20.2 million PCS were shipped in the EMEA region in Q1’15, IDC data shows – a 7.7% fall YoY. Following a strong 2014, the market returned to decline, as expected, following the end of Windows XP renewal purchases.

While the European macro-economy improved, currency fluctuations and political tensions in the CEMA sub-region dampened the rise. A strong dollar led to price increases in several local currencies.

Overall, portable PCs outperformed desktops thanks to the final shipments of low-cost 15″ Windows 8.1 with Bing units in Western Europe and some parts of CEE. The portable market was down 3.6% YoY, but desktops fell 14%. Resulting inventories appear high across the different channels; however, IDC expects that these are of little concern as product values are low and most were purchased when the dollar rate was favourable.

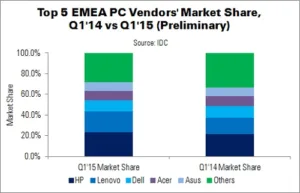

The commercial market is slowing, pushing all three sub-regions (Western Europe, CEE and MEA) to contraction. Western Europe was only down 2%, while MEA fell 10% and CEE 23%. Consolidation is progressing; the top two vendors (HP and Lenovo) continued to gain significant market share and battle for EMEA leadership.

| Top 5 EMEA PC Vendors’ PC Shipments, Q1’15 (Preliminary) (000 Units) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’15 Units | Q1’14 Units | Q1’15 Market Share | Q1’14 Market Share | YoY Change |

| HP | 4,708 | 4,702 | 23.2% | 21.4% | 0.1% |

| Lenovo | 4,141 | 3,457 | 20.4% | 15.8% | 19.8% |

| Dell | 2,205 | 2,453 | 10.9% | 11.2% | -10.1% |

| Acer | 1,760 | 2,106 | 8.7% | 9.6% | -16.4% |

| Asus | 1,751 | 1,918 | 8.6% | 8.7% | -8.7% |

| Others | 5,689 | 7,306 | 28.1% | 33.3% | -22.1% |

| Total | 20,254 | 21,942 | 100.0% | 100.0% | -7.7% |

| Source: IDC | |||||

The commercial market fall in Western Europe was affected by exchange rate fluctuations, contributing to rising component and PC prices. Enterprise demand fell as a result. There was also an unfavourable YoY comparison, especially in the desktop space, due to last year’s XP renewals. As a result, commercial shipments in the sub-region were down 9.5% YoY, while desktop shipments fell 17.2%. Southern Europe was the exception; Greece, Italy, Portugal and Spain all continued to benefit from economic recovery, with strong rises in commercial PC shipments. However, the biggest economies in Western Europe fell, with double-digit declines in the UK and Germany, and a flat result in France.

Consumer shipments in Western Europe were better than expected, as vendors continued to purchase low-cost Bing notebooks. There was substantial sell-in into the market in January, before the Bing promotion ended in February. Consumer portable PC shipments rose 8.4% across the sub-region because of this. While the result was higher than expected, IDC’s Maciek Gornicki noted that unfavourable exchange rates and the end of the Bing promotions are likely to cause shipments to drop in coming quarters. Vendors are expected to focus on clearing inventory, limiting new shipments. The commercial market is also expected to remain negative.

Taken together, the CEE and MEA sub-regions (CEMA) fell 16% YoY. Currency devaluation, a slowing economy and high inventory in some countries – as well as the ongoing turmoil in the Eastern zone – all affected consumer and commercial IT spending.

The Czech Republic, Slovakia, Romania and Hungary reported double-digit growth in CEE, thanks to a push of Bing PCs in the channel. The overall MEA sub-region, however, was pulled down by weak currencies, low oil prices and political tensions.

HP continued to outperform the market, with strong portable PC gains. Western Europe and MEA were particularly strong. The company focused on product innovations and go-to-market execution.

Lenovo came in second place, with the strongest growth among the top five – almost 20% YoY. Market share exceeded 20% for the first time, fuelled by strong growth in Southern Europe.

Dell maintained its third place spot. Desktop shipments were in line with the market, but portable PCs were down more than average.

Acer beat the market in desktop PCs, but suffered from the situation in CEE – especially Russia. Asus’ results were also slightly below the market, with desktops contracting after several quarters of growth.