The Q4’18 update of DSCC’s Quarterly Smartphone Display Cost Report adds the panels used in the upcoming Samsung Galaxy S10 models and the Galaxy Foldable smartphone.

Foldable smartphones have the potential to dramatically change the smartphone landscape and it is critical to understand their costs and cost reduction potential to estimate their impact on smartphone prices and likelihood of success.

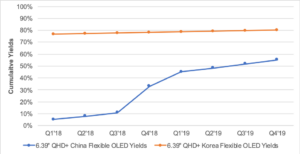

Importantly, the latest issue reveals the sud- den improvement in yields for flexible OLEDs made in China. Through Q3’18, Samsung Display (SDC) has enjoyed a dramatic yield advantage resulting in significantly higher profits and output and lower costs than its competitors. However, in Q4’18, BOE enjoyed a dramatic yield improvement with yields tripling to over 30% in Q4’18 with additional gains expected in 2019 as shown. This resulted in BOE boosting their shipments from <125K units per month in Q3’18 to an estimated 1M units per month in Q4’18 with Huawei’s Mate 20 Pro taking most of the output.

Quarterly 6.39” QHD+ China (BOE) and Korea Flexible OLED Yields

Source: DSCC Quarterly Smartphone Display Cost Report

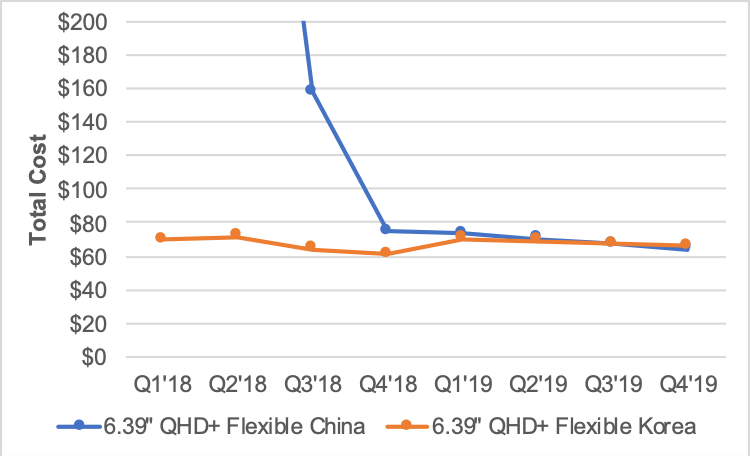

According to DSCC CEO Ross Young, “While BOE has inputted little capacity until now, the improved yields on Phase 1 at B7 will enable them to start production at other lines within B7 and B11 in 2019 and begin to emerge as a real threat to Samsung’s dominance in flexible OLEDs. In addition, because a significant share of BOE’s fab costs are subsidized, we estimate that their costs can fall below SDC’s by the end of 2019 as shown below although their scale will be significantly below SDC’s for some time.

Quarterly 6.39” QHD+ China (BOE) and Korea Flexible OLED Costs

Source: DSCC Quarterly Smartphone Display Cost Report

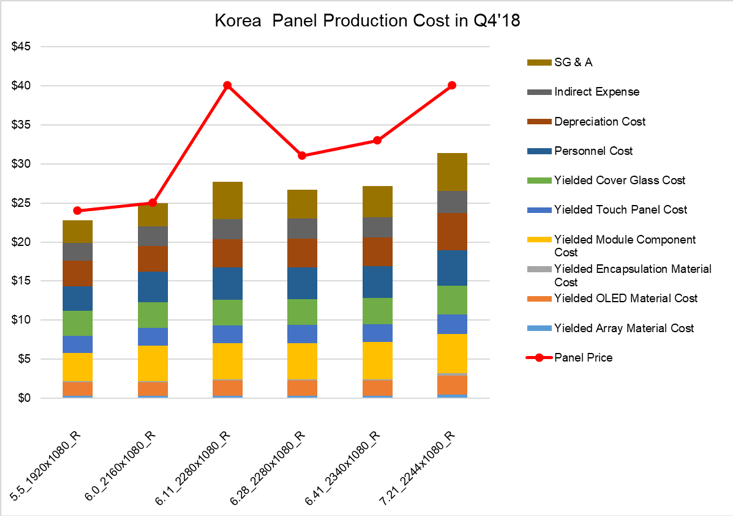

The report also includes detailed cost profiles for 28 different smartphone panel types, covering rigid, flexible and foldable OLEDs, on suitable production lines in both Korea and China. An example chart is shown below; with utilization slowing down in Q4’18. The most commoditized panels are little better than break-even, but larger and higher resolution panels are solidly profitable, with operating margins as high as 31%.

