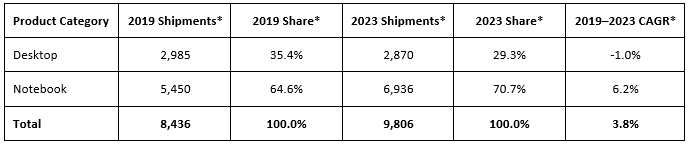

The Europe, Middle East, and Africa (EMEA) market for gaming desktops and notebooks grew in the third quarter of 2019, increasing 2.0% YoY and totaling 2.2 million units, according to International Data Corporation (IDC). Growth is expected to continue into the final quarter of 2019 (4.1% YoY), which will be sufficient to keep the PC gaming market afloat for the full year 2019 — growing 0.3% YoY and reaching 8.4 million units.

By the end of 2023 the market is expected to increase to 9.8 million units with a four-year compound annual growth rate (CAGR) of 3.8%.

IDC identifies gaming PCs as desktops or notebooks that have a premium- or performance-grade GPU. This includes the midrange and high-end offerings from Nvidia and AMD. Professional-grade GPUs such as the Quadro and Radeon Pro are excluded from IDC’s gaming PC definition.

In 3Q19, the Western Europe PC gaming market had another stable performance, posting modest growth of 0.4% YoY.

“It was desktop that drove the gaming market to stability in Western Europe, although the ongoing polarization between the very-high-end premium and very-low-end, borderline-spectator devices continued to expand,” said Liam Hall, senior research analyst, IDC Western Europe. “Notebook posted a slight decline but is expected to bounce back in the holiday quarter as more casual gamers enter the market, while certain key components become more affordable and more games utilize some of the benefits that said components can provide.”

The PC gaming market in the CEMA region increased by 5.7% YoY after three quarters of decline, reaching 0.69 million units shipped during 3Q19.

The two regions performed inversely in the quarter. The Middle East and Africa increased significantly by 30.2% YoY driven primarily by Turkey, where a much stronger than expected recovery in shipments took place, with the market seeing very strong growth on the back of a weak 3Q18. Central Eastern Europe, on the other hand, remained in negative territory, declining by 4.4% YoY as soft consumer demand accompanied by high inventory pressures in a few countries, as well as a high 3Q18 base, had a negative effect on the PC gaming market.

Positive growth rates are expected in both regions in the last quarter of 2019 as Black Friday and holiday year-end promotions will have a strong impact on consumer consumption in the CEE region, while further market recovery will drive the PC gaming market in the MEA region.

“In the mid- and long-term forecast, the market will benefit from increasing consumer awareness and growth in the gaming community. Gaming systems are of major interest to vendors because of their higher costs and margins, as well as their more frequent replacement cycles,” said Nikolina Jurisic, program manager, IDC CEMA. “End users are therefore benefitting from a broad gaming range, new product launches, and more attractive pricing due to fiercer competition. Cloud gaming is still in the early stages of acceptance in CEMA and is not expected to negatively affect the gaming market in the mid- or short-term forecast.”

“Beyond early adopters, it is unlikely we will see a sizeable migration of gamers away from traditional hardware in favor of the cloud any time soon,” said Hall. “Conversely, by providing a lower barrier of entry for new gamers, cloud gaming could actually act as a gateway into console and PC gaming for those who otherwise wouldn’t have discovered their passion for gaming and now want to take it to the next level.”

EMEA Gaming Tracker Forecast by Product Category, 2019–2023 (Shipments in Thousands)

Source: IDC Worldwide Quarterly Gaming Tracker, December 12, 2019. *Forecast data