Central and Eastern Europe PC shipments exceeded 18.5 million units last year, falling 14% YoY, says IDC. 2014 was the second year of contraction, as the region’s market was limited by currency fluctuations and economic slowdown in the East. Portable shipments were down 14.5% (to 11.92 million), while desktops fell 12.9% (to 6.63 million).

42.6% of shipments went to Russia; the country weights the results heavily. Russia saw a double-digit decline, along with Ukraine and Kazakhstan. All three were affected by ‘significant’ devaluation of their national currencies; deteriorating macroeconomic conditions; and the situation in Ukraine.

The news is not all bad. PC shipments in countries in the Central sub-region rose YoY in each quarter of 2014, mainly due to PC renewals bolstered by Microsoft’s ‘Windows 8.1 with Bing’ offer. Promotions around the offer, combined with XP renewals, translated into a 16.1% rise in portable PC shipments and 1.5% in desktops. Shipments in Poland, the Czech Republic and Romania – the largest three markets – rose 8%, 19% and 24.5% YoY, respectively.

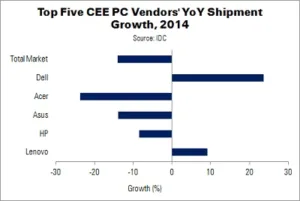

More than 70% of shipments in CEE were covered by the top five vendors. Lenovo led, maintaining its lead with 9.1% YoY growth thanks to consumer market gains, plus an attractive product portfolio and competitive pricing. HP came second, despite posting an 8.4% decline, and remained the leader in the desktop and commercial segments. Shipments at Asus and Acer (third and fourth place) fell 13.9% and 23.7%, respectively. Dell, despite coming fifth, posted a 23.7% rise.

IDC expects the CEE PC market to decline 14.6% in 2015, followed by a recovery in 2016. IDC’s Nikolina Jurisic said, “The worsening economic outlook in the Eastern part of the region, the rise in PC prices due to the devaluation of national currencies, and a lack of low-priced 15″ MS Bing portable PCs on the market will negatively affect PC shipments”.