Q4’18 Costs and Prices for Rigid OLED Smartphone Panels from Korea on Gen 5.5

Source: DSCC Quarterly Smartphone Display Cost Report

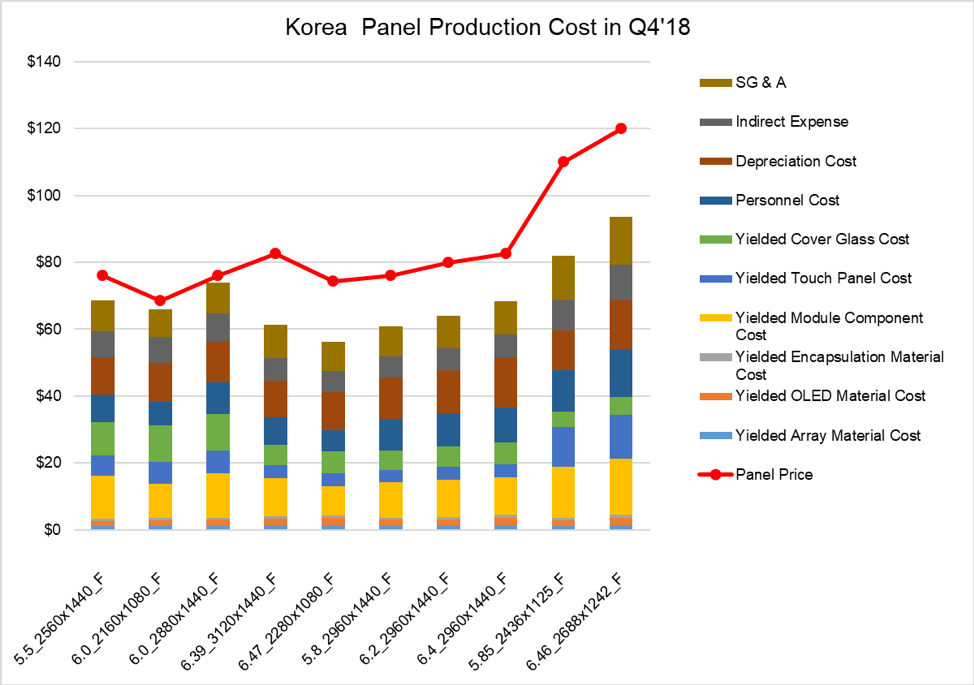

The corresponding picture for flexible smartphones in Korea is shown next. Again, the smaller and lower resolution panels have low margins, but larger size panels have significantly higher margins, up to 26%. The product architecture and supply basis of the newer flexible panels allows for a structurally lower cost; Driver ICs employing Chip on Plastic (COP) and 3D cover glass manufactured in house both lead to substantial cost reductions.

