The EMEA smartphone market reached 83.7 million units in the first quarter of the year, a 3.3% drop on the same quarter last year — confirming recent trends of a slowing market.

According to International Data Corporation’s (IDC) latest Quarterly Mobile Phone Tracker, total value was down more steeply, at $26,780 million at retail value before sales tax, just over 10% less than in 2018Q1. Feature phone sales reached 45.9 million units, more than two-thirds of which were shipments to Africa.

The Middle East recorded the biggest contraction in smartphone volumes, at 18.8% below the year before total, and a drop of almost a third in value, as recent buoyancy in the oil price has so far failed to translate into more consumer confidence and expenditure. The African market was the fastest growing, at 6%, with little change in the European volumes.

Average sales prices declined across Western Europe, and there was a sharp drop in the Middle East. Only in Central and Eastern Europe have average sales prices been sustained year on year, though these average prices remain little more than half of those in Western Europe.

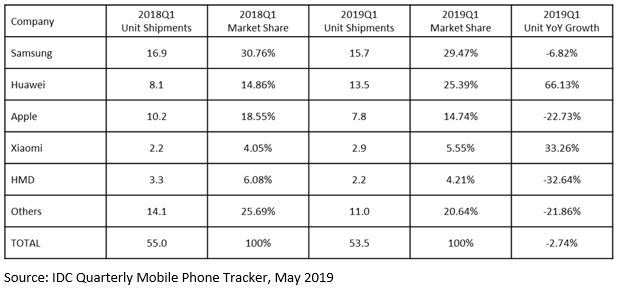

“In brands, Huawei continued to make incremental advances, and so did Xiaomi, while Apple had a tough quarter, with its 23% market share across Europe the lowest Q1 result in five years,” said Marta Pinto, research manager at IDC EMEA.

The top three Chinese brands, including the Transsion stable in Africa, took 36.8% of the total market, against 32.8% a year ago, confirming the trend toward consolidation. Samsung showed resilience in gaining nearly four percentage points since 2018Q4.

“The market has been changing in the last few quarters in relatively predictable ways,” said Pinto. “Shipments have slowed as consumers hold on to devices for longer, Apple has been challenged with its latest devices, and Chinese manufacturers have been making strides each quarter.”

According to Simon Baker, program director at IDC EMEA, “Europe has been a global focus of vendor concentration in recent quarters, with some of the smaller players under a lot of pressure. Looking ahead, it is no longer possible to see clear trends as before. The blacklisting of Huawei in the U.S. on May 16 is creating so many unknowns, and uncertainty is the new key word in the industry as global geopolitics — unconnected directly with Europe or EMEA — becomes the single most important factor in how the market will develop over the rest of the year.”

In April Europe saw the launch of its first 5G network, in Switzerland, soon followed by networks from the U.K.’s EE and the pan-European Vodafone Group.

“Despite some considerable fanfare over the launches, with the U.K. being the next country to see the new networks go live, it will take some time before 5G devices are an important part of the European smartphone market,” said Pinto.

IDC expects 5G adoption in Europe to be slower than with 4G. Though 5G premium devices will be available across the region by year-end, the widespread availability of 4G service will make mobile operators work hard to convince consumers of the need for an early upgrade.

For more on 5G services rollout in Europe, see IDC’s 5G Blog.

Current IDC forecasts are for the take-up of 5G in Europe to be slower than the 4G generation before it.

Top 5 Smartphone Companies in Western, Central, and Eastern Europe — Shipments, Market Share, and Year-Over-Year Growth, First-Quarter 2019 (Units in Millions)