According to IDC, the EMEA region PC market showed growth of 1.6% in the first quarter of 2017, and hit 17.4 million units. There was strong performance from notebooks which grew 8.9% in the EMEA region, 9.2% in Western Europe and 8.3% in the CEMA region, based on comparisons with the same quarter in 2016. Commercial notebooks grew 18.6% in CEMA, mainly due to favourable exchange rates against the US dollar, and 11.2% in Western Europe. Consumer notebooks grew 8.1% in Central and Eastern Europe and 7.5% in Western Europe, mainly due to some previous quarter backlogs. Desktop shipments in EMEA decreased by 12%, continuing the previous decline.

Andrea Minonne, a research analyst at IDC noted that the return to growth shows stabilisation of the traditional PC market in the EMEA region. Some memory and SSD shortages caused backlogs in 2016 and these were fulfilled in the first quarter of 2017.

The picture was mixed in Western Europe, where overall PCs grew 3.1%. France grew 8.2%, Germany grew 5.8%, while the UK, as expected, saw a drop of 7.9%. Drops in Southern European economies were on their way to stabilisation with Italy dropping 2.6% and Spain dropping 2.8%, compared to the same quarter last year. Commercial notebooks, grew 11.2% and pushed the entire commercial market upward. Desktops, however, continued their fall. The consumer market started to stabilise after several quarters of decline, due to a 7.5% growth in notebook performance. Fulfilment of backlogs plus increasing demand for mobile gaming PCs and thin and light solutions boosted the results. The commercial market saw vendors and channels build up notebook inventory in anticipation of further price hikes due to exchange rate volatility.

For the CEE region, the first quarter of 2017 saw healthy annual growth of 4.5%. The market was driven by notebooks with an overall growth of 11.7%. Both consumer and commercial markets increased, despite inventory built up at the end of 2016, except the desktop market which declined 7.7% in the quarter compared to the same quarter in 2016.

For the MEA region, the first quarter of 2017 saw a decline of 6.2%. The notebook market grew by 5.1% despite the ongoing market slowdown and the consumer spending skewed toward detachable tablets and mobile phones. The growth in the region was contributed by a few large notebook education deals.

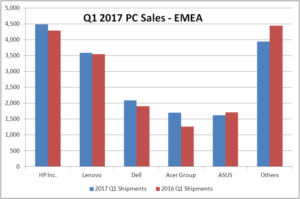

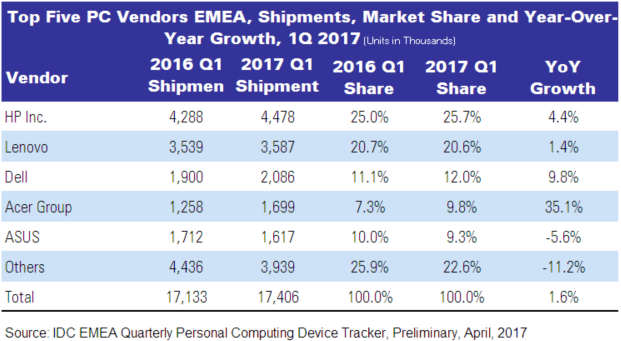

The share of the top five vendors continued to grow in the quarter, and accounted for 77.4% of the total market volume compared with 74.1% for the same quarter last year. HP reinforced its leadership, gaining a 25.7% share and growing 4.4%, and Lenovo had 20.6% share and grew 1.4%. Dell saw growth of 9.8% and increased its market share to 12.0% while the Acer Group saw a 35.1% growth with a 9.8% market share. Asus saw growth drop 5.6% with a 9.3% market share, as it faced challenges related to competitive notebook price pressure and inventory.