Q4 2018 Costs and Prices for Flexible OLED Smartphone Panels from Korea on Gen 6

Source: DSCC Quarterly Smartphone Display Cost Report

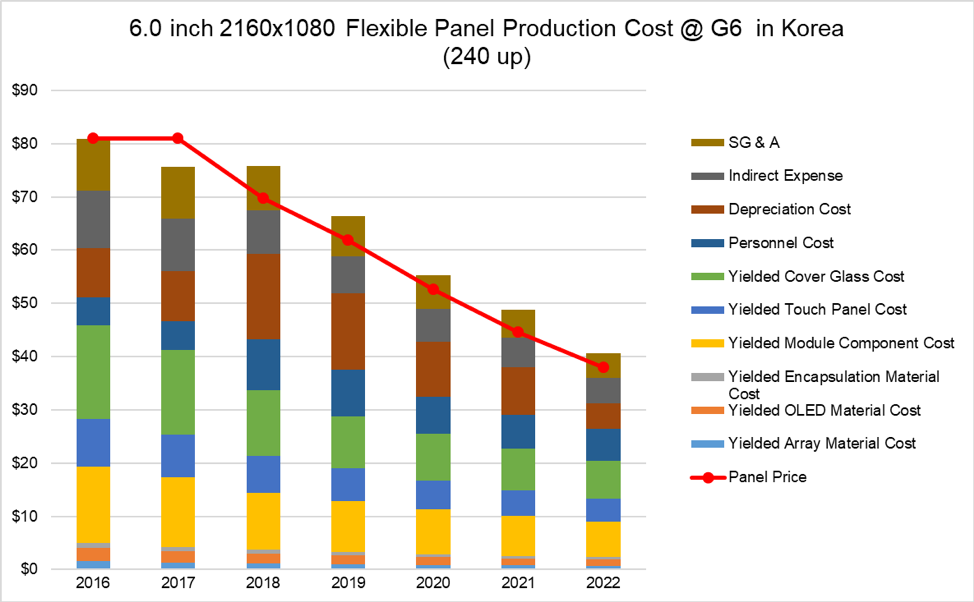

The cost report projects the expected panels costs out to 2022, with an example given here for 6” flexible panels. These panels, without the cost reductions noted above, are expected to have negative operating margins in Korea, although they will be cash positive.

Costs for 6.0” Flexible OLED Panels in Korea, 2016-2022

Source: DSCC Quarterly Smartphone Display Cost Report

Flexible panel costs in Korea will continue to be sub-optimized because of low utilization, a function of the substantial oversupply of flexible panel capacity. We expect utilization for flexible OLED capacity to improve slowly, from 54% in 2019 to 69% in 2020, 77% in 2021 and 81% in 2022. Higher utilization and yield allow for better amortization of the fixed costs: depreciation, personnel, and indirect costs.

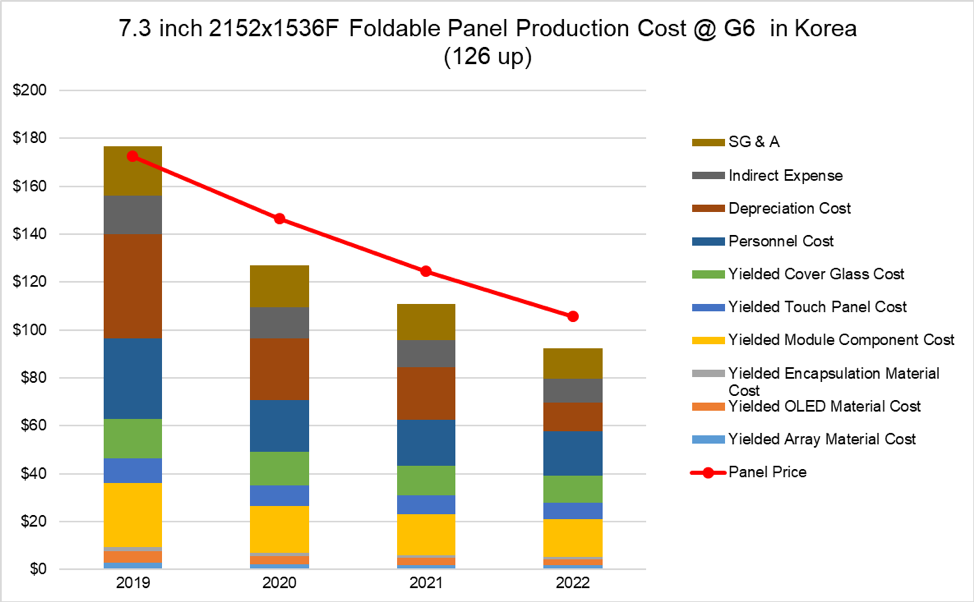

Next we show the first results of foldable in our cost model. We include one foldable panel configuration in this quarter’s update, a 7.3” panel with a 4.2:3 aspect ratio and resolution of 2152 x 1536.

7.3″ Foldable OLED Cost Forecast (Korea)

Source: DSCC Quarterly Smartphone Display Cost Report

The cost structure for foldable panels carries the burden of low flexible panel fab utilization noted above, but adds the lower yields on this difficult product. As a result, the amortized fixed costs are very high, but come down as yields and UT% improves.

The new phone panel configurations included in the Q4 update include the three upcoming Galaxy S10 models:

?

