Shipments of EMEA traditional PCs (a combination of desktops, notebooks, and workstations) will total 71.3 million in 2019, a 0.4% YoY decline. The commercial appetite will remain strong throughout 2019, driven by renewal cycles across the market, but it will be insufficient to offset the heavy declines in the consumer market.

Supply constraints to entry-level CPU’s will have a moderate effect on overall volume in the first half of the year, primarily impacting the available volume to meet back-to-school demand. Nevertheless, the commercial market will experience considerable growth throughout 2019 as the upcoming end of Windows 7 support will spur major renewal cycles across both public and private sectors. On the notebook side, thin and light and convertibles will continue to experience the strongest growth as organizations prioritize ultraportable form factors in order to meet the demand of their ever-growing mobile workforce. Despite the growing paradigm shift towards mobility, stationary devices will still have a strong foothold in the commercial space, as the security benefits they provide make them essential in certain verticals, while the increased transition towards smaller form factors continues to reinvigorate the desktop market at large. As we approach the tail end of the long desktop life cycles, accelerated renewals can be expected throughout 2019.

“Despite the ongoing CPU supply chain shortage and political uncertainties, the Western European PC market has proven to be resilient in 2019Q1,” said Malini Paul, research manager, IDC Western European Personal Computing Devices. “The market is expected to gain further stability in the forthcoming quarters, thanks to continuous strong demand from large and medium-sized businesses through to the end of 2019 ahead of the end of life of Windows 7 in January 2020.”

On the consumer side, higher inventory after a relatively weak holiday season will continue to constrict sell in throughout the first half of 2019. However, promotional activity to clear stock as well as expected price drops for certain components will result in a more optimistic second half of the year. Extending device life cycles stemming from shifting consumer buying habits results in an ongoing negative outlook for the consumer market. However, premium, thin, and light form factors and gaming will remain the sweet spot in the market, offering much needed pockets of growth. Furthermore, future launches of models with innovative new form factors will elicit intrigue from consumers and potentially drive solid growth in 2020.

“The overall PC forecast was revised downwards in the CEE region for 2019Q2, following postponed deals in the public sector due to soft consumer demand and deterioration of economic conditions in some countries,” said Nikolina Jurisic, program manager Europe. “2019Q2 is expected to contract by 2.8% YoY, with the consumer space suffering the most. The second half of 2019 is expected to regain momentum thanks to SMB market growth, coupled with the expected public deals in the corporate sector.

“The MEA region PC forecast has been revised upwards from the previous forecast, across all the remaining quarters of 2019, driven by expected demand in the commercial space. The close date for the end of Windows 7 is a reminder to update the old installed base, where the public sector and SMBs are still using Windows 7. Consumer demand in the MEA region will remain double-digit negative in the next quarter, only improving in the second half of the year.”

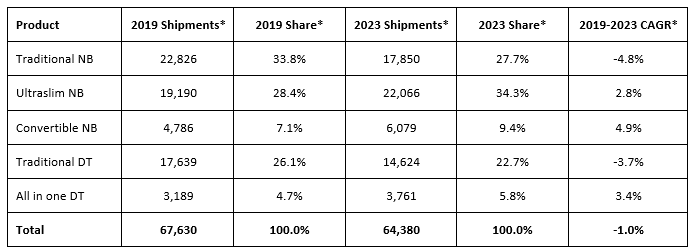

EMEA Traditional PC Forecast by Product

2019Q1 Forecast for 2019 to 2023 (Shipments in Thousands)

Source: IDC Worldwide Quarterly Personal Computing Device Tracker, May 22nd, 2019. *Forecast data

IDC’s Quarterly PCD Tracker provides unmatched market coverage and forecasts for the entire device space, covering PCs and tablets, in more than 80 countries — providing fast, essential, and comprehensive market information across the entire personal computing device market.

For more information on IDC’s EMEA Quarterly Personal Computing Device Tracker or other IDC research services, please contact Vice President Karine Paoli on +44 (0) 20 8987 7218 or at [email protected]. Alternatively, contact your local IDC office or visit www.idc.com.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC or @IDCEMEA.