Digital TV Research says that the impact of cord-cutting will be ‘minimal’ in Western Europe. Despite market maturity, pay-TV penetration is expected to grow from 56.7% at end-2014 to 60.4% in 2020. Subscribers will rise almost 2.6 million, to 99 million, as the region recovers from the global recession.

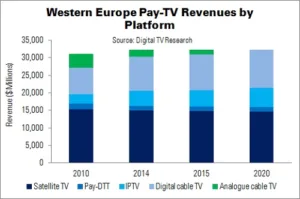

Total pay-TV subs will increase by 8.3 million (8.7% rise) between 2014 and 2020. Digital pay-TV growth will be sharper, rising almost 20 million (23.1%). Analogue cable will fall from 11.3 million in 2014 to 0 by 2019, while digital cable will add almost 10 million customers (30%).

DTVR expects pay-IPTV to overtake pay-satellite this year. IPTV will rise 8.6 million (37%) over the period, while satellite will add only 1.2 million subscribers (5%). DTT will climb 0.3 million (6%).

Despite rising subscriber numbers, DTVR expects pay-TV revenues to remain flat (around $32 billion). ARPU is falling in most countries and on most platforms, and competition is rising.