- Galaxy S10 Light: 5.75”, 2340×1080. 260-up on Gen 6

- Galaxy S10: 6.11”, 3120×1440. 240-up on Gen 6

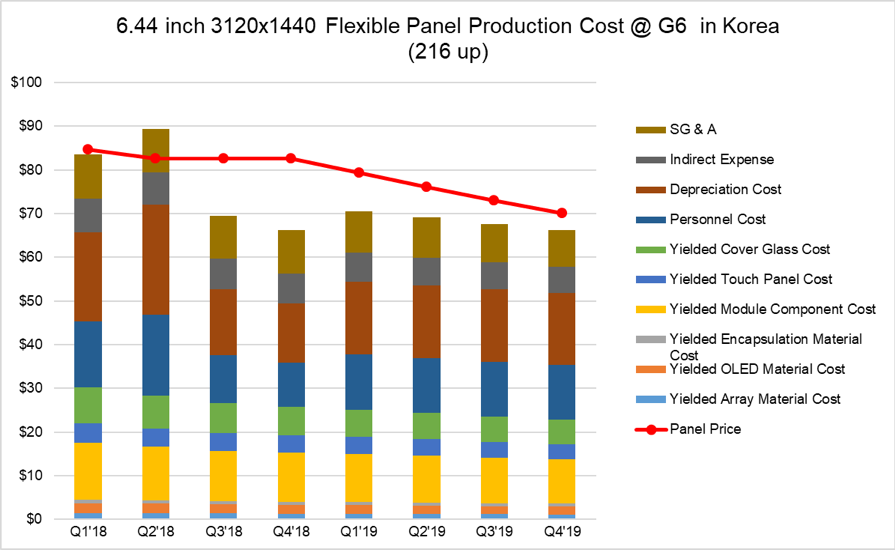

- Galaxy S10+: 6.44”, 3120×1440. 216-up on Gen 6

Compared to the S9, the S10 Light has a similar screen size, but lower resolution (the S9 is 5.8”, 2960×1440). For SDC, the higher number of cuts combined with cost savings from the lower resolution allow a total cost that is $10 lower in 2019, allowing SDC to sustain profitability at a price point $10 lower than the S9 (and this lower price point improves the profitability of Samsung Mobile Communications).

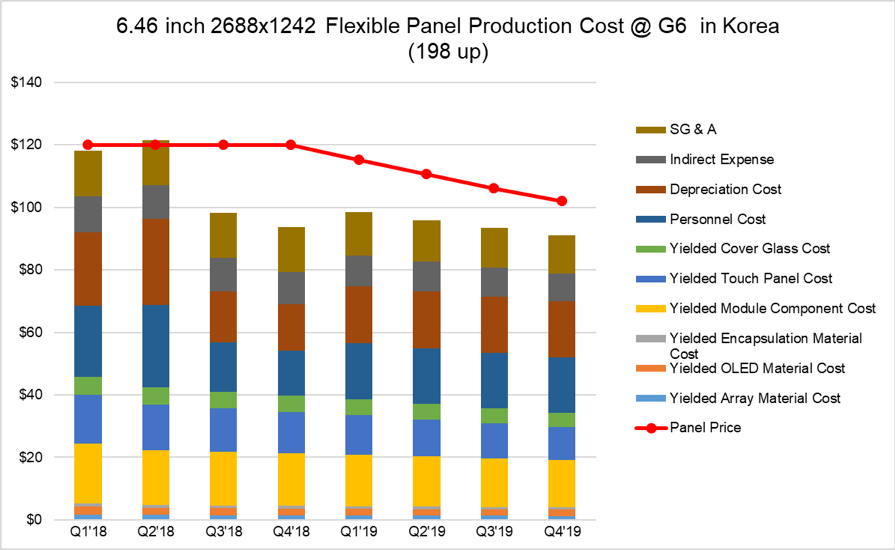

The structural cost improvements achieved by Samsung in the Galaxy phone designs are especially dramatic when comparing the flagship Galaxy S10+ with its counterpart for Apple, the iPhone XS Max, as shown on the next two charts.

Galaxy S10+ Smartphone Panel Costs and Prices, Q1 2018 to Q4 2019

Source: DSCC Quarterly Smartphone Display Cost Report

iPhone XS Max Smartphone Panel Costs and Prices, Q1 2018 to Q4 2019

Source: DSCC Quarterly Smartphone Display Cost Report

?The two panels have comparable screen sizes, but the Galaxy has higher resolution, and still has a cost about $30 lower than the XS Max, allowing good profitability for Samsung Display even with panel prices $30-35 lower than Apple is paying for the iPhone.

?Subscribers to the smartphone cost report receive an Excel worksheet with all the details of the 28 phone models covered, with quarterly cost estimates to 2022, and a Powerpoint presentation with selected cost highlights including the comparisons given above. DSCC Weekly Review readers who are interested in subscribing to the Quarterly Smartphone Display Cost Report should contact [email protected].