Bose, Huawei, and Razer. Though at the higher end of the price range (at an average of $250), they are gaining interest from both tech vendors and consumers.

Earwear accounted for 11.7 million units in the European market; this is the largest product share in the wearable market, with 53.2% market share. Truly wireless earwear remained popular among consumers, with greater interest in fitness, lower ASPs, and bundled promotional campaigns driving